Notice 746 Rev 12 Information About Your Notice, Penalty and Interest 2024-2026

Understanding Notice 746 Rev 12

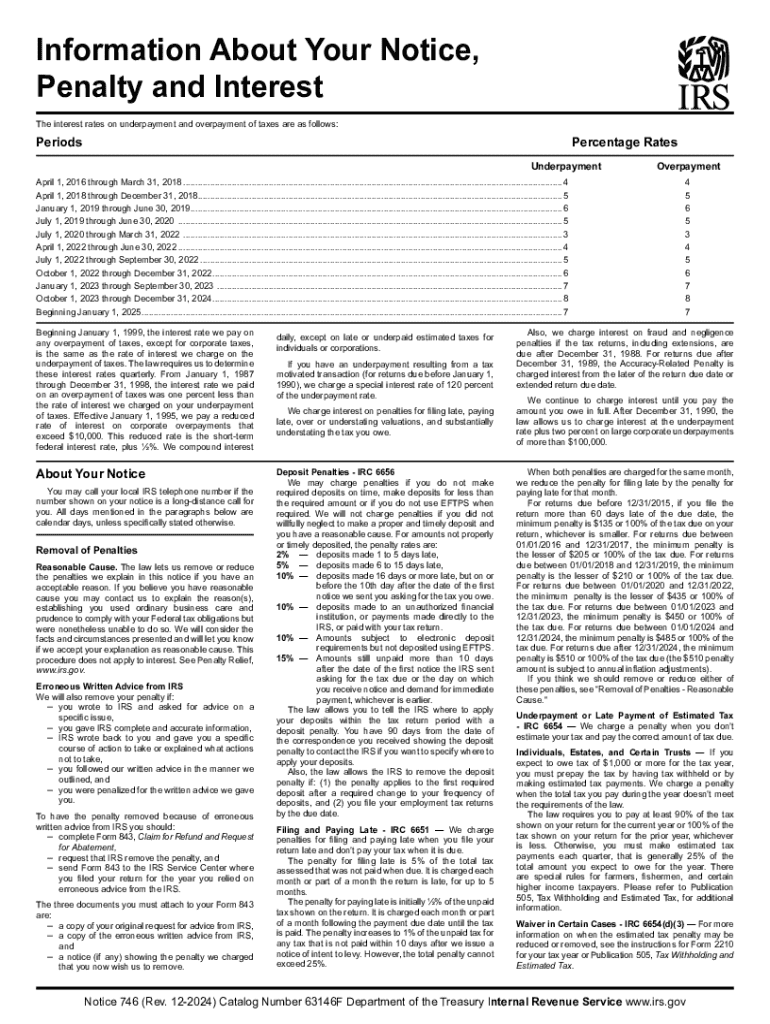

Notice 746 Rev 12 is an important document issued by the IRS that provides information about penalties and interest related to tax obligations. This notice outlines the reasons for any penalties assessed, the amount of interest charged, and the specific tax periods affected. It is crucial for taxpayers to understand this notice to manage their tax liabilities effectively and avoid further complications.

How to Utilize Notice 746 Rev 12

To effectively use Notice 746 Rev 12, taxpayers should first read the notice carefully to understand the details of any penalties and interest. It is essential to verify the accuracy of the information provided, including the tax periods and amounts. If discrepancies are found, taxpayers can prepare to contest the penalties or seek relief. The notice also includes instructions on how to respond or take action if necessary.

Obtaining Notice 746 Rev 12

Taxpayers can obtain Notice 746 Rev 12 directly from the IRS website or by contacting the IRS customer service. It is advisable to have personal tax information on hand when making inquiries or requesting copies of any notices. Additionally, some tax professionals may provide copies if they are handling your tax affairs.

Key Components of Notice 746 Rev 12

Notice 746 Rev 12 contains several key components that taxpayers should pay attention to:

- Penalty Amounts: Specific amounts that have been assessed for late payments or other compliance issues.

- Interest Rates: The interest rate applied to unpaid taxes, which can accumulate over time.

- Tax Periods: The specific tax years or periods for which the penalties and interest apply.

- Contact Information: Details on how to reach the IRS for further questions or clarifications.

IRS Guidelines on Penalties and Interest

The IRS has established guidelines regarding the assessment of penalties and interest. These guidelines specify the conditions under which penalties are applied, such as failure to file or pay taxes on time. Understanding these guidelines can help taxpayers avoid incurring additional penalties and manage their tax obligations more effectively.

Filing Deadlines and Important Dates

It is vital for taxpayers to be aware of filing deadlines and important dates related to their tax obligations. Missing deadlines can result in additional penalties and interest. Notice 746 Rev 12 may reference specific dates that are relevant to the penalties assessed, and taxpayers should keep track of these dates to ensure compliance with IRS requirements.

Penalties for Non-Compliance

Failure to comply with IRS regulations can lead to significant penalties. These can include monetary fines, increased interest rates, and potential legal action. Understanding the penalties associated with non-compliance is essential for taxpayers to avoid unnecessary financial burdens and to ensure that they remain in good standing with the IRS.

Create this form in 5 minutes or less

Find and fill out the correct notice 746 rev 12 information about your notice penalty and interest

Create this form in 5 minutes!

How to create an eSignature for the notice 746 rev 12 information about your notice penalty and interest

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS penalty interest and how does it affect my business?

IRS penalty interest is the interest charged on unpaid taxes or late payments to the IRS. It can accumulate quickly, increasing the total amount owed. Understanding how this interest works is crucial for businesses to manage their tax obligations effectively and avoid unnecessary financial strain.

-

How can airSlate SignNow help me manage IRS penalty interest?

airSlate SignNow provides a streamlined solution for sending and eSigning tax documents, ensuring timely submissions to the IRS. By using our platform, you can reduce the risk of late payments and the associated IRS penalty interest, helping you stay compliant and financially secure.

-

Are there any costs associated with using airSlate SignNow to avoid IRS penalty interest?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Investing in our service can save you money in the long run by helping you avoid IRS penalty interest through timely document management and submission.

-

What features does airSlate SignNow offer to help with tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated reminders for document deadlines. These tools help ensure that your tax documents are submitted on time, minimizing the risk of incurring IRS penalty interest.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow offers integrations with various accounting software platforms. This allows for seamless document management and helps you keep track of your tax obligations, reducing the likelihood of incurring IRS penalty interest due to oversight.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents provides efficiency, security, and compliance. By ensuring that your documents are signed and submitted on time, you can avoid the stress of IRS penalty interest and focus on growing your business.

-

Is airSlate SignNow suitable for small businesses concerned about IRS penalty interest?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it ideal for small businesses. By utilizing our platform, small businesses can effectively manage their tax documents and avoid costly IRS penalty interest.

Get more for Notice 746 Rev 12 Information About Your Notice, Penalty And Interest

- Renew bus pass southampton 396704208 form

- T sql fundamentals third edition pdf download form

- Wiersbes expository outlines on the old testament pdf form

- Trespass affidavit form

- Pediatric physical therapy evaluation template form

- Concealed carry louisiana form

- Rockwood school district form

- Filled joint declaration form epf

Find out other Notice 746 Rev 12 Information About Your Notice, Penalty And Interest

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement