Publication 5279 Rev 4 Your Pathway to Becoming an Enrolled Agent Starts Here 2022

Understanding Publication 5279 Rev 4

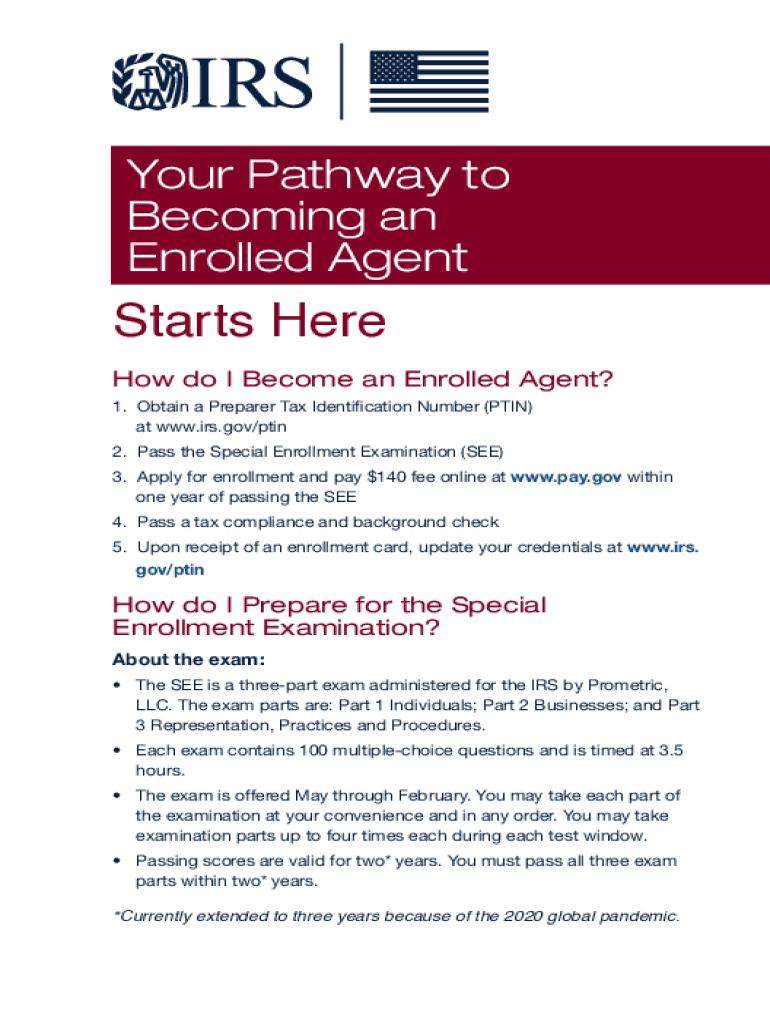

Publication 5279 Rev 4 serves as a comprehensive guide for individuals aspiring to become enrolled agents. This document outlines the requirements, processes, and responsibilities associated with obtaining the enrolled agent designation. It is specifically tailored to help candidates navigate the complexities of the enrollment process, providing essential information about the necessary qualifications and the role of enrolled agents in representing taxpayers before the IRS.

How to Utilize Publication 5279 Rev 4

To effectively use Publication 5279 Rev 4, individuals should first familiarize themselves with its contents. The publication offers step-by-step instructions on the enrollment process, including how to apply for the enrolled agent examination. It is advisable to review the eligibility criteria, required documents, and application procedures outlined in the publication. By following these guidelines, candidates can ensure they meet all necessary requirements and submit a complete application.

Obtaining Publication 5279 Rev 4

Individuals can obtain Publication 5279 Rev 4 through the IRS website or by contacting the IRS directly. The publication is available in digital format, allowing for easy access and download. Additionally, printed copies may be requested if preferred. Keeping a copy of this publication on hand is beneficial for reference throughout the enrollment process.

Steps to Complete the Enrollment Process

The enrollment process outlined in Publication 5279 Rev 4 includes several key steps:

- Review eligibility criteria to ensure qualification.

- Gather required documents, such as proof of identification and tax compliance.

- Complete the application form as specified in the publication.

- Schedule and prepare for the enrolled agent examination.

- Submit the application and await confirmation from the IRS.

Following these steps carefully can enhance the likelihood of a successful application.

Legal Use of Publication 5279 Rev 4

Publication 5279 Rev 4 is an official IRS document and is legally recognized as a valid resource for individuals seeking to become enrolled agents. It provides authoritative guidance on the rules and regulations governing the enrollment process. Adhering to the instructions within this publication ensures compliance with IRS standards and helps maintain the integrity of the enrolled agent designation.

Key Elements of Publication 5279 Rev 4

Key elements of Publication 5279 Rev 4 include:

- Detailed descriptions of the roles and responsibilities of enrolled agents.

- Information on the types of tax matters enrolled agents can assist with.

- Guidelines for maintaining enrolled agent status, including continuing education requirements.

- Important deadlines and filing requirements relevant to the enrollment process.

Understanding these elements is crucial for anyone aiming to navigate the path to becoming an enrolled agent successfully.

Quick guide on how to complete publication 5279 rev 4 your pathway to becoming an enrolled agent starts here

Complete Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here effortlessly on any device

Online document handling has become popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Manage Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here on any platform with airSlate SignNow Android or iOS applications and ease any document-related task today.

How to edit and eSign Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here with ease

- Obtain Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 5279 rev 4 your pathway to becoming an enrolled agent starts here

Create this form in 5 minutes!

How to create an eSignature for the publication 5279 rev 4 your pathway to becoming an enrolled agent starts here

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here'?

'Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here' is a comprehensive guide designed to help aspiring enrolled agents navigate the process of becoming certified. This publication includes essential information on requirements, procedures, and resources to efficiently achieve your goals in tax representation.

-

How can I benefit from 'Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here'?

By utilizing 'Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here', individuals gain access to valuable insights about the enrolled agent process. It provides step-by-step instructions that simplify navigating the journey to becoming a licensed tax professional, making it easier to understand and meet the necessary qualifications.

-

Are there any costs associated with 'Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here'?

While 'Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here' serves as a free resource, there may be additional costs depending on the recommended study materials or certification exams. It is important to evaluate potential expenses to fully prepare for your path to enrollment.

-

What features are included in 'Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here'?

'Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here' includes detailed guidance on eligibility requirements, best study practices, and tips from experienced enrolled agents. Its organized format ensures users can easily follow along their educational journey with confidence.

-

Is 'Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here' useful for beginners?

Absolutely! 'Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here' is specifically tailored for beginners and those unfamiliar with the enrolled agent process. By breaking down complex information into digestible sections, it provides a clear pathway to achieving enrollment.

-

Can 'Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here' be accessed online?

Yes, 'Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here' is readily available online for convenient access. This ensures that you're able to study and refer to the publication anytime, anywhere, making it easier to stay on track with your goals.

-

What integration options exist with 'Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here'?

While 'Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here' itself does not include integration features, it is compatible with various educational resources and tools that can aid your learning journey. We recommend exploring additional software solutions that complement your studies.

Get more for Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here

Find out other Publication 5279 Rev 4 Your Pathway To Becoming An Enrolled Agent Starts Here

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast