IRS Federal Tax Underpayment Penalty & Interest Rates 2023

Understanding IRS Penalty Interest Rates

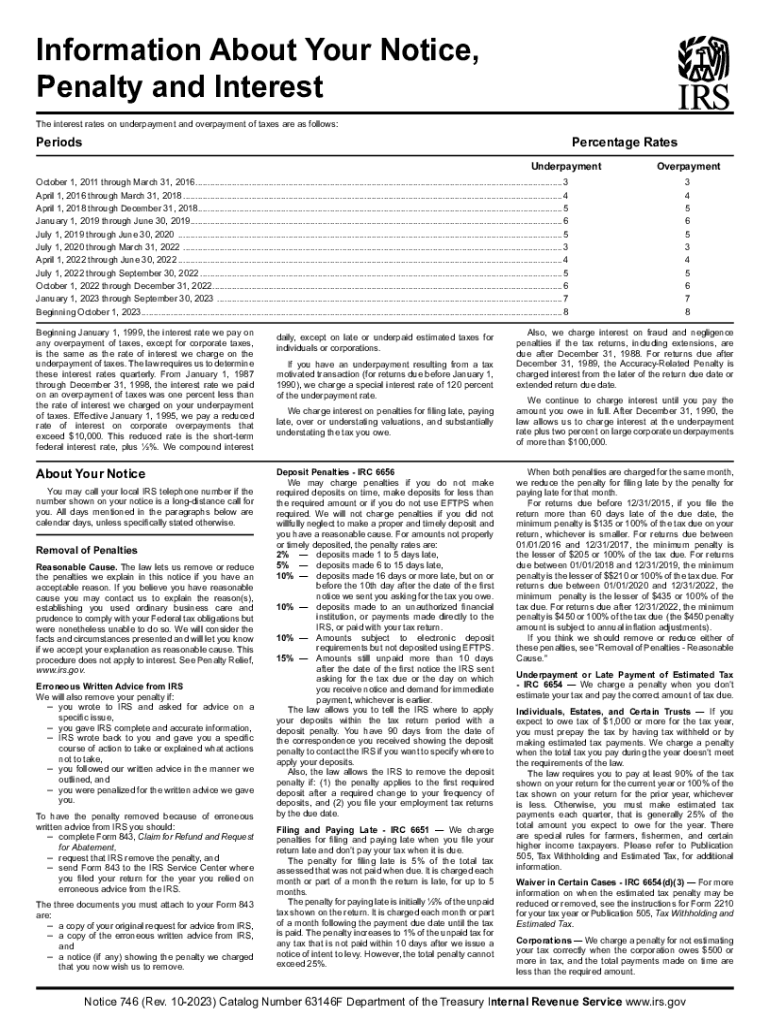

The IRS imposes penalty interest on underpayments of federal taxes. This interest is calculated based on the federal short-term rate plus three percentage points. The rate can vary quarterly, so it is essential to check the current rate when assessing potential penalties. For 2023, the IRS has provided specific guidelines regarding these rates, which can impact taxpayers who fail to pay the correct amount by the due date.

Taxpayers should be aware that the penalty interest accrues daily on the unpaid balance. This means that the longer the payment is delayed, the more interest will accumulate. Understanding how these rates work can help in planning payments and avoiding additional costs.

Steps to Calculate IRS Penalty Interest

Calculating the IRS penalty interest involves a few straightforward steps:

- Determine the amount of underpayment. This is the difference between what you owed and what you paid.

- Identify the applicable penalty interest rate for the period during which the underpayment occurred.

- Calculate the daily interest by multiplying the underpayment amount by the penalty interest rate and dividing by three hundred sixty-five.

- Multiply the daily interest by the number of days the payment was overdue to find the total penalty interest owed.

Using these steps can help taxpayers estimate their potential liabilities and plan accordingly.

IRS Guidelines for Penalty Interest

The IRS has established clear guidelines regarding penalty interest to ensure transparency and fairness. Taxpayers should familiarize themselves with these guidelines, as they outline how interest is calculated, when it begins to accrue, and any exceptions that may apply. For instance, the IRS may waive penalties in certain circumstances, such as reasonable cause or first-time penalty abatement.

It is crucial to keep accurate records of payments and communications with the IRS to support any claims for penalty waivers. Understanding these guidelines can help taxpayers navigate their obligations more effectively.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is essential to avoid incurring IRS penalty interest. Taxpayers should mark important dates on their calendars, including:

- The due date for estimated tax payments, which is typically April 15 for most individuals.

