Information About Your Notice, Penalty and Interest IRS 2023

Understanding IRS Penalty Interest

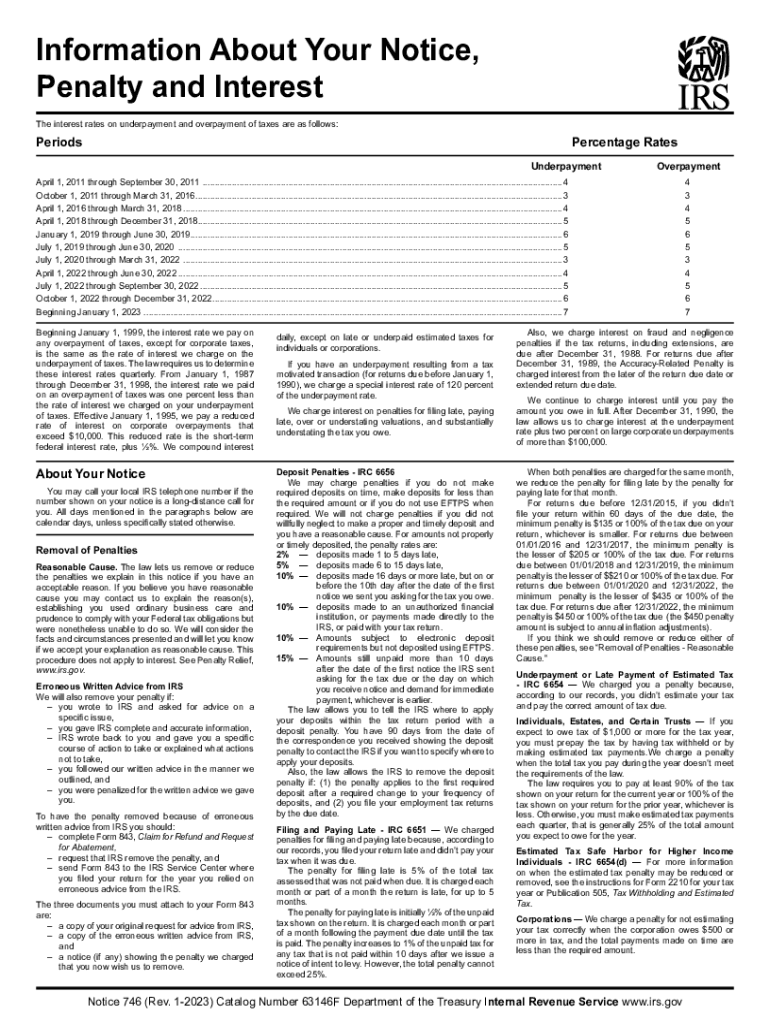

The IRS penalty interest refers to the interest charged on unpaid taxes or penalties owed to the Internal Revenue Service. This interest accrues daily and is compounded, meaning that the longer the payment is delayed, the more significant the amount owed becomes. The interest rate is determined quarterly and is based on the federal short-term rate plus three percentage points. Understanding how this interest works is crucial for taxpayers to manage their obligations effectively and avoid further financial strain.

Steps to Address IRS Penalty Interest

To address IRS penalty interest, follow these steps:

- Review your IRS notice, particularly notice 746, which outlines the penalties and interest owed.

- Calculate the total amount due, including both the principal tax and accrued interest.

- Consider options for payment, such as full payment, installment agreements, or requesting a penalty abatement.

- Submit any necessary forms, such as the IRS penalty form, to formalize your payment plan or request.

- Keep records of all communications and payments made to the IRS for future reference.

Legal Implications of IRS Penalty Interest

The legal implications of IRS penalty interest can be significant. Failing to pay taxes on time can lead to additional penalties and interest, which can compound quickly. The IRS has the authority to enforce collections through various means, including wage garnishments and bank levies. Understanding your rights and responsibilities as a taxpayer is essential to navigate these complexities. It is advisable to consult with a tax professional if you find yourself facing substantial penalties or interest.

Required Documents for IRS Penalty Interest Resolution

When addressing IRS penalty interest, certain documents may be required to facilitate the process:

- IRS notices, such as notice 746, that detail the penalties and interest owed.

- Completed IRS penalty forms, which may include requests for abatement or payment plans.

