Interest RatesArizona Department of Revenue 2020

Understanding IRS Penalty Interest

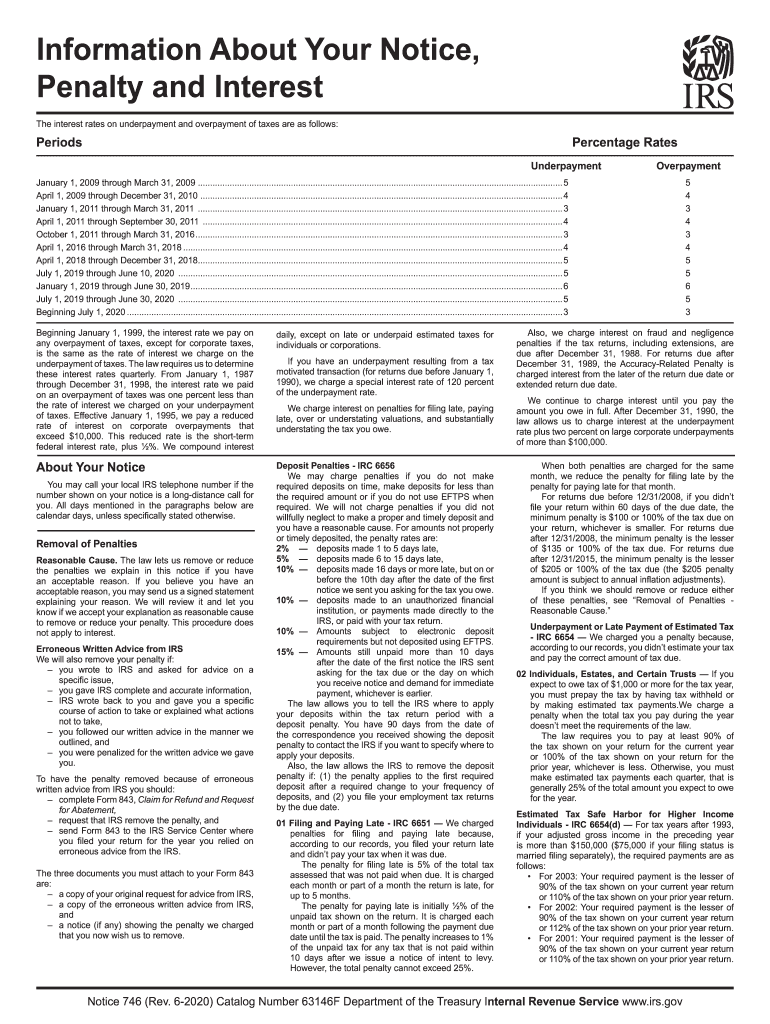

The IRS penalty interest is the interest charged on unpaid taxes or penalties. This interest accrues daily on the amount owed until it is paid in full. The rate is determined quarterly and can vary based on federal short-term interest rates. For taxpayers, understanding how this interest works is crucial to managing their tax obligations effectively.

How IRS Penalty Interest is Calculated

The calculation of IRS penalty interest is based on the principal amount owed and the interest rate set by the IRS. The interest compounds daily, which means that the longer the payment is delayed, the more interest accumulates. Taxpayers can find the current interest rates on the IRS website, which are updated quarterly. Keeping track of these rates can help in estimating the total amount owed over time.

Filing Deadlines and Important Dates

It is essential to be aware of filing deadlines to avoid incurring additional penalties and interest. The IRS typically sets specific dates for tax returns and payments, which can vary each year. Missing these deadlines can lead to increased penalty interest. Taxpayers should mark their calendars and consider filing early to prevent last-minute issues.

Required Documents for IRS Penalty Interest

When addressing IRS penalty interest, certain documents may be required. These can include tax returns, notices from the IRS, and any relevant correspondence regarding payments. Keeping organized records can simplify the process of resolving any penalties or interest charges. Taxpayers should ensure they have copies of all necessary documentation when communicating with the IRS.

Penalties for Non-Compliance

Failing to comply with IRS regulations can result in significant penalties, including increased interest on unpaid amounts. The IRS may impose additional charges for late payments, which can compound the financial burden. Understanding the implications of non-compliance is vital for taxpayers to avoid escalating their tax liabilities.

Steps to Address IRS Penalty Interest

To address IRS penalty interest, taxpayers should take the following steps:

- Review the IRS notice detailing the penalties and interest owed.

- Gather all relevant documentation, including tax returns and payment records.

- Calculate the total amount owed, including any accrued interest.

- Consider contacting the IRS for clarification or to discuss payment options.

- Make a payment as soon as possible to minimize further interest accrual.

Examples of IRS Penalty Interest Scenarios

Different scenarios can lead to IRS penalty interest. For instance, if a taxpayer files their return late, they may incur penalties based on the amount owed. Similarly, if a payment is made after the due date, interest will begin to accumulate on the unpaid balance. Understanding these scenarios can help taxpayers navigate their obligations more effectively.

Quick guide on how to complete interest ratesarizona department of revenue

Effortlessly Prepare Interest RatesArizona Department Of Revenue on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, as you can locate the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without hassle. Manage Interest RatesArizona Department Of Revenue across any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Alter and Electronically Sign Interest RatesArizona Department Of Revenue with Ease

- Obtain Interest RatesArizona Department Of Revenue and click Get Form to begin.

- Take advantage of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact confidential information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Choose your method of sending the form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form-finding, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from the device of your choice. Alter and electronically sign Interest RatesArizona Department Of Revenue and guarantee effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct interest ratesarizona department of revenue

Create this form in 5 minutes!

How to create an eSignature for the interest ratesarizona department of revenue

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is IRS penalty interest and how does it apply to tax payments?

IRS penalty interest refers to the additional charges imposed by the IRS when tax payments are late. This interest accumulates on the unpaid tax balance from the due date until the tax is paid in full. Understanding this concept is crucial for businesses to avoid unexpected costs, and using airSlate SignNow can streamline the eSigning of necessary documents related to tax payments.

-

How can airSlate SignNow help reduce IRS penalty interest?

By utilizing airSlate SignNow for timely document signing and submission, businesses can ensure that their tax documents are filed on time. This reduces the risk of incurring IRS penalty interest due to late payment or filing. The platform's efficient workflow aids in maintaining compliance and avoiding costly penalties.

-

What features of airSlate SignNow are tailored for handling tax-related documents?

airSlate SignNow offers features like templates, automated reminders, and secure storage designed specifically for tax-related documents. These features help users efficiently prepare and sign documents, thus minimizing the chances of incurring IRS penalty interest due to delays. The user-friendly interface further enhances the experience.

-

Is there a cost associated with using airSlate SignNow for tax document management?

While airSlate SignNow does have pricing plans, the cost can be justified by the potential savings in avoiding IRS penalty interest. By ensuring timely eSigning and submission of tax documents, businesses can prevent the additional costs that come from late payments. It's important to evaluate the pricing against your potential savings.

-

Can I integrate airSlate SignNow with other accounting software?

Yes, airSlate SignNow can be seamlessly integrated with various accounting software, allowing for smoother document management related to tax filings. This integration can help keep a consistent flow of information, reducing the chances of mistakes that could result in IRS penalty interest. It's a proactive approach to managing your business finances.

-

How does airSlate SignNow enhance collaboration for tax compliance?

With airSlate SignNow, team members can easily collaborate on documents that require signatures for tax compliance. The platform provides real-time updates, allowing users to track document status and ensure timely completion, which is vital to avoid IRS penalty interest. Enhanced collaboration ultimately leads to more efficient tax preparation and compliance.

-

Are there any security measures in place with airSlate SignNow for sensitive tax documents?

Absolutely, airSlate SignNow prioritizes the security of sensitive tax documents by implementing advanced encryption and compliance with data protection regulations. Keeping your information secure allows businesses to focus on completing tax documents without fear of unauthorized access, thereby minimizing risks associated with IRS penalty interest due to mismanagement.

Get more for Interest RatesArizona Department Of Revenue

Find out other Interest RatesArizona Department Of Revenue

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement