Kentucky Personal Property Tax Form Fill Out and Sign 2023

What is the Kentucky Personal Property Tax Form

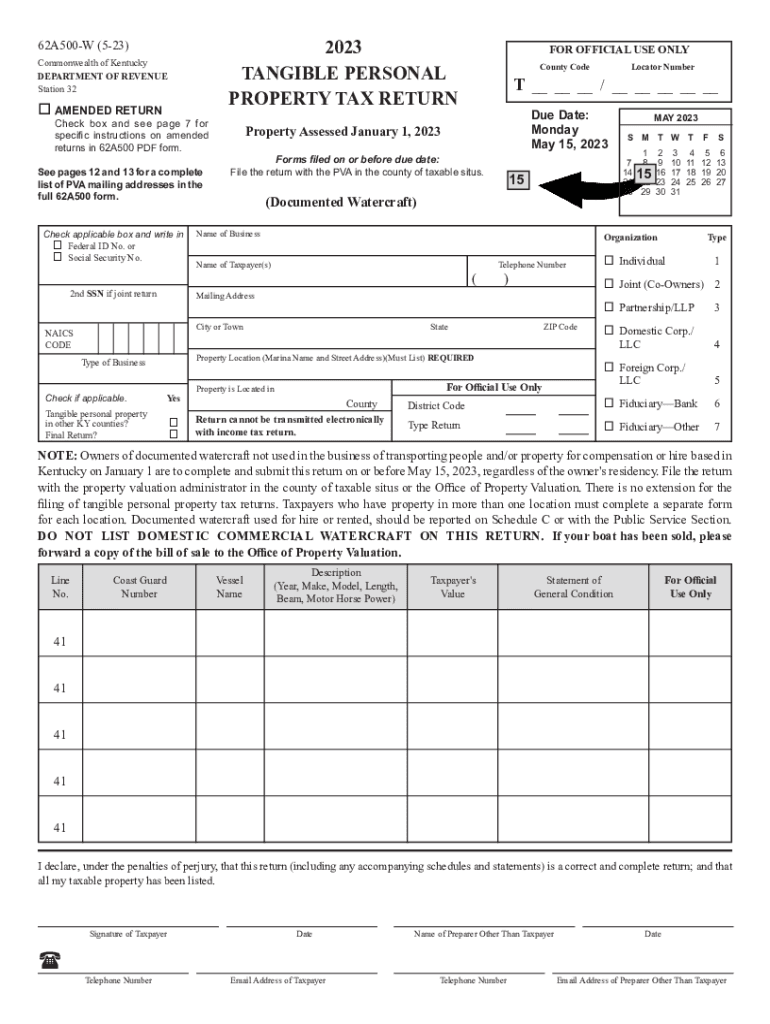

The Kentucky Personal Property Tax Form is a document used by individuals and businesses to report personal property owned within the state of Kentucky. This form is essential for determining the amount of personal property tax owed. It includes details about various types of personal property, such as vehicles, machinery, and equipment. Proper completion of this form ensures compliance with state tax regulations and helps in the accurate assessment of taxes owed.

Steps to complete the Kentucky Personal Property Tax Form

Filling out the Kentucky Personal Property Tax Form involves several key steps:

- Gather necessary information: Collect details about all personal property owned, including descriptions, values, and purchase dates.

- Obtain the form: Access the Kentucky Personal Property Tax Form from the appropriate state or local government website or office.

- Fill out the form: Provide accurate information in each section of the form, ensuring that all required fields are completed.

- Review for accuracy: Double-check all entries for correctness to avoid potential issues with tax assessments.

- Submit the form: Follow the submission guidelines, which may include online filing, mailing, or in-person delivery.

How to use the Kentucky Personal Property Tax Form

The Kentucky Personal Property Tax Form is used to report personal property to local tax authorities. Users must fill out the form accurately to reflect the current status of their personal property. This includes listing items owned, their estimated values, and any relevant details that may affect tax calculations. Once completed, the form serves as a declaration of personal property for tax purposes and must be submitted by the designated deadline to avoid penalties.

Key elements of the Kentucky Personal Property Tax Form

Several key elements are crucial for the Kentucky Personal Property Tax Form:

- Property description: A detailed description of each item of personal property, including make, model, and year.

- Value assessment: An estimated value for each item, which is typically based on market value or purchase price.

- Owner information: The name, address, and contact information of the property owner or business.

- Signature: The form must be signed by the owner or an authorized representative, certifying that the information provided is accurate.

Filing Deadlines / Important Dates

Filing deadlines for the Kentucky Personal Property Tax Form are typically set by local tax authorities. It is important to be aware of these deadlines to avoid late fees or penalties. Generally, the form must be submitted annually by a specific date, often in the spring. Checking with local tax offices for the exact dates is advisable to ensure timely compliance.

Form Submission Methods

The Kentucky Personal Property Tax Form can be submitted through various methods, including:

- Online submission: Many counties offer an online portal for electronic filing.

- Mail: Completed forms can be mailed to the appropriate local tax office.

- In-person submission: Individuals may also choose to deliver the form directly to their local tax office.

Quick guide on how to complete kentucky personal property tax form fill out and sign

Easily Prepare Kentucky Personal Property Tax Form Fill Out And Sign on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your files quickly and efficiently. Manage Kentucky Personal Property Tax Form Fill Out And Sign across any device with the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The easiest way to alter and electronically sign Kentucky Personal Property Tax Form Fill Out And Sign effortlessly

- Locate Kentucky Personal Property Tax Form Fill Out And Sign and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes moments and bears the same legal significance as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Kentucky Personal Property Tax Form Fill Out And Sign and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kentucky personal property tax form fill out and sign

Create this form in 5 minutes!

How to create an eSignature for the kentucky personal property tax form fill out and sign

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kentucky Personal Property Tax Form and why is it important?

The Kentucky Personal Property Tax Form is a required document for reporting personal property to your local tax authority. Completing this form is crucial to ensure compliance with state tax regulations and avoid penalties. airSlate SignNow provides a streamlined way to fill out and sign this form efficiently.

-

How can I fill out the Kentucky Personal Property Tax Form using airSlate SignNow?

You can easily fill out the Kentucky Personal Property Tax Form using airSlate SignNow's intuitive interface. Simply upload the form, input your information, and use our eSignature feature to sign it digitally. This process saves time and reduces the hassle of traditional paper forms.

-

Is it secure to use airSlate SignNow for my Kentucky Personal Property Tax Form?

Yes, airSlate SignNow prioritizes security with a robust encryption system to protect your personal information. When you choose to fill out and sign the Kentucky Personal Property Tax Form, rest assured that your data is secure and complies with necessary regulations.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including a free trial. For those looking to fill out and sign the Kentucky Personal Property Tax Form, our cost-effective solutions provide excellent value. Check our website for the most current pricing details.

-

Can I integrate airSlate SignNow with other software tools?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions, enhancing your workflow. This makes it easy to fill out and sign the Kentucky Personal Property Tax Form and connect with tools you already use—boosting productivity across your organization.

-

What features does airSlate SignNow offer for completing the Kentucky Personal Property Tax Form?

airSlate SignNow includes features like templates, automated workflows, and eSignatures, making it simple to fill out and sign the Kentucky Personal Property Tax Form. These tools streamline the process, allowing for quick submission and reducing the chances of errors.

-

How can airSlate SignNow benefit me when filing my taxes?

Using airSlate SignNow to fill out and sign the Kentucky Personal Property Tax Form offers signNow benefits, including time savings and reduced stress. The online platform ensures that your forms are completed accurately and submitted on time. Enjoy the convenience of digital signatures and tracking capabilities.

Get more for Kentucky Personal Property Tax Form Fill Out And Sign

- Cover sheet for protection order no contact order form

- Referral for services southside obgyn form

- Release of medical records authorization allergy and asthma form

- Fillable online crg patient registration form childrens resource

- Massage therapy bhealth questionnaireb boetelmassagecom form

- 49937 fill in pdf reset form nurse aide registry cna

- Indiana state department of health application form

- Sc7 fitness to work assessment food safety authority of form

Find out other Kentucky Personal Property Tax Form Fill Out And Sign

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe