Tangible Personal Property Tax Form 2025-2026

What is the Tangible Personal Property Tax Form

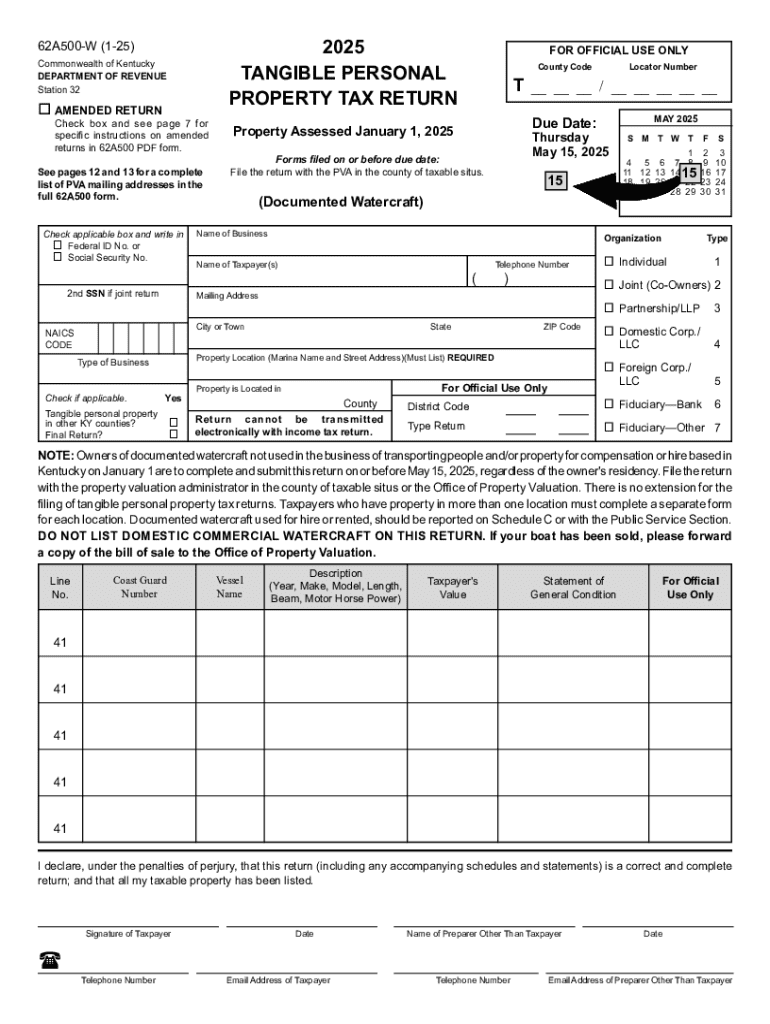

The Tangible Personal Property Tax Form is a document used by property owners to report their tangible personal property to the local tax authority. This form is essential for assessing property taxes on items such as machinery, equipment, furniture, and other physical assets that are not real estate. Each state in the U.S. may have its specific version of this form, and it is important to understand the local requirements to ensure compliance.

How to use the Tangible Personal Property Tax Form

Using the Tangible Personal Property Tax Form involves several steps. First, gather all relevant information about your tangible personal property, including descriptions, values, and acquisition dates. Next, fill out the form accurately, ensuring that all required fields are completed. Once completed, submit the form to your local tax authority by the specified deadline. It is advisable to keep a copy of the submitted form for your records.

Steps to complete the Tangible Personal Property Tax Form

Completing the Tangible Personal Property Tax Form typically involves the following steps:

- Collect information about all tangible personal property owned.

- Determine the fair market value of each item.

- Fill out the form, providing detailed descriptions and values.

- Review the form for accuracy before submission.

- Submit the form by mail, online, or in person, depending on local regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Tangible Personal Property Tax Form vary by state. Generally, forms must be submitted annually, with deadlines often falling between January and April. It is crucial to check the specific deadlines for your jurisdiction to avoid late fees or penalties. Marking these dates on your calendar can help ensure timely submission.

Required Documents

When completing the Tangible Personal Property Tax Form, you may need to provide supporting documents. Commonly required documents include:

- Purchase receipts or invoices for tangible personal property.

- Previous tax returns that include property information.

- Appraisals or valuations for high-value items.

Having these documents ready can facilitate the completion of the form and support the reported values.

Penalties for Non-Compliance

Failing to file the Tangible Personal Property Tax Form or submitting inaccurate information can result in penalties. These penalties may include fines, interest on unpaid taxes, and potential legal action from tax authorities. Understanding the importance of compliance can help property owners avoid these negative consequences.

Who Issues the Form

The Tangible Personal Property Tax Form is typically issued by the local tax authority or assessor's office in your jurisdiction. Each state may have different agencies responsible for managing property taxes, so it is essential to identify the correct office to obtain the appropriate form and any relevant instructions.

Create this form in 5 minutes or less

Find and fill out the correct tangible personal property tax form

Create this form in 5 minutes!

How to create an eSignature for the tangible personal property tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Tangible Personal Property Tax Form?

A Tangible Personal Property Tax Form is a document used to report personal property owned by individuals or businesses for tax purposes. This form helps local governments assess the value of tangible assets, such as equipment and inventory, to determine tax liabilities. Understanding how to complete this form accurately is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with the Tangible Personal Property Tax Form?

airSlate SignNow simplifies the process of completing and submitting the Tangible Personal Property Tax Form by providing an intuitive eSignature platform. Users can easily fill out the form, sign it electronically, and send it directly to the appropriate tax authority. This streamlines the process, saving time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Tangible Personal Property Tax Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that enhance the management of documents, including the Tangible Personal Property Tax Form. Users can choose a plan that best fits their budget and requirements.

-

What features does airSlate SignNow offer for managing the Tangible Personal Property Tax Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the Tangible Personal Property Tax Form. These tools ensure that users can efficiently manage their tax documents while maintaining compliance with local regulations. Additionally, the platform allows for easy collaboration among team members.

-

Can I integrate airSlate SignNow with other software for the Tangible Personal Property Tax Form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the Tangible Personal Property Tax Form alongside your existing tools. Whether you use accounting software or document management systems, these integrations enhance workflow efficiency and data accuracy.

-

What are the benefits of using airSlate SignNow for the Tangible Personal Property Tax Form?

Using airSlate SignNow for the Tangible Personal Property Tax Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick electronic signatures, which speeds up the submission process. Additionally, users can store and access their forms securely in the cloud.

-

Is airSlate SignNow user-friendly for completing the Tangible Personal Property Tax Form?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the Tangible Personal Property Tax Form. The platform features a straightforward interface that guides users through the process, ensuring that even those with minimal technical skills can navigate it effectively.

Get more for Tangible Personal Property Tax Form

Find out other Tangible Personal Property Tax Form

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF