Personal Property Tax Forms and Instructions Kentucky 2020

Understanding the 2020 Tangible Personal Property Tax Forms and Instructions in Kentucky

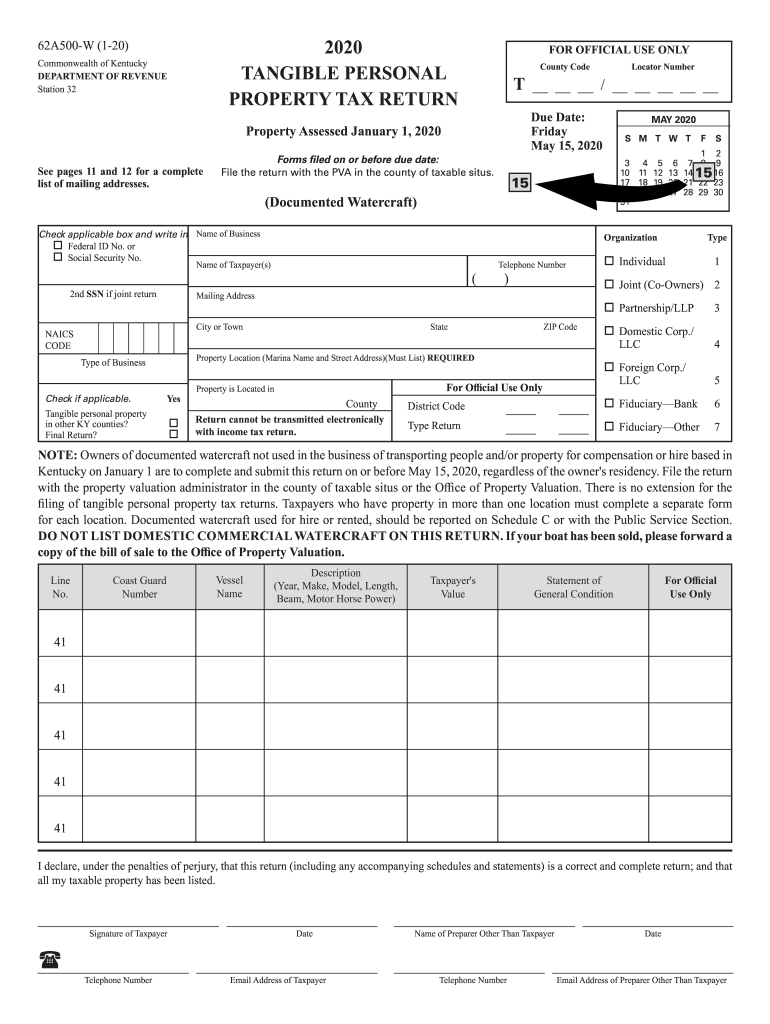

The 2020 tangible personal property tax forms in Kentucky are essential for individuals and businesses to report their personal property to the state. These forms require detailed information about the property owned, including its type, value, and location. Understanding the specific requirements and instructions for these forms ensures compliance with state tax laws. The forms are designed to capture various categories of personal property, such as machinery, equipment, and furniture, which are subject to taxation.

Steps to Complete the 2020 Tangible Personal Property Tax Return

Completing the 2020 tangible personal property tax return involves several key steps. First, gather all necessary documentation, including purchase receipts and previous tax returns. Next, accurately assess the value of your personal property, as this will determine your tax liability. Fill out the form by providing detailed descriptions of each item, including its condition and market value. After completing the form, review it for accuracy before submitting it to the appropriate local tax authority by the specified deadline.

Filing Deadlines and Important Dates for the 2020 Tax Year

For the 2020 tangible personal property tax return in Kentucky, it is crucial to be aware of filing deadlines. Typically, the return must be filed by May 15 of the tax year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Late submissions may incur penalties, so staying informed about these dates is essential for compliance and avoiding unnecessary fees.

Legal Use of the 2020 Tangible Personal Property Tax Forms

The 2020 tangible personal property tax forms are legally binding documents. When filled out correctly and submitted, they serve as official declarations to the state regarding personal property ownership. It is important to ensure that all information provided is accurate and truthful, as any discrepancies may lead to audits or penalties. Utilizing a reliable platform for electronic signatures can enhance the legal standing of your submission, ensuring compliance with state regulations.

Required Documents for Filing the 2020 Tangible Personal Property Tax Return

When preparing to file the 2020 tangible personal property tax return, several documents are necessary. These include proof of ownership, such as purchase invoices or receipts, and any previous tax returns related to the property. Additionally, you may need to provide documentation supporting the valuation of the property, such as appraisals or market analysis reports. Having these documents ready will facilitate a smoother filing process.

Form Submission Methods for the 2020 Tangible Personal Property Tax Return

There are multiple methods for submitting the 2020 tangible personal property tax return in Kentucky. Taxpayers can file their returns online through the state’s tax portal, which offers a convenient and efficient way to complete the process. Alternatively, forms can be mailed directly to the local tax authority or submitted in person at designated offices. Each method has its own advantages, and choosing the right one depends on individual preferences and circumstances.

Quick guide on how to complete 2020 personal property tax forms and instructions kentucky

Make Personal Property Tax Forms And Instructions Kentucky effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed papers, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without holdups. Manage Personal Property Tax Forms And Instructions Kentucky on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Personal Property Tax Forms And Instructions Kentucky with ease

- Find Personal Property Tax Forms And Instructions Kentucky and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that reason.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign Personal Property Tax Forms And Instructions Kentucky and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 personal property tax forms and instructions kentucky

Create this form in 5 minutes!

People also ask

-

What is the 2020 tangible personal property tax?

The 2020 tangible personal property tax refers to taxes levied on physical assets owned by businesses, such as machinery and equipment. It is essential for business owners to understand this tax as it affects their overall financial obligations. Proper management of tangible personal property tax can lead to signNow savings for businesses.

-

How can airSlate SignNow help with managing the 2020 tangible personal property tax?

AirSlate SignNow simplifies the process of collecting and storing documents related to the 2020 tangible personal property tax. By using our eSignature solutions, businesses can efficiently manage tax-related paperwork, making filing and tracking much easier. This not only saves time but also reduces the risk of errors in documentation.

-

What features does airSlate SignNow offer for tax documentation related to the 2020 tangible personal property tax?

AirSlate SignNow offers features such as customizable templates, secure eSigning, and document storage to facilitate tax documentation for the 2020 tangible personal property tax. These tools ensure that your forms are complete and compliant with local regulations, streamlining the tax filing process. Additionally, the platform allows for easy collaboration, ensuring that all stakeholders are involved.

-

Is airSlate SignNow a cost-effective solution for handling the 2020 tangible personal property tax?

Yes, airSlate SignNow provides a cost-effective solution for managing the paperwork associated with the 2020 tangible personal property tax. With flexible pricing plans, businesses can choose a subscription that fits their needs without breaking the bank. This value is especially beneficial during tax season when efficiency is crucial.

-

Can airSlate SignNow integrate with accounting software for the 2020 tangible personal property tax?

AirSlate SignNow integrates seamlessly with various accounting software, allowing for efficient management of the 2020 tangible personal property tax documentation. This integration ensures that all your financial data is consolidated, making it easier to file taxes accurately. Such compatibility enhances workflow and reduces the need for manual data entry.

-

What are the benefits of using airSlate SignNow for the 2020 tangible personal property tax?

Using airSlate SignNow for the 2020 tangible personal property tax provides businesses with enhanced efficiency, security, and accuracy in managing tax documentation. Our platform saves time by automating the eSignature process and ensures compliance with legal requirements. Businesses can also track document status in real-time, allowing for better planning and execution.

-

Are there any additional resources available for the 2020 tangible personal property tax through airSlate SignNow?

Yes, airSlate SignNow offers various resources to help businesses understand and manage the 2020 tangible personal property tax. These include webinars, guides, and blog articles that provide valuable insights into tax filing best practices and compliance tips. Access to such resources can enhance your knowledge and strategy related to tangible personal property tax.

Get more for Personal Property Tax Forms And Instructions Kentucky

- Cosmetology mini salon license application instructionsmissouri cosmetology license application renewal state board of form

- Illinois secretary of state guide to the sos literacy effort form

- Ld a 211 form

- Illinois state archives archives monthposter form

- Ar d 144 form

- Application for initial identification card form

- Illinois state archives guidelines for genealogical research form

- Illinois state archives mapping your past form

Find out other Personal Property Tax Forms And Instructions Kentucky

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF