IRS Form 1040 Schedule LEP Request for Change in

What is the IRS Form 1040 Schedule LEP Request For Change In

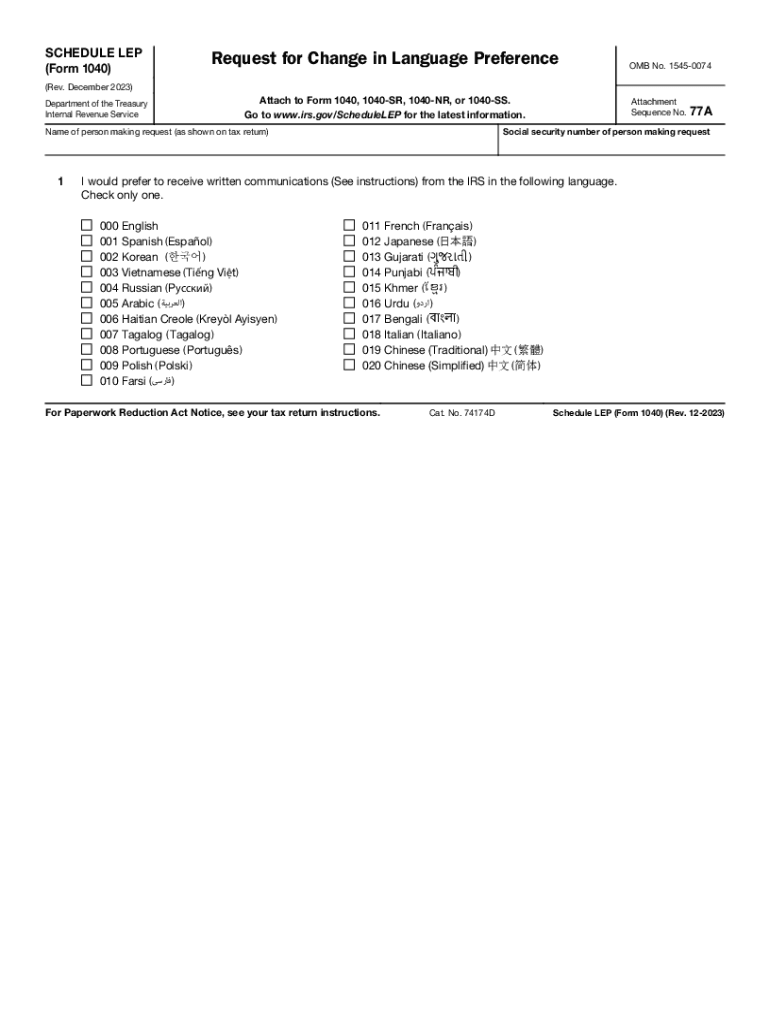

The IRS Form 1040 Schedule LEP Request For Change In is a specific form used by taxpayers to request a change in their Limited English Proficiency status. This form is essential for individuals who need to communicate effectively with the IRS in their preferred language. By submitting this form, taxpayers can ensure that they receive assistance and documentation in a language that they understand, facilitating smoother interactions with the IRS.

How to use the IRS Form 1040 Schedule LEP Request For Change In

To effectively use the IRS Form 1040 Schedule LEP Request For Change In, taxpayers should follow a few straightforward steps. First, download the form from the IRS website or obtain a physical copy. Next, fill out the required sections, providing accurate information regarding your current language preference and the desired change. It is crucial to ensure that all details are correct to avoid delays. Finally, submit the completed form to the IRS using the designated submission method, which can include mailing it to the appropriate address or submitting it electronically if applicable.

Steps to complete the IRS Form 1040 Schedule LEP Request For Change In

Completing the IRS Form 1040 Schedule LEP Request For Change In involves several key steps:

- Download the form from the IRS website or obtain it from a local IRS office.

- Enter your personal information, including your name, Social Security number, and current contact details.

- Specify your current language preference and the language you wish to change to.

- Review the information for accuracy and completeness.

- Sign and date the form to certify the information provided.

- Submit the form according to the instructions provided, either by mail or electronically.

Legal use of the IRS Form 1040 Schedule LEP Request For Change In

The IRS Form 1040 Schedule LEP Request For Change In is legally recognized for facilitating communication between the IRS and taxpayers who require language assistance. Utilizing this form ensures compliance with federal regulations regarding language access, allowing individuals to receive necessary tax information and support in their preferred language. This legal framework aims to protect the rights of taxpayers and promote equitable access to IRS services.

Required Documents

When submitting the IRS Form 1040 Schedule LEP Request For Change In, certain documents may be required to support your request. Typically, you should include:

- A copy of your current tax return, if applicable.

- Any previous correspondence with the IRS related to your language preference.

- Identification documents that verify your identity and residency.

It is advisable to check the latest IRS guidelines for any additional documentation that may be necessary.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 1040 Schedule LEP Request For Change In align with the general tax filing deadlines. Typically, individual tax returns are due on April fifteenth of each year. If you are submitting this form to change your language preference, it is recommended to do so as early as possible to ensure that your request is processed in time for the upcoming tax season. Always verify specific deadlines with the IRS to avoid penalties or delays.

Quick guide on how to complete irs form 1040 schedule lep request for change in

Complete IRS Form 1040 Schedule LEP Request For Change In effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Handle IRS Form 1040 Schedule LEP Request For Change In on any platform with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign IRS Form 1040 Schedule LEP Request For Change In with ease

- Obtain IRS Form 1040 Schedule LEP Request For Change In and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign IRS Form 1040 Schedule LEP Request For Change In and ensure efficient communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 1040 schedule lep request for change in

Create this form in 5 minutes!

How to create an eSignature for the irs form 1040 schedule lep request for change in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 1040 Schedule LEP Request For Change In used for?

The IRS Form 1040 Schedule LEP Request For Change In is used by taxpayers to request changes to their previous tax filings. This form enables individuals to modify details such as income, deductions, or credits related to their tax returns. Using airSlate SignNow, you can easily prepare and eSign this form to ensure a smooth and efficient process.

-

How can airSlate SignNow help with the IRS Form 1040 Schedule LEP Request For Change In?

airSlate SignNow simplifies the process of completing the IRS Form 1040 Schedule LEP Request For Change In by providing easy-to-use templates and eSigning capabilities. You can store and manage your documents online, ensuring that you have quick access to all your tax-related forms. This efficiency can save you time and reduce the stress of tax season.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans to suit various business needs, which includes plans that allow for electronic signatures on documents like the IRS Form 1040 Schedule LEP Request For Change In. Whether you are a small business or a large enterprise, there’s a pricing tier that can accommodate your requirements. You can also take advantage of free trials to explore the features before making a commitment.

-

Is airSlate SignNow secure for eSigning IRS Form 1040 Schedule LEP Request For Change In?

Yes, airSlate SignNow employs industry-leading security measures to protect your sensitive information while eSigning documents like the IRS Form 1040 Schedule LEP Request For Change In. With end-to-end encryption and secure cloud storage, you can rest assured that all your documents are safe. Compliance with regulations ensures that your personal data remains confidential.

-

Can I integrate airSlate SignNow with other tools for handling the IRS Form 1040 Schedule LEP Request For Change In?

Absolutely! airSlate SignNow integrates seamlessly with many applications commonly used in business and finance. This means you can streamline your workflow for the IRS Form 1040 Schedule LEP Request For Change In by connecting it with tools such as CRMs, document management systems, and payment processors for enhanced productivity.

-

What features does airSlate SignNow offer to assist with tax documentation?

airSlate SignNow provides a variety of features tailored for tax documentation, including the ability to create, store, and eSign documents like the IRS Form 1040 Schedule LEP Request For Change In. Additionally, you can track document statuses, set reminders for deadlines, and collaborate with others to ensure everything is completed accurately and on time.

-

How can I access support for questions about IRS Form 1040 Schedule LEP Request For Change In?

airSlate SignNow offers dedicated customer support for any queries you may have regarding the IRS Form 1040 Schedule LEP Request For Change In. You can signNow out to support through various channels including live chat, email, or through their extensive help center filled with resources and guides tailored to assist users.

Get more for IRS Form 1040 Schedule LEP Request For Change In

- Spindletop oil amp gas company filed its annual report form 10 k

- International health certificate form

- Cadetapplicant name csbs csusb form

- Custodianship certificate to support claim on behalf of minor children of deceased members of the armed forces omb no form

- Form ct 222 underpayment of estimated tax by a corporation tax year 772083723

- Financial coach contract template form

- Financial contract template form

- Financial loan contract template form

Find out other IRS Form 1040 Schedule LEP Request For Change In

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT