PPT Alabama Department of Revenue Alabama Gov 2017

What is the PPT Alabama Department Of Revenue Alabama gov

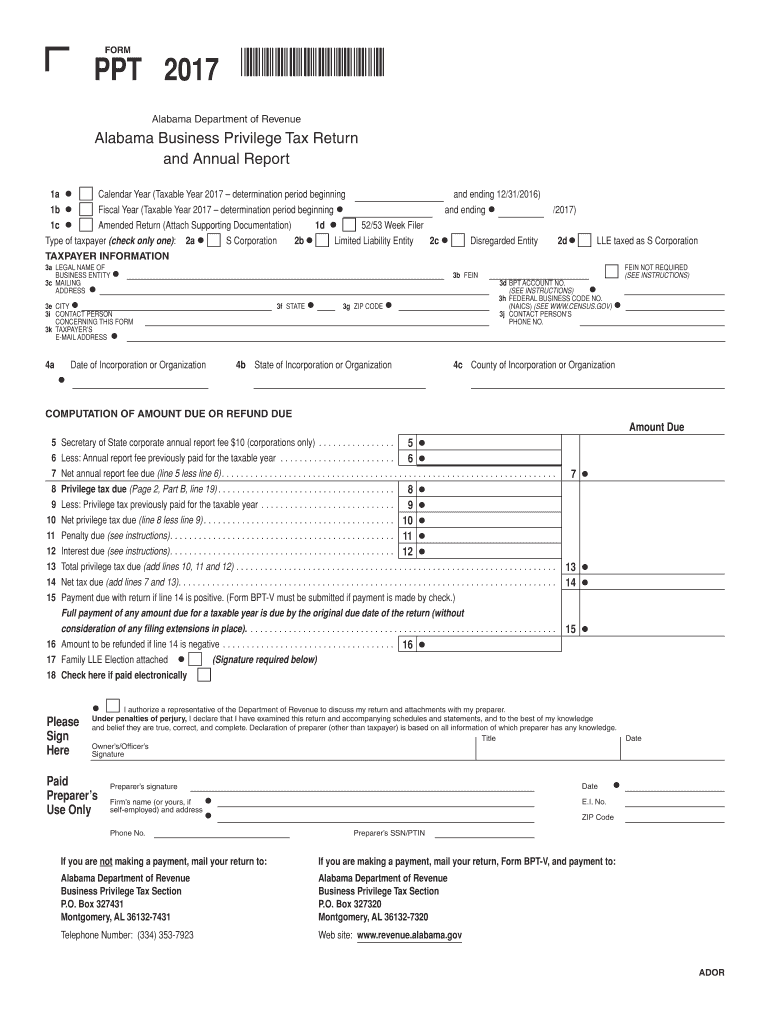

The PPT, or Property Tax Return, is a form issued by the Alabama Department of Revenue. This form is essential for reporting personal property owned by businesses and individuals within the state. It plays a critical role in determining property taxes owed, ensuring compliance with state tax laws. The PPT form requires detailed information about the property, including its value, location, and usage. Accurate completion of this form is vital for proper tax assessment and to avoid potential penalties.

Steps to complete the PPT Alabama Department Of Revenue Alabama gov

Completing the PPT form involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the property, including its description, location, and value. Next, access the form through the Alabama Department of Revenue's website. Fill out the form carefully, ensuring that all required fields are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the form by the specified deadline to avoid penalties.

How to obtain the PPT Alabama Department Of Revenue Alabama gov

The PPT form can be obtained directly from the Alabama Department of Revenue's official website. Users can download and print the form or fill it out electronically if available. Additionally, physical copies may be available at local county revenue offices. It is important to ensure that you are using the most current version of the form to comply with state regulations.

Legal use of the PPT Alabama Department Of Revenue Alabama gov

The legal use of the PPT form is governed by Alabama state tax laws. This form must be completed and submitted by individuals and businesses that own taxable personal property. Failure to file the PPT can result in penalties, including fines and interest on unpaid taxes. It is crucial to understand the legal implications of submitting this form accurately and on time to maintain compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the PPT form are critical for compliance. Typically, the form is due annually on a specific date set by the Alabama Department of Revenue. It is essential to stay informed about these deadlines to avoid late fees and penalties. Marking these dates on your calendar can help ensure timely submission of the form.

Required Documents

When completing the PPT form, certain documents may be required to substantiate the information provided. These documents can include proof of property ownership, previous tax returns, and any relevant financial statements. Having these documents ready can facilitate a smoother completion process and ensure that the information reported is accurate and verifiable.

Quick guide on how to complete ppt 2017 alabama department of revenue alabamagov

Your assistance manual on how to prepare your PPT Alabama Department Of Revenue Alabama gov

If you’re wondering how to create and submit your PPT Alabama Department Of Revenue Alabama gov, here are some brief guidelines to simplify tax processing.

To begin, you only need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that allows you to edit, draft, and complete your tax forms with ease. Using its editing features, you can toggle between text, checkboxes, and eSignatures, and revisit to modify information as needed. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing options.

Follow the steps below to finish your PPT Alabama Department Of Revenue Alabama gov in just a few minutes:

- Establish your account and begin handling PDFs within moments.

- Utilize our directory to locate any IRS tax form; scroll through various versions and schedules.

- Press Obtain form to access your PPT Alabama Department Of Revenue Alabama gov in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Use the Signature Tool to insert your legally recognized eSignature (if necessary).

- Examine your document and amend any errors.

- Save changes, print your copy, submit it to your intended recipient, and download it to your device.

Make use of this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can lead to return errors and delay refunds. Naturally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ppt 2017 alabama department of revenue alabamagov

Create this form in 5 minutes!

How to create an eSignature for the ppt 2017 alabama department of revenue alabamagov

How to make an electronic signature for your Ppt 2017 Alabama Department Of Revenue Alabamagov in the online mode

How to make an electronic signature for the Ppt 2017 Alabama Department Of Revenue Alabamagov in Chrome

How to make an eSignature for signing the Ppt 2017 Alabama Department Of Revenue Alabamagov in Gmail

How to make an eSignature for the Ppt 2017 Alabama Department Of Revenue Alabamagov from your smartphone

How to generate an eSignature for the Ppt 2017 Alabama Department Of Revenue Alabamagov on iOS

How to make an eSignature for the Ppt 2017 Alabama Department Of Revenue Alabamagov on Android devices

People also ask

-

What is the PPT Alabama Department Of Revenue Alabama gov?

The PPT Alabama Department Of Revenue Alabama gov refers to the Property Tax and Personal Property Tax forms and services provided by the Alabama Department of Revenue. This platform helps individuals and businesses manage their property tax obligations efficiently, ensuring compliance with state regulations.

-

How can airSlate SignNow assist with the PPT Alabama Department Of Revenue Alabama gov forms?

airSlate SignNow streamlines the process of filling out and submitting PPT Alabama Department Of Revenue Alabama gov forms by allowing users to eSign documents securely. With its user-friendly interface, businesses can easily complete necessary paperwork and submit it electronically, saving time and reducing errors.

-

Is airSlate SignNow suitable for small businesses dealing with PPT Alabama Department Of Revenue Alabama gov?

Yes, airSlate SignNow is an ideal choice for small businesses managing their PPT Alabama Department Of Revenue Alabama gov requirements. The platform offers cost-effective pricing plans that cater to different business sizes, ensuring that smaller enterprises can access essential document signing and management tools.

-

What features does airSlate SignNow offer for managing PPT Alabama Department Of Revenue Alabama gov documents?

airSlate SignNow provides a variety of features for managing PPT Alabama Department Of Revenue Alabama gov documents, including customizable templates, secure eSignatures, and document tracking. These features enhance efficiency by allowing users to quickly prepare and send necessary forms while ensuring compliance with state regulations.

-

Can airSlate SignNow integrate with other software for handling PPT Alabama Department Of Revenue Alabama gov tasks?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions that can help manage PPT Alabama Department Of Revenue Alabama gov tasks. Whether you're using CRM systems or accounting software, these integrations allow for a unified workflow, making it easier to handle property tax documents.

-

What are the benefits of using airSlate SignNow for PPT Alabama Department Of Revenue Alabama gov forms?

Using airSlate SignNow for PPT Alabama Department Of Revenue Alabama gov forms provides numerous benefits, including increased efficiency, enhanced security, and reduced paper usage. This digital solution simplifies the process of signing and sending documents, ensuring you meet all deadlines and maintain compliance.

-

How secure is airSlate SignNow when handling PPT Alabama Department Of Revenue Alabama gov documents?

airSlate SignNow prioritizes security, implementing advanced encryption protocols to protect your sensitive PPT Alabama Department Of Revenue Alabama gov documents. The platform also complies with industry standards and regulations, ensuring that all your documents are secure during transmission and storage.

Get more for PPT Alabama Department Of Revenue Alabama gov

- Transcript request bor form apl117f ides illinois

- Risk based pricing notice form

- Hotel groundskeeper contract agreement bid form

- Domestic violence safety plan verbal abuse journals form

- Authorization for the release of information under state

- 2254 form printable 195654

- Download a permit application here luke air force base form

- Gutter contract template 787751959 form

Find out other PPT Alabama Department Of Revenue Alabama gov

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online