Tradlet 2015-2026

What is the Tradlet

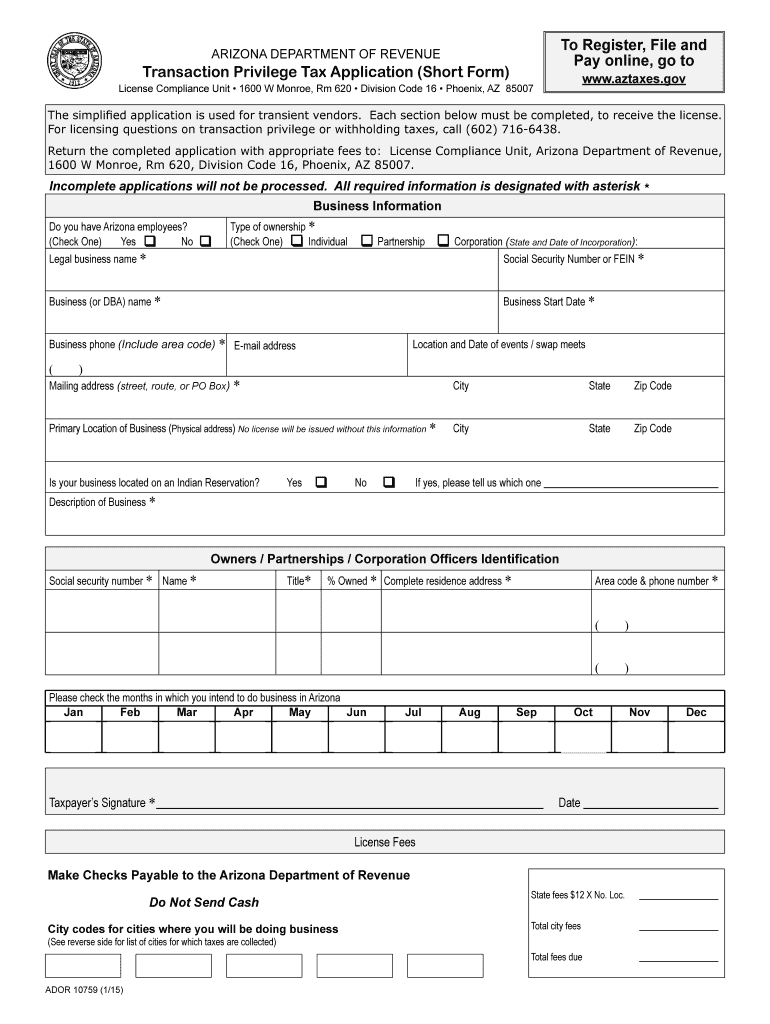

The Tradlet is a specific form used in Arizona for reporting transaction privilege tax. This tax is levied on businesses for the privilege of conducting business within the state. The form captures essential details about the business operations, including gross income, deductions, and the applicable tax rate. Understanding the Tradlet is crucial for businesses to ensure compliance with state tax regulations and to avoid potential penalties.

How to Use the Tradlet

To effectively use the Tradlet, businesses must first gather all necessary financial information, such as sales figures and allowable deductions. The form is designed with fillable fields that allow users to input their data directly. It is important to follow the instructions carefully to ensure accuracy. Once completed, the form can be submitted electronically or via mail, depending on the preference of the business.

Steps to Complete the Tradlet

Completing the Tradlet involves several key steps:

- Gather financial records, including sales and tax documents.

- Access the Tradlet form, either online or in a printable format.

- Fill in the required fields, ensuring all information is accurate.

- Review the completed form for any errors or omissions.

- Submit the form through the chosen method: online, by mail, or in person.

Legal Use of the Tradlet

The Tradlet must be used in accordance with Arizona state law. This includes ensuring that all reported income and deductions are legitimate and properly documented. Misuse of the form, such as falsifying information, can lead to significant penalties, including fines and legal repercussions. Businesses should familiarize themselves with the legal requirements to ensure compliance.

Required Documents

When completing the Tradlet, businesses should have the following documents on hand:

- Sales records for the reporting period.

- Documentation for any deductions claimed.

- Previous tax returns, if applicable.

- Any correspondence from the Arizona Department of Revenue regarding tax status.

Filing Deadlines / Important Dates

It is essential for businesses to be aware of the filing deadlines associated with the Tradlet. Typically, the form is due on a monthly or quarterly basis, depending on the business's tax reporting schedule. Missing a deadline can result in penalties and interest charges. Businesses should mark their calendars and ensure timely submissions to avoid complications.