- The deadline for filing annual tax returns, usually April 15, unless it falls on a weekend or holiday.

- Any extensions that may apply, which can provide additional time to file but not to pay.

Missing these deadlines can lead to significant penalties, so planning ahead is advisable.

Required Documents for IRS Penalty Interest

To address issues related to IRS penalty interest, taxpayers may need to gather specific documents. Commonly required documents include:

- Previous tax returns to verify income and deductions.

- Payment records to show amounts paid and dates of payment.

- IRS notices or correspondence regarding penalties or interest.

Having these documents readily available can facilitate communication with the IRS and help resolve any discrepancies more efficiently.

Penalties for Non-Compliance

Failing to comply with IRS requirements regarding tax payments can lead to severe penalties. These may include:

- Accrued penalty interest on unpaid taxes, which can add up quickly.

- Additional fines for late filing or late payment.

- Potential legal action if the IRS deems the non-compliance severe.

Understanding these penalties can motivate taxpayers to meet their obligations and avoid unnecessary costs.

Quick guide on how to complete irs federal tax underpayment penalty ampamp interest rates

Effortlessly Prepare IRS Federal Tax Underpayment Penalty & Interest Rates on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents promptly without any delays. Manage IRS Federal Tax Underpayment Penalty & Interest Rates on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

Steps to Modify and Electronically Sign IRS Federal Tax Underpayment Penalty & Interest Rates with Ease

- Locate IRS Federal Tax Underpayment Penalty & Interest Rates and click Get Form to begin.

- Utilize the available tools to complete your form.

- Emphasize relevant sections of your documents or hide sensitive information with tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require you to print new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign IRS Federal Tax Underpayment Penalty & Interest Rates to ensure superior communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs federal tax underpayment penalty ampamp interest rates

Create this form in 5 minutes!

How to create an eSignature for the irs federal tax underpayment penalty ampamp interest rates

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS penalty interest?

IRS penalty interest refers to the additional charges that can be incurred when taxes are not paid on time. Understanding how it accumulates is crucial for taxpayers using airSlate SignNow to organize their financial documents. By using our solution, you can ensure timely submissions and potentially avoid these penalties.

-

How can airSlate SignNow help with IRS penalty interest?

airSlate SignNow offers a streamlined process for managing tax-related documents, which is essential for avoiding IRS penalty interest. By eSigning and sending documents promptly, businesses can reduce the risk of delayed payments and the subsequent penalties. This way, our platform directly correlates to efficient tax management.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides various pricing packages that cater to different business needs, allowing users to manage their documents effectively. While our pricing is competitive, avoiding IRS penalty interest by staying organized can lead to long-term savings. Explore our plans to find one that fits your budget and requirements.

-

Are there any special features to help manage tax documents?

Yes, airSlate SignNow includes features such as customizable templates and reminders to help manage tax documents efficiently. These tools aid in mitigating IRS penalty interest by ensuring timely submissions. Our platform makes it easier for users to stay on top of their tax responsibilities.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, enhancing your workflow. This integration can aid in efficient tax management and help prevent IRS penalty interest through streamlined processes. Maintaining clear records across platforms reduces the risk of missing deadlines.

-

What benefits will I gain from using airSlate SignNow for my business?

Using airSlate SignNow allows businesses to enhance their document management capabilities, which is crucial in preventing IRS penalty interest. By digitizing and organizing important documents, you can efficiently handle your tax obligations. The ease of use and cost-effectiveness further benefit businesses managing financial records.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Yes, airSlate SignNow is designed to be intuitive and user-friendly even for those new to eSigning. This simplicity ensures that users can quickly get up to speed, minimizing the risk of errors that could lead to IRS penalty interest. Our platform provides guidance to support all users.

Get more for IRS Federal Tax Underpayment Penalty & Interest Rates

- Base technologies form

- Owcp form 44 rehabilitation action report

- Application list my rental home form

- Vanderbilt housing application form

- Ancient civilization project rubric ampamp worksheetstpt form

- 4506t ez rev january form

- Tn beer permit application form

- 2089 amendment to sale contract v7 99 sampleqxp image form

Find out other IRS Federal Tax Underpayment Penalty & Interest Rates

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online