Instructions for Form it 602 Claim for EZ Capital Tax Credit 2022

What is the Instructions For Form IT 602 Claim For EZ Capital Tax Credit

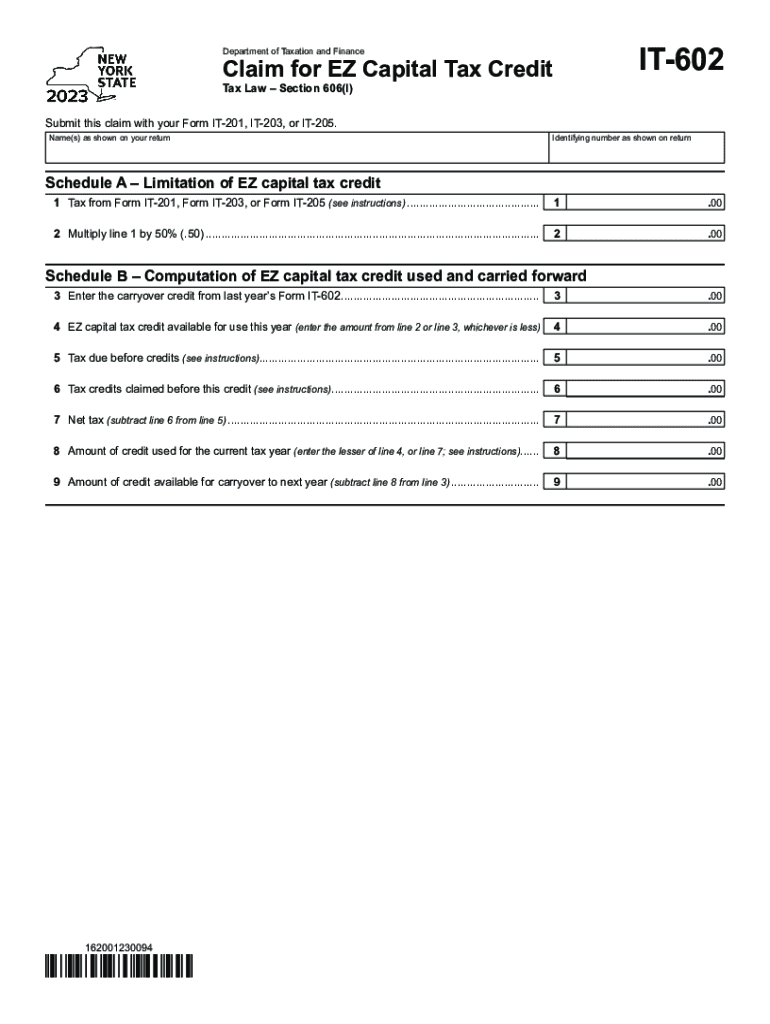

The Instructions For Form IT 602 Claim For EZ Capital Tax Credit provide detailed guidance for taxpayers seeking to claim the EZ Capital Tax Credit in the United States. This credit is designed to encourage investment in qualified businesses and promote economic growth. By following these instructions, taxpayers can ensure they meet eligibility requirements and accurately complete the necessary forms to benefit from this tax incentive.

Steps to complete the Instructions For Form IT 602 Claim For EZ Capital Tax Credit

Completing Form IT 602 involves several key steps. First, gather all necessary documentation, including proof of investment and business eligibility. Next, carefully fill out the form, ensuring that all sections are completed accurately. Pay special attention to the calculations related to the credit amount, as errors can lead to delays or rejections. Once the form is filled out, review it for accuracy before submission.

Eligibility Criteria

To qualify for the EZ Capital Tax Credit, certain eligibility criteria must be met. Generally, the business must be located in a designated area and meet specific size requirements. Additionally, the investment must be made in qualified assets or activities that align with the goals of the credit program. It is essential to review the detailed eligibility requirements outlined in the instructions to ensure compliance.

Required Documents

When filing Form IT 602, taxpayers must provide specific documentation to support their claim. This may include financial statements, proof of investment, and any other relevant records that demonstrate eligibility for the credit. Ensuring that all required documents are included will facilitate a smoother review process and help avoid potential delays in receiving the credit.