Quick guide on how to complete arizona transaction privilege tax application short form 2015 2019

Your assistance manual on how to prepare your Tradlet

If you’re curious about how to complete and submit your Tradlet, here are some brief instructions on how to simplify tax filing.

To begin, simply create your airSlate SignNow account to revolutionize your approach to managing documents online. airSlate SignNow is an extremely user-friendly and powerful document platform that allows you to alter, draft, and finish your income tax papers effortlessly. With its editing features, you can navigate between text, checkboxes, and eSignatures and return to modify responses as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and straightforward sharing options.

Follow the steps below to complete your Tradlet in just a few minutes:

- Set up your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Tradlet in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkboxes).

- Employ the Sign Tool to place your legally-binding eSignature (if required).

- Examine your document and fix any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please remember that filing on paper can lead to more errors and slow down refunds. Of course, before e-filing your taxes, consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct arizona transaction privilege tax application short form 2015 2019

FAQs

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

Create this form in 5 minutes!

How to create an eSignature for the arizona transaction privilege tax application short form 2015 2019

How to make an electronic signature for the Arizona Transaction Privilege Tax Application Short Form 2015 2019 in the online mode

How to create an electronic signature for your Arizona Transaction Privilege Tax Application Short Form 2015 2019 in Chrome

How to generate an electronic signature for putting it on the Arizona Transaction Privilege Tax Application Short Form 2015 2019 in Gmail

How to create an electronic signature for the Arizona Transaction Privilege Tax Application Short Form 2015 2019 right from your smart phone

How to generate an eSignature for the Arizona Transaction Privilege Tax Application Short Form 2015 2019 on iOS

How to create an eSignature for the Arizona Transaction Privilege Tax Application Short Form 2015 2019 on Android devices

People also ask

-

What is a transaction privilege tax and how does it apply to my business?

A transaction privilege tax is a tax imposed on businesses for the privilege of conducting business in a specific area. It varies by location and may affect your pricing structure. Understanding what is a transaction privilege tax is crucial for compliance and financial planning.

-

How does airSlate SignNow assist businesses in managing transaction privilege taxes?

airSlate SignNow helps businesses streamline their document management, including tax documentation related to transaction privilege taxes. With our eSigning capabilities, you can easily maintain compliance and keep records organized. This efficiency supports your understanding of what is a transaction privilege tax.

-

Are there features in airSlate SignNow that help with invoice management related to transaction privilege taxes?

Yes, airSlate SignNow includes features for invoice management that help you track and manage transaction privilege taxes. Our platform allows for the seamless creation and signing of invoices that include necessary tax information. This feature simplifies understanding what is a transaction privilege tax.

-

What are the pricing options for using airSlate SignNow related to transaction privilege tax management?

airSlate SignNow offers various pricing plans that provide tools for managing transaction privilege taxes effectively. Depending on your needs, you can choose a plan that fits your business size and budget while providing features tailored for tax documentation. Understanding what is a transaction privilege tax is supported by our pricing model, ensuring cost-effectiveness.

-

Can airSlate SignNow integrate with my existing accounting software to handle transaction privilege taxes?

Absolutely! airSlate SignNow offers integrations with various accounting software that can help manage transaction privilege taxes seamlessly. By integrating with platforms like QuickBooks or Xero, you can easily track and report taxes. This integration simplifies the process of understanding what is a transaction privilege tax.

-

What benefits can my business expect from using airSlate SignNow for transaction privilege tax documentation?

Using airSlate SignNow for transaction privilege tax documentation can save time and reduce errors. Our electronic signature capabilities ensure that all documents are signed quickly and securely. This efficiency allows your team to focus on understanding what is a transaction privilege tax rather than getting bogged down in paperwork.

-

How does eSigning with airSlate SignNow simplify the process of dealing with transaction privilege taxes?

eSigning with airSlate SignNow simplifies the process by allowing users to sign important tax documents digitally, ensuring things are filed on time. This reduces delays associated with traditional paper signing methods. Knowing what is a transaction privilege tax becomes easier when document management is efficient and straightforward.

Get more for Tradlet

- Illinois withholding allowance worksheet example 42276470 form

- Borrowers personal information auto loan philippines

- Penndot form mv 44 commonwealth auto tags

- Crime busters science olympiad practice test form

- Harris teeter vaccine consent form

- Medical for families form

- Injury assessment form

- Virginia individual income tax declaration for electronic filing form

Find out other Tradlet

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself