Form 13441 a

What is the Form 13441 A

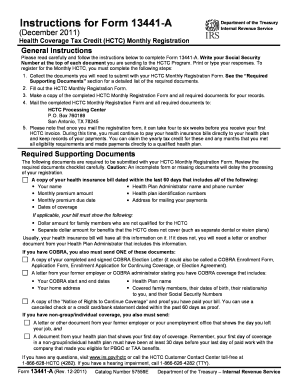

The Form 13441 A is a document used by individuals to request a tax return transcript from the Internal Revenue Service (IRS). This form is particularly useful for taxpayers who need to verify their income or tax filing status for various purposes, such as applying for loans or financial aid. It serves as a formal request for the IRS to provide a summary of tax information, which can be crucial for both personal and business financial activities.

How to use the Form 13441 A

Using the Form 13441 A involves several straightforward steps. First, ensure that you have the correct version of the form, which can be obtained from the IRS website or through authorized tax professionals. Next, fill out the required fields, including your personal information, such as your name, address, and Social Security number. After completing the form, submit it to the IRS via the specified method, which may include mailing it to a designated address or submitting it electronically, depending on the current IRS guidelines.

Steps to complete the Form 13441 A

Completing the Form 13441 A requires careful attention to detail. Follow these steps:

- Download the form from the IRS website or obtain it from a tax professional.

- Provide your personal information, including your full name, Social Security number, and address.

- Indicate the type of transcript you are requesting, such as a tax return transcript or an account transcript.

- Sign and date the form to validate your request.

- Submit the completed form according to the IRS instructions.

Legal use of the Form 13441 A

The Form 13441 A is legally recognized as a valid request for tax information under U.S. law. When filled out correctly and submitted to the IRS, it allows individuals to obtain necessary tax documents that can be used for various legal and financial purposes. It is essential to ensure that all information provided is accurate to avoid delays or issues with the request.

Filing Deadlines / Important Dates

When using the Form 13441 A, it is crucial to be aware of any relevant deadlines. Although there is no specific deadline for submitting this form, it is advisable to request transcripts well in advance of any deadlines associated with financial applications or tax filings. This proactive approach helps ensure that you receive the necessary documentation in a timely manner.

Required Documents

To successfully complete the Form 13441 A, you may need to provide certain documents to verify your identity. These may include:

- A valid government-issued photo ID, such as a driver's license or passport.

- Proof of your Social Security number, which may be included on your tax return.

- Any additional documentation requested by the IRS to support your application.

Form Submission Methods (Online / Mail / In-Person)

The Form 13441 A can be submitted through various methods, depending on your preference and the IRS guidelines. You may choose to:

- Mail the completed form to the address specified by the IRS.

- Submit the form electronically through the IRS website if available.

- Visit a local IRS office to submit the form in person, although this option may require an appointment.

Quick guide on how to complete form 13441 a

Effortlessly Complete Form 13441 A on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Form 13441 A on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centered task today.

How to Modify and Electronically Sign Form 13441 A with Ease

- Obtain Form 13441 A and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Form 13441 A and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 13441 a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 13441 A and how can airSlate SignNow assist with it?

Form 13441 A is a document used for requesting an Individual Taxpayer Identification Number (ITIN) from the IRS. airSlate SignNow simplifies the process by enabling users to fill out, eSign, and securely share this form online, ensuring compliance and accuracy.

-

Is airSlate SignNow a cost-effective solution for managing Form 13441 A?

Yes, airSlate SignNow offers competitive pricing plans that are designed to be cost-effective, allowing users to efficiently manage Form 13441 A and other documents without breaking the bank. With features tailored for businesses, you get great value for your investment.

-

What features does airSlate SignNow offer for completing Form 13441 A?

airSlate SignNow provides a user-friendly interface for completing Form 13441 A, with features such as templates, eSignature capabilities, and document tracking. These tools ensure that your forms are completed correctly and submitted efficiently.

-

Can I integrate airSlate SignNow with other software to manage Form 13441 A?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing you to manage Form 13441 A alongside your existing workflows. This integration enhances productivity by streamlining document management.

-

What are the benefits of using airSlate SignNow for Form 13441 A?

Using airSlate SignNow for Form 13441 A provides numerous benefits, including enhanced security, ease of use, and a faster signing process. This means you can focus more on your business while ensuring compliance with IRS requirements.

-

How does airSlate SignNow ensure the security of Form 13441 A documents?

airSlate SignNow employs advanced encryption and security protocols to protect Form 13441 A and all other documents you handle. This commitment to security reassures users that their sensitive information is safe from unauthorized access.

-

Is there support available for users of airSlate SignNow when completing Form 13441 A?

Yes, airSlate SignNow offers comprehensive customer support to assist users with any questions regarding Form 13441 A. Our support team is available to guide you through eSigning and document management processes.

Get more for Form 13441 A

Find out other Form 13441 A

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors