Minnesota State Income Tax Form

What is the Minnesota State Income Tax Form

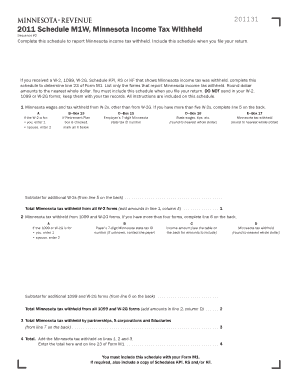

The Minnesota State Income Tax Form is a document used by residents of Minnesota to report their income and calculate their state tax obligations. This form is essential for individuals and businesses alike, as it helps determine the amount of tax owed to the state government. The form typically includes sections for reporting various types of income, deductions, and credits that may apply to the taxpayer's situation.

Steps to complete the Minnesota State Income Tax Form

Completing the Minnesota State Income Tax Form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Identify applicable deductions and credits that may reduce your taxable income.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Review the completed form for any errors or omissions before submission.

- Submit the form either electronically or by mail, depending on your preference.

How to obtain the Minnesota State Income Tax Form

The Minnesota State Income Tax Form can be obtained through several channels. Taxpayers can download the form directly from the Minnesota Department of Revenue's website. Additionally, physical copies may be available at local government offices or libraries. It is advisable to ensure you have the most current version of the form, as updates may occur annually.

Legal use of the Minnesota State Income Tax Form

The Minnesota State Income Tax Form must be completed and submitted in compliance with state tax laws. It is legally binding, meaning that any information provided must be accurate and truthful. Filing this form is mandatory for residents who meet the income thresholds set by the state. Failure to file correctly can result in penalties or legal consequences.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Minnesota have multiple options for submitting their State Income Tax Form. The most common methods include:

- Online Submission: Many taxpayers opt to file electronically through the Minnesota Department of Revenue's e-file system, which is often faster and more efficient.

- Mail: For those who prefer to file by paper, completed forms can be mailed to the appropriate state address indicated on the form.

- In-Person: Some individuals may choose to submit their forms in person at local tax offices, although this option may be less common.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the Minnesota State Income Tax Form. Generally, the deadline for filing is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of any extensions they may apply for, as well as deadlines for making payments to avoid interest and penalties.

Quick guide on how to complete minnesota state income tax form

Complete Minnesota State Income Tax Form easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Minnesota State Income Tax Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The optimal way to edit and electronically sign Minnesota State Income Tax Form effortlessly

- Locate Minnesota State Income Tax Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign Minnesota State Income Tax Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota state income tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Minnesota state income tax?

Minnesota state income tax is a tax levied by the state of Minnesota on the income earned by residents and non-residents within the state. Rates vary based on income brackets and can signNowly affect your overall tax liability. Understanding these nuances can help individuals make informed financial decisions.

-

How does airSlate SignNow help with Minnesota state income tax forms?

airSlate SignNow allows users to easily create, send, and electronically sign Minnesota state income tax forms. Our platform simplifies the process, ensuring that your documents are completed accurately and efficiently. With secure storage and signature management, you can focus on what matters most: filing your taxes.

-

What features does airSlate SignNow offer for handling Minnesota state income tax documents?

airSlate SignNow provides a user-friendly interface with features such as templates for Minnesota state income tax forms and advanced editing tools. You can also track document status and set reminders for important tax deadlines. This makes managing your Minnesota state income tax documents hassle-free.

-

Is airSlate SignNow cost-effective for small businesses dealing with Minnesota state income tax?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing Minnesota state income tax obligations. Our competitive pricing packages offer great value, allowing you to save both time and money while ensuring compliance with state tax regulations.

-

Can airSlate SignNow integrate with accounting software to manage Minnesota state income tax?

Yes, airSlate SignNow integrates seamlessly with various accounting software platforms. This integration allows you to efficiently manage your financial documents related to Minnesota state income tax alongside your accounting tasks, ensuring accuracy and reducing the potential for errors.

-

How secure is airSlate SignNow for handling sensitive Minnesota state income tax information?

Security is a top priority at airSlate SignNow. We use industry-leading encryption protocols to protect your sensitive Minnesota state income tax documents and personal information. With our platform, you can have peace of mind knowing your data is secure while you manage your tax filings.

-

What benefits does eSigning via airSlate SignNow provide for Minnesota state income tax paperwork?

eSigning through airSlate SignNow offers numerous benefits for handling Minnesota state income tax paperwork. It accelerates the signing process, reduces the need for physical documents, and allows for immediate submission of forms. Additionally, our system provides legally binding signatures, ensuring your tax documents are valid.

Get more for Minnesota State Income Tax Form

Find out other Minnesota State Income Tax Form

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later