Form it 249 Claim for Long Term Care Insurance Credit Tax Year 2023-2026

What is the Form IT 249 Claim For Long Term Care Insurance Credit Tax Year

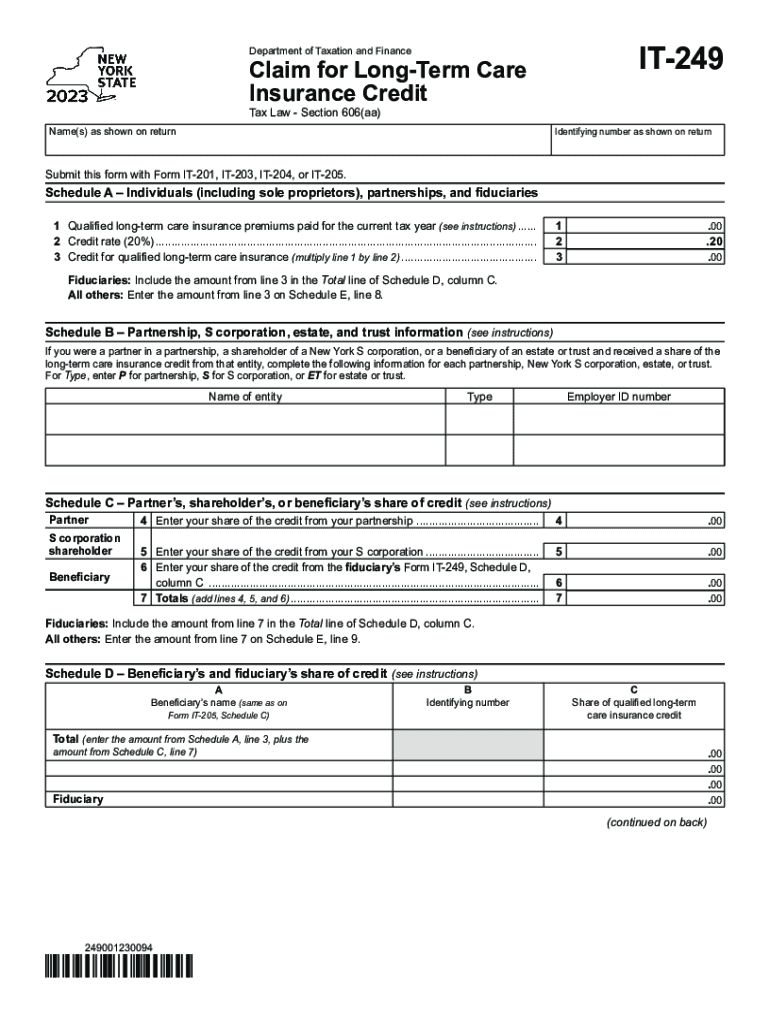

The IT 249 form is a tax document specific to New York State, designed for taxpayers who wish to claim a credit for long-term care insurance premiums. This form allows individuals to report their eligible long-term care insurance expenses, which can help reduce their overall tax liability. The credit is particularly relevant for those who have incurred costs related to long-term care services, making it an essential tool for financial planning and tax preparation.

How to use the Form IT 249 Claim For Long Term Care Insurance Credit Tax Year

Using the IT 249 form involves several key steps. First, gather all relevant documentation regarding your long-term care insurance premiums, including policy details and payment records. Next, accurately complete the form by entering your personal information and the total amount of premiums paid during the tax year. Ensure that you follow the instructions carefully to avoid errors that could delay processing. Finally, submit the completed form along with your state tax return to claim your credit.

Steps to complete the Form IT 249 Claim For Long Term Care Insurance Credit Tax Year

Completing the IT 249 form requires careful attention to detail. Start by filling in your name, address, and Social Security number at the top of the form. Next, report the total amount of long-term care insurance premiums paid in the designated section. Be sure to include any necessary supporting documentation, such as receipts or policy statements. After reviewing your entries for accuracy, sign and date the form before submitting it with your tax return.

Eligibility Criteria

To be eligible for the IT 249 credit, taxpayers must meet specific criteria. Primarily, the individual must be a resident of New York State and have paid long-term care insurance premiums during the tax year. Additionally, the insurance policy must meet state requirements for coverage. It is important to verify that the policy is active and that the premiums were paid in full to qualify for the credit.

Required Documents

When preparing to file the IT 249 form, certain documents are necessary to substantiate your claim. These include:

- Proof of payment for long-term care insurance premiums, such as receipts or bank statements.

- A copy of your long-term care insurance policy, detailing the coverage and terms.

