Form it 249 Claim for Long Term Care Insurance Credit 2022

What is the Form IT 249 Claim For Long Term Care Insurance Credit

