Corporation Tax 2023-2026

What is form 318925?

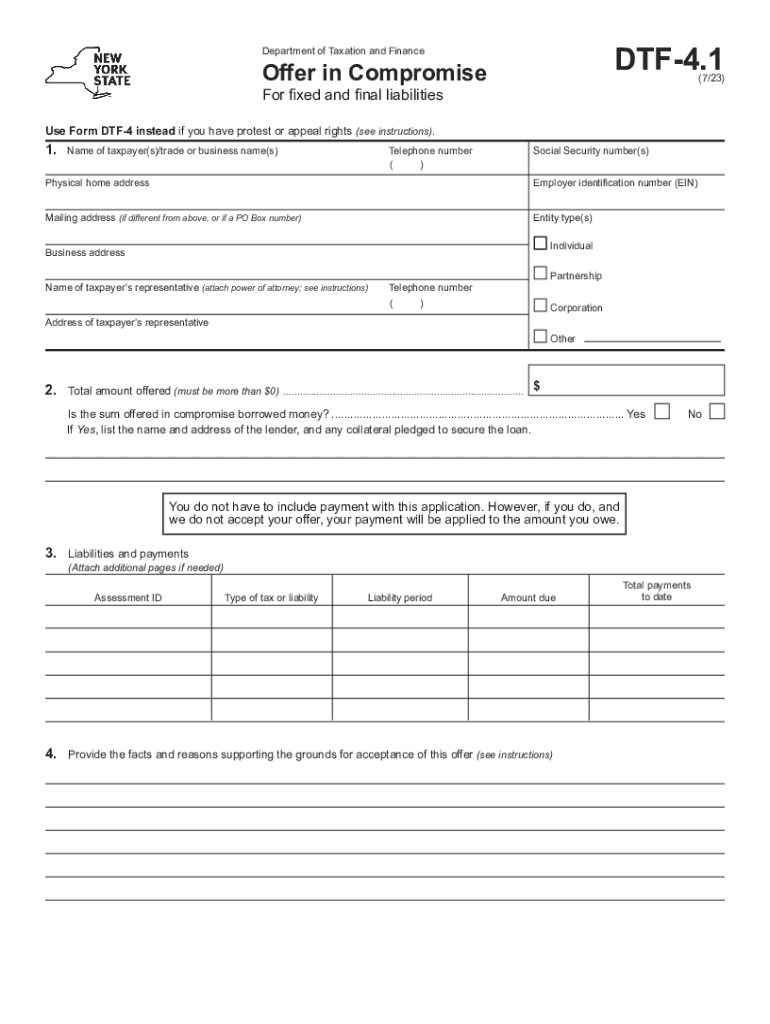

Form 318925 is a specific form used in New York State for tax purposes, particularly related to offers in compromise. This form allows taxpayers to propose a settlement with the state for their outstanding tax liabilities. By submitting this form, individuals or businesses can negotiate a reduced payment amount that satisfies their tax obligations. Understanding the purpose and function of form 318925 is essential for anyone considering this option to resolve their tax debts.

Steps to complete form 318925

Completing form 318925 involves several key steps to ensure accuracy and compliance with state regulations. Here is a simplified process:

- Gather necessary financial documents, including income statements, bank statements, and any relevant tax returns.

- Fill out the form with accurate personal and financial information, ensuring all sections are completed.

- Calculate the offer amount based on your ability to pay, considering your current financial situation.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate tax authority, either online or via mail, depending on your preference.

Legal use of form 318925

Form 318925 is legally recognized for negotiating tax liabilities in New York State. It is essential for taxpayers to understand that submitting this form does not guarantee acceptance of the offer. The state will review the proposal based on the taxpayer's financial situation and the overall tax debt. Legal compliance is crucial, and any inaccuracies or fraudulent information can lead to penalties or rejection of the offer.

Penalties for non-compliance

Failing to comply with the requirements associated with form 318925 can result in significant penalties. These may include:

- Rejection of the offer in compromise, which means the taxpayer remains liable for the full amount owed.

- Potential legal action from the state for unpaid taxes.

- Additional fines or interest on the outstanding tax debt.

It is vital for taxpayers to ensure all information provided is accurate and complete to avoid these consequences.

Required documents

When submitting form 318925, several documents are typically required to support the offer in compromise. These documents help verify financial information and demonstrate the taxpayer's inability to pay the full tax liability. Commonly required documents include:

- Recent pay stubs or proof of income.

- Bank statements for the past few months.

- Tax returns for the previous years.

- Documentation of any assets owned, such as property or vehicles.

Providing comprehensive documentation can strengthen the proposal and improve the chances of acceptance.

IRS guidelines related to form 318925

While form 318925 is specific to New York State, it is essential to be aware of IRS guidelines regarding offers in compromise at the federal level. The IRS has its own processes and requirements for similar forms, which can impact how state offers are viewed. Taxpayers should consider consulting IRS resources or a tax professional to ensure they meet all necessary guidelines and understand the implications of their state offer.

Quick guide on how to complete corporation tax

Complete Corporation Tax effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files quickly without delays. Manage Corporation Tax on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Corporation Tax seamlessly

- Find Corporation Tax and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Corporation Tax and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct corporation tax

Create this form in 5 minutes!

How to create an eSignature for the corporation tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 318925 and how can it benefit my business?

Form 318925 is a customizable document used for various business purposes, including agreements and contracts. By utilizing airSlate SignNow, you can create, send, and eSign this form effortlessly, streamlining your workflow and enhancing document management.

-

How do I create form 318925 using airSlate SignNow?

Creating form 318925 in airSlate SignNow is straightforward. You can start by selecting a template or building your form from scratch using the intuitive drag-and-drop editor, allowing you to tailor it to your specific needs.

-

What are the pricing plans for using form 318925 with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to various business sizes and needs. You can choose a plan that includes access to features for managing form 318925, with options suitable for individuals and larger teams.

-

Can I integrate form 318925 with other applications?

Yes, airSlate SignNow supports integration with various applications, making it easy to manage form 318925 alongside your existing tools. This compatibility allows for seamless workflow enhancements and document sharing across platforms.

-

Is it easy to eSign form 318925 through airSlate SignNow?

Absolutely! airSlate SignNow simplifies the eSigning process for form 318925, enabling your clients and team members to sign documents online securely and quickly. This efficiency can greatly reduce turnaround times for approvals.

-

What security features does airSlate SignNow offer for form 318925?

airSlate SignNow prioritizes security for all documents, including form 318925. It employs industry-standard encryption and complies with regulations to ensure that your data remains confidential and secure throughout the eSigning process.

-

Are there templates available for form 318925?

Yes, airSlate SignNow provides various templates, including options for form 318925, which can help you get started quickly. These templates are customizable, allowing you to modify them according to your specific business requirements.

Get more for Corporation Tax

- Down syndrome form special olympics kansas

- Kancare service authorization form otr

- Jayhawk primary care history sheet kansas city hospital form

- Client intake form horse sense kc

- Fidelity transfer death form

- C384 form 626643554

- R38 expat claiming for a repayment of an amount overpaid form

- Patient registration tri city dermatology form

Find out other Corporation Tax

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online