Definitions and General Instructions Revenue Ky Gov 2022

Understanding the 2022 Property Tax Form

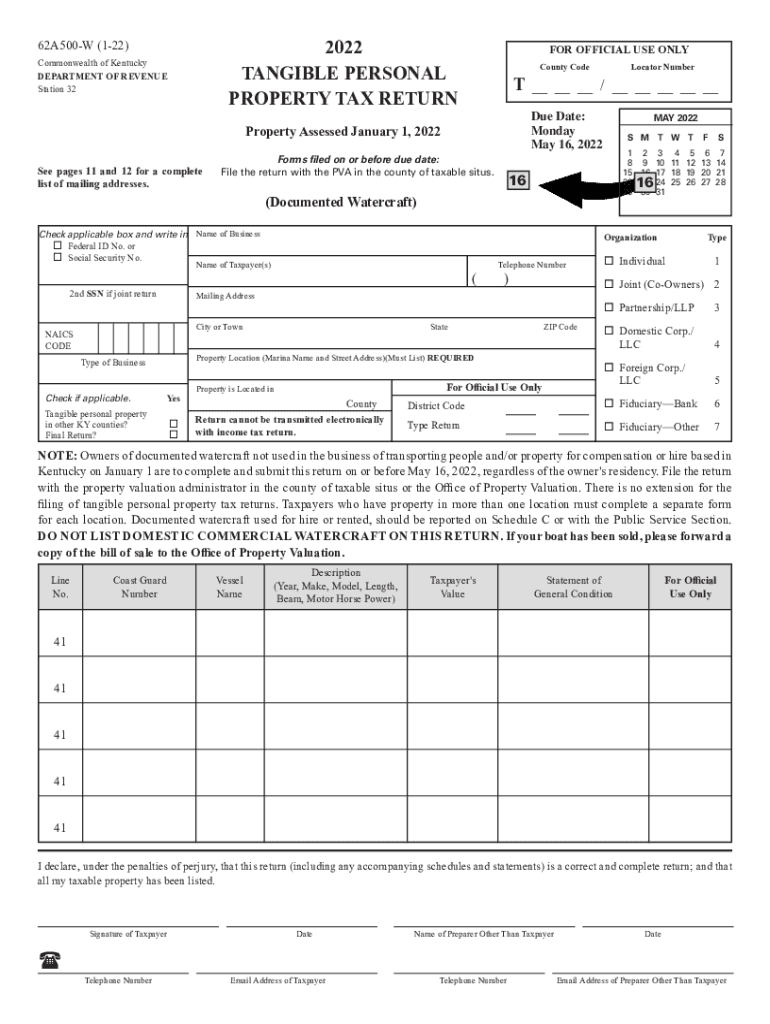

The 2022 property tax form is a crucial document used by property owners to report their property value and calculate taxes owed to local governments. This form typically requires detailed information about the property, including its location, type, and assessed value. Understanding the requirements and purpose of this form is essential for accurate filing and compliance with local tax laws.

Steps to Complete the 2022 Property Tax Form

Completing the 2022 property tax form involves several important steps:

- Gather necessary information about your property, including its legal description and assessed value.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline to avoid penalties.

Required Documents for Filing

When preparing to file the 2022 property tax form, certain documents may be required. These typically include:

- Proof of property ownership, such as a deed or title.

- Previous year’s property tax statement for reference.

- Any relevant documentation supporting claims for exemptions or deductions.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the 2022 property tax form. Typically, property tax forms must be submitted by a specific date, often in the spring. Missing this deadline can result in penalties or interest on unpaid taxes. Always check with your local tax authority for the exact dates relevant to your area.

Legal Use of the 2022 Property Tax Form

The 2022 property tax form serves as a legally binding document when completed and submitted according to local regulations. It is essential that all information provided is truthful and accurate, as discrepancies can lead to legal repercussions. Understanding the legal implications of this form helps ensure compliance and protects property owners from potential disputes.

Form Submission Methods

There are various methods available for submitting the 2022 property tax form. These may include:

- Online submission through the local tax authority's website.