- Supporting documentation that justifies your case for penalty relief, such as proof of reasonable cause for late payment.

- Tax returns for the relevant years, which may help clarify your tax situation.

Filing Deadlines for IRS Penalty Interest

Filing deadlines are critical when dealing with IRS penalty interest. Typically, taxpayers must respond to IRS notices within a specific timeframe, usually 30 days from the date of the notice. Additionally, if you are appealing a penalty or requesting an abatement, it is essential to adhere to any deadlines provided by the IRS. Missing these deadlines can result in the loss of rights to contest the penalties or interest accrued.

Examples of IRS Penalty Interest Scenarios

Understanding how IRS penalty interest applies in various scenarios can help taxpayers navigate their obligations:

- A self-employed individual who fails to make estimated tax payments may incur penalty interest on the unpaid amounts.

- A taxpayer who files their return late may face both penalties for late filing and interest on any taxes owed.

- An individual who receives notice 746 may need to evaluate their options for payment or dispute the penalties based on reasonable cause.

Quick guide on how to complete information about your notice penalty and interest irs

Effortlessly prepare Information About Your Notice, Penalty And Interest IRS on any device

Digital document management has become increasingly favored by businesses and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly and without delays. Manage Information About Your Notice, Penalty And Interest IRS on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

The simplest way to modify and eSign Information About Your Notice, Penalty And Interest IRS effortlessly

- Find Information About Your Notice, Penalty And Interest IRS and click on Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Emphasize important sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to misplaced or lost documents, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Information About Your Notice, Penalty And Interest IRS and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct information about your notice penalty and interest irs

Create this form in 5 minutes!

How to create an eSignature for the information about your notice penalty and interest irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS penalty interest?

IRS penalty interest is the additional amount charged by the Internal Revenue Service on unpaid taxes and certain transactions. This interest can accumulate quickly, impacting your overall tax liability if not managed appropriately. Understanding IRS penalty interest is crucial for effective financial planning.

-

How can airSlate SignNow help with managing IRS penalty interest?

AirSlate SignNow streamlines the document signing process, allowing businesses to efficiently manage tax-related documents and agreements. By using our platform, you can easily execute necessary documents to dispute or negotiate tax liabilities, including any associated IRS penalty interest. This helps in quick resolution and potentially reducing your penalties.

-

Is there a cost associated with using airSlate SignNow to address IRS penalty interest?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for businesses looking to manage their documents efficiently. Our subscriptions provide a range of features that can assist in handling IRS penalty interest effectively, making the service a worthwhile investment for streamlined document management.

-

What features does airSlate SignNow provide that are relevant to IRS penalty interest?

AirSlate SignNow offers features like electronic signatures, document templates, and real-time tracking, all of which are crucial for handling IRS penalty interest documentation. These tools ensure that you can quickly send, sign, and store documents related to your tax payments and liabilities, simplifying the overall process.

-

Can I integrate airSlate SignNow with my existing accounting software to handle IRS penalty interest?

Absolutely! AirSlate SignNow integrates seamlessly with popular accounting software, enabling you to manage IRS penalty interest documents directly from your preferred platform. This integration allows for better tracking and management of tax-related documents, reducing the risk of penalties.

-

What are the benefits of using airSlate SignNow for IRS-related documents?

Using airSlate SignNow for IRS-related documents provides numerous benefits, including improved efficiency, enhanced security, and decreased turnaround time. By digitizing your document workflow, you can address IRS penalty interest matters more swiftly and accurately, helping you stay compliant with tax regulations.

-

How does airSlate SignNow ensure the security of documents related to IRS penalty interest?

AirSlate SignNow prioritizes document security with advanced encryption and compliance with industry standards. This ensures that sensitive information pertaining to IRS penalty interest and other tax matters remains secure and protected from unauthorized access.

Get more for Information About Your Notice, Penalty And Interest IRS

- Apprenticeship agreement to teach a certain trade craft or skill 497328472 form

- Form credit agreement

- Affidavit attorney in fact form

- Affidavit by an attorney in fact for a corporation or in the capacity form

- Affidavit executor form

- Affidavit of attorney in fact form

- Deed trust form pdf

- Attorney in fact form

Find out other Information About Your Notice, Penalty And Interest IRS

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple