SPECIMEN TRUST DEED of a GENERAL CHARITABLE TRUST Form

What is the specimen trust deed of a general charitable trust

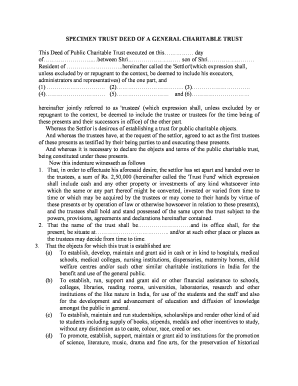

The specimen trust deed of a general charitable trust is a legal document that outlines the framework for establishing and operating a charitable trust. This deed serves as a template that specifies the trust's purpose, governance structure, and the responsibilities of trustees. It is designed to ensure that the trust operates in compliance with state and federal laws while fulfilling its charitable objectives. The document typically includes details such as the name of the trust, the designation of trustees, the beneficiaries, and the types of charitable activities the trust will support.

Key elements of the specimen trust deed of a general charitable trust

Several critical components are essential in the specimen trust deed of a general charitable trust. These include:

- Name of the Trust: The official title under which the trust will operate.

- Trustees: Individuals or entities responsible for managing the trust and ensuring its compliance with legal requirements.

- Purpose: A clear statement outlining the charitable goals and activities the trust intends to pursue.

- Beneficiaries: Identification of individuals or groups who will benefit from the trust's activities.

- Distribution of Assets: Guidelines on how the trust's assets will be allocated to fulfill its charitable mission.

- Amendment Procedures: The process for making changes to the trust deed if necessary.

How to use the specimen trust deed of a general charitable trust

Using the specimen trust deed involves several steps to ensure that it meets legal requirements and serves its intended purpose. First, individuals or organizations should review the template to ensure it aligns with their charitable goals. Next, they should customize the document by filling in specific details, such as the trust's name and the names of the trustees. Once completed, the deed must be signed by the trustees and may require notarization to enhance its legal validity. Finally, it is advisable to file the trust deed with the appropriate state authorities to ensure compliance with local regulations.

Steps to complete the specimen trust deed of a general charitable trust

Completing the specimen trust deed involves a systematic approach:

- Review the specimen deed to understand its structure and requirements.

- Gather necessary information, including the names and addresses of trustees and beneficiaries.

- Customize the document by entering specific details relevant to the trust.

- Ensure that the purpose of the trust is clearly defined and aligns with charitable activities.

- Obtain signatures from all trustees and consider having the document notarized.

- File the completed deed with the appropriate state agency, if required.

Legal use of the specimen trust deed of a general charitable trust

The legal use of the specimen trust deed is crucial for establishing a valid charitable trust. It must comply with state laws governing trusts, including registration and reporting requirements. The trust deed serves as the foundational document that outlines the trust's operation and ensures that it adheres to the Internal Revenue Service (IRS) guidelines for tax-exempt status. Proper legal use includes maintaining accurate records of the trust's activities and ensuring that distributions are made in accordance with the trust's stated purposes.

State-specific rules for the specimen trust deed of a general charitable trust

Each state has its own regulations regarding the establishment and operation of charitable trusts. It is essential to be aware of these state-specific rules when using the specimen trust deed. This may include requirements for registration, annual reporting, and compliance with state tax laws. Some states may also have unique provisions concerning the duties and powers of trustees, as well as specific guidelines on charitable distributions. Consulting with a legal professional familiar with local laws can help ensure compliance and proper governance of the trust.

Quick guide on how to complete specimen trust deed of a general charitable trust

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It provides an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents promptly and without delays. Manage [SKS] on any device with the airSlate SignNow apps available for Android or iOS and streamline any document-related procedure today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Decide how you wish to send your form, whether through email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign [SKS] to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to SPECIMEN TRUST DEED OF A GENERAL CHARITABLE TRUST

Create this form in 5 minutes!

How to create an eSignature for the specimen trust deed of a general charitable trust

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a SPECIMEN TRUST DEED OF A GENERAL CHARITABLE TRUST?

A SPECIMEN TRUST DEED OF A GENERAL CHARITABLE TRUST is a legal document that outlines the terms governing a charitable trust. This document serves as a template for establishing the structure and operational guidelines of the trust, designed to hold and manage assets for charitable purposes.

-

Why do I need a SPECIMEN TRUST DEED OF A GENERAL CHARITABLE TRUST?

A SPECIMEN TRUST DEED OF A GENERAL CHARITABLE TRUST is essential for anyone looking to create a charitable trust. It provides a clear framework for managing funds, ensuring compliance with legal requirements, and facilitating transparent operations for charitable activities.

-

How can airSlate SignNow help with SPECIMEN TRUST DEED OF A GENERAL CHARITABLE TRUST?

airSlate SignNow simplifies the process of managing a SPECIMEN TRUST DEED OF A GENERAL CHARITABLE TRUST by allowing users to easily send, receive, and eSign documents. Our platform is designed to ensure that all necessary parties can review and sign the trust deed efficiently, streamlining the setup of your charitable trust.

-

Are there any costs associated with obtaining a SPECIMEN TRUST DEED OF A GENERAL CHARITABLE TRUST?

The costs associated with a SPECIMEN TRUST DEED OF A GENERAL CHARITABLE TRUST can vary depending on whether you use a template or seek professional legal assistance to draft it. Utilizing airSlate SignNow can also help minimize costs by providing a straightforward platform for document management and eSigning.

-

What features does airSlate SignNow offer for managing trust documents?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure cloud storage for managing documents like the SPECIMEN TRUST DEED OF A GENERAL CHARITABLE TRUST. Additionally, our intuitive interface makes it easy for users to navigate through the document signing process.

-

Can I integrate airSlate SignNow with other applications for managing my SPECIMEN TRUST DEED OF A GENERAL CHARITABLE TRUST?

Yes, airSlate SignNow offers integrations with various applications and platforms that enhance your experience when managing a SPECIMEN TRUST DEED OF A GENERAL CHARITABLE TRUST. These integrations facilitate easier document sharing and collaboration, making it an efficient choice for managing charitable trust documents.

-

What are the benefits of using airSlate SignNow for my trust documents?

Using airSlate SignNow for your SPECIMEN TRUST DEED OF A GENERAL CHARITABLE TRUST offers multiple benefits, including increased efficiency in document handling, enhanced security for sensitive information, and reduced turnaround times for obtaining signatures. Our platform is designed to meet the needs of both individuals and organizations.

Get more for SPECIMEN TRUST DEED OF A GENERAL CHARITABLE TRUST

Find out other SPECIMEN TRUST DEED OF A GENERAL CHARITABLE TRUST

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form