Filing Deadlines / Important Dates

Filing deadlines for Form IT 602 are crucial for taxpayers to observe. Typically, the form must be submitted by a specified date following the end of the tax year in which the investment was made. It is important to stay informed about these deadlines to ensure timely submission and avoid penalties. Checking the official guidelines for any updates or changes in deadlines is advisable.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting Form IT 602. The form can often be filed online through the appropriate state tax agency portal, which may expedite processing. Alternatively, taxpayers can mail the completed form to the designated address or, in some cases, submit it in person at local tax offices. Each submission method has its own requirements and timelines, so it is important to choose the one that best suits individual circumstances.

Quick guide on how to complete instructions for form it 602 claim for ez capital tax credit

Prepare Instructions For Form IT 602 Claim For EZ Capital Tax Credit effortlessly on any device

Online document management has become a favored choice among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Instructions For Form IT 602 Claim For EZ Capital Tax Credit on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Instructions For Form IT 602 Claim For EZ Capital Tax Credit with ease

- Locate Instructions For Form IT 602 Claim For EZ Capital Tax Credit and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize crucial parts of your documents or conceal sensitive data with tools that airSlate SignNow offers specifically for this function.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your PC.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you choose. Modify and eSign Instructions For Form IT 602 Claim For EZ Capital Tax Credit to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 602 claim for ez capital tax credit

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 602 claim for ez capital tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form IT 602 Claim For EZ Capital Tax Credit?

The Instructions For Form IT 602 Claim For EZ Capital Tax Credit provide detailed guidelines for businesses seeking to claim this tax credit. These instructions include eligibility criteria, documentation requirements, and how to fill out the form correctly to ensure compliance with tax laws.

-

How can airSlate SignNow assist with the Instructions For Form IT 602 Claim For EZ Capital Tax Credit?

airSlate SignNow simplifies the process of managing the Instructions For Form IT 602 Claim For EZ Capital Tax Credit by allowing users to electronically sign and send necessary documents. This feature ensures a quicker turnaround, helping you submit your claim without unnecessary delays.

-

What features does airSlate SignNow offer for handling tax forms like Form IT 602?

airSlate SignNow offers features such as electronic signing, document tracking, and customizable templates for tax forms like Form IT 602. With these tools, you can streamline your documentation process while focusing on optimizing your tax credits.

-

Are there any pricing options available for airSlate SignNow to assist with tax credits?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, making it cost-effective for handling tasks like the Instructions For Form IT 602 Claim For EZ Capital Tax Credit. You can choose a plan that fits your budget while still gaining access to robust features.

-

Can I integrate airSlate SignNow with other software when working on tax credits?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, enhancing your ability to manage the Instructions For Form IT 602 Claim For EZ Capital Tax Credit. This integration simplifies workflows and keeps all your financial documentation organized.

-

What benefits does electronic signing provide when filing the Instructions For Form IT 602?

Electronic signing through airSlate SignNow accelerates the process of filing the Instructions For Form IT 602 Claim For EZ Capital Tax Credit. With secure and fast signatures, you can avoid mailing delays, ensuring your claim is submitted on time and processed quickly.

-

Is airSlate SignNow suitable for small businesses managing tax credits?

Yes, airSlate SignNow is particularly beneficial for small businesses that need an efficient solution for the Instructions For Form IT 602 Claim For EZ Capital Tax Credit. Its user-friendly interface and affordable pricing make it ideal for those looking to maximize tax benefits without the overhead of expensive software.

Get more for Instructions For Form IT 602 Claim For EZ Capital Tax Credit

- Pdf9filler form

- Mtr 18 form pdf

- Cc159 r form

- Printable behavior charts anger management stoplight form

- Hipaa consent to photograph form

- Sibley hospital maternity registration form

- Www postallocations comokenidpost office in enid ok hours and location postal locations form

- Horry county wellness center form

Find out other Instructions For Form IT 602 Claim For EZ Capital Tax Credit

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free