- Your completed IT 249 form with accurate information.

Having these documents organized will facilitate a smoother filing process and ensure compliance with state regulations.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the IT 249 form. Typically, the form must be submitted along with your New York State tax return by the due date, which is usually April fifteenth for most taxpayers. If you require an extension, ensure that you still file the IT 249 form by the extended deadline to avoid penalties. Keeping track of these dates will help ensure that your claim is processed in a timely manner.

Quick guide on how to complete form it 249 claim for long term care insurance credit tax year

Complete Form IT 249 Claim For Long Term Care Insurance Credit Tax Year effortlessly on any device

Online document handling has gained traction among organizations and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed papers, as you can locate the correct template and securely preserve it online. airSlate SignNow提供所有所需工具,快速生成、修改和电子签署文档,不会出现延误。在任何平台上处理Form IT 249 Claim For Long Term Care Insurance Credit Tax Year,通过airSlate SignNow的Android或iOS应用程序,今天就简化任何基于文档的操作。

如何轻松更改和电子签署Form IT 249 Claim For Long Term Care Insurance Credit Tax Year

- 找到Form IT 249 Claim For Long Term Care Insurance Credit Tax Year并点击获取表格以开始。

- 利用我们提供的工具填写文档。

- 突出显示文档中的相关段落或使用airSlate SignNow专门提供的工具隐藏敏感信息。

- 使用签名工具创建您的签名,该工具只需几秒钟,并具有与传统湿墨签名完全相同的法律效力。

- 仔细检查信息后,点击完成按钮以保存更改。

- 选择您希望如何提供表格,通过电子邮件、短信、邀请链接,或下载到您的电脑。

忘记遗失或放错的文件、繁琐的表格浏览或需要打印新副本的错误。airSlate SignNow在您选择的设备上,只需几次点击便能满足您所有的文档管理需求。更改和电子签署Form IT 249 Claim For Long Term Care Insurance Credit Tax Year,确保在您表格准备过程的每个阶段都有出色的沟通,使用airSlate SignNow。

Create this form in 5 minutes or less

Find and fill out the correct form it 249 claim for long term care insurance credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 249 claim for long term care insurance credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 249 feature in airSlate SignNow?

The it 249 feature in airSlate SignNow refers to our comprehensive electronic signature solution that streamlines document management. This feature allows users to easily send and sign documents online, ensuring a quicker turnaround and efficient workflow.

-

How much does it cost to use airSlate SignNow with the it 249 feature?

Pricing for airSlate SignNow with the it 249 feature starts at a competitive rate, offering various plans that cater to different business needs. Customers can choose from monthly or yearly subscriptions depending on their usage requirements and budget.

-

What are the key benefits of using the it 249 feature?

The it 249 feature provides numerous benefits, such as increased productivity, reduced document turnaround time, and improved security for sensitive information. By utilizing airSlate SignNow, businesses can enhance their operational efficiency while ensuring compliance with industry standards.

-

Can I integrate airSlate SignNow's it 249 feature with other applications?

Yes, airSlate SignNow's it 249 feature supports integrations with a variety of applications, enhancing its usability. Popular integrations include CRM systems, cloud storage platforms, and productivity tools, allowing you to streamline your workflow even further.

-

Is it possible to customize templates with the it 249 feature?

Absolutely! The it 249 feature in airSlate SignNow allows users to create and customize templates according to their specific needs. This flexibility enables businesses to save time and maintain consistency in their document processes.

-

How secure is the it 249 feature for handling sensitive documents?

airSlate SignNow's it 249 feature is designed with security as a priority, employing advanced encryption methods to protect your documents. Additionally, the platform complies with legal standards, ensuring that all electronic signatures are valid and secure.

-

What types of documents can be signed using the it 249 feature?

You can use the it 249 feature to sign a wide variety of documents, including contracts, agreements, and forms. This versatility makes airSlate SignNow an ideal solution for different industries needing secure and efficient document handling.

Get more for Form IT 249 Claim For Long Term Care Insurance Credit Tax Year

- B 01 republic of the philippines city of imus province of cavite office of the building official application for building form

- Application for health coverage and help paying costs nh gov nh form

- Da form 5425

- Hpsm ace raf form

- Australian air force cadets aviation medical declaration form aviation 3wg aafc org

- Australian air force cadets oic activity approval level hq 3wg aafc org form

- Nominated qualified supervisor consent declaration form

- Application for appointment as an officer or instructor 412sqn aafc org form

Find out other Form IT 249 Claim For Long Term Care Insurance Credit Tax Year

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template