- Mailing a physical copy of the form to the appropriate office.

- In-person submission at designated tax offices.

Choosing the right submission method can streamline the process and ensure timely filing.

Quick guide on how to complete definitions and general instructions revenuekygov

Effortlessly Prepare Definitions And General Instructions Revenue ky gov on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an excellent environmentally-friendly substitute for traditional printed and signed papers, allowing you to easily locate the needed form and securely store it on the web. airSlate SignNow equips you with all the resources necessary to create, adjust, and electronically sign your documents swiftly and seamlessly. Handle Definitions And General Instructions Revenue ky gov on any device using the airSlate SignNow apps available for Android or iOS, and streamline any document-related process today.

Modify and eSign Definitions And General Instructions Revenue ky gov with Ease

- Locate Definitions And General Instructions Revenue ky gov and then click Get Form to begin.

- Utilize the features we offer to finalize your form.

- Emphasize crucial sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as an ordinary wet ink signature.

- Review the details and then select the Done button to save your changes.

- Choose your preferred method to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Revise and eSign Definitions And General Instructions Revenue ky gov to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct definitions and general instructions revenuekygov

Create this form in 5 minutes!

People also ask

-

What is the purpose of the 2022 property tax form?

The 2022 property tax form is essential for property owners to report their property values and calculate the taxes owed for the year. Properly filling out this form ensures that you comply with local tax laws and can potentially influence your tax rates based on the current valuation of your property. Understanding how to complete this form is crucial for accurate tax filing.

-

How can airSlate SignNow help with the 2022 property tax form?

AirSlate SignNow provides a user-friendly platform to digitize and streamline the signing of your 2022 property tax form. You can easily upload, fill out, and send the completed form for signature, ensuring you meet all deadlines. This saves time and reduces the stress associated with paper forms.

-

Is there a cost to use airSlate SignNow for the 2022 property tax form?

AirSlate SignNow offers various pricing plans to accommodate different business needs, including those needing to manage the 2022 property tax form. Our plans are designed to be cost-effective, ensuring you only pay for the features you need. You can also enjoy a free trial to explore the platform before committing.

-

What features does airSlate SignNow offer for managing the 2022 property tax form?

With airSlate SignNow, you get features like customizable templates, automated reminders, and secure document storage that facilitate the management of your 2022 property tax form. These features ensure a smooth process from start to finish, reducing errors and speeding up document turnaround times. The easy-to-navigate interface makes accessing and completing your forms straightforward.

-

Can I integrate airSlate SignNow with other software for my 2022 property tax form?

Yes, airSlate SignNow integrates seamlessly with various popular software applications to help you manage your 2022 property tax form effectively. Whether you use accounting software, CRMs, or other document management tools, our integration capabilities offer a streamlined workflow. This enhances collaboration and keeps all your documents organized in one place.

-

What are the benefits of eSigning my 2022 property tax form?

eSigning your 2022 property tax form with airSlate SignNow offers numerous benefits, such as faster processing times and improved security. Electronic signatures are legally binding and allow for immediate submission, meaning you can meet deadlines efficiently. Plus, you'll reduce paper usage, contributing to a more sustainable business practice.

-

How secure is airSlate SignNow for filing my 2022 property tax form?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the 2022 property tax form. Our platform employs encryption, secure cloud storage, and multi-factor authentication to protect your data. You can confidently manage your documents knowing they are safe from unauthorized access.

Get more for Definitions And General Instructions Revenue ky gov

- Notice to lessor exercising option to purchase connecticut form

- Ct assignment 497301133 form

- Assignment of lease from lessor with notice of assignment connecticut form

- Letter from landlord to tenant as notice of abandoned personal property connecticut form

- Guaranty or guarantee of payment of rent connecticut form

- Letter from landlord to tenant as notice of default on commercial lease connecticut form

- Residential or rental lease extension agreement connecticut form

- Ct lease form

Find out other Definitions And General Instructions Revenue ky gov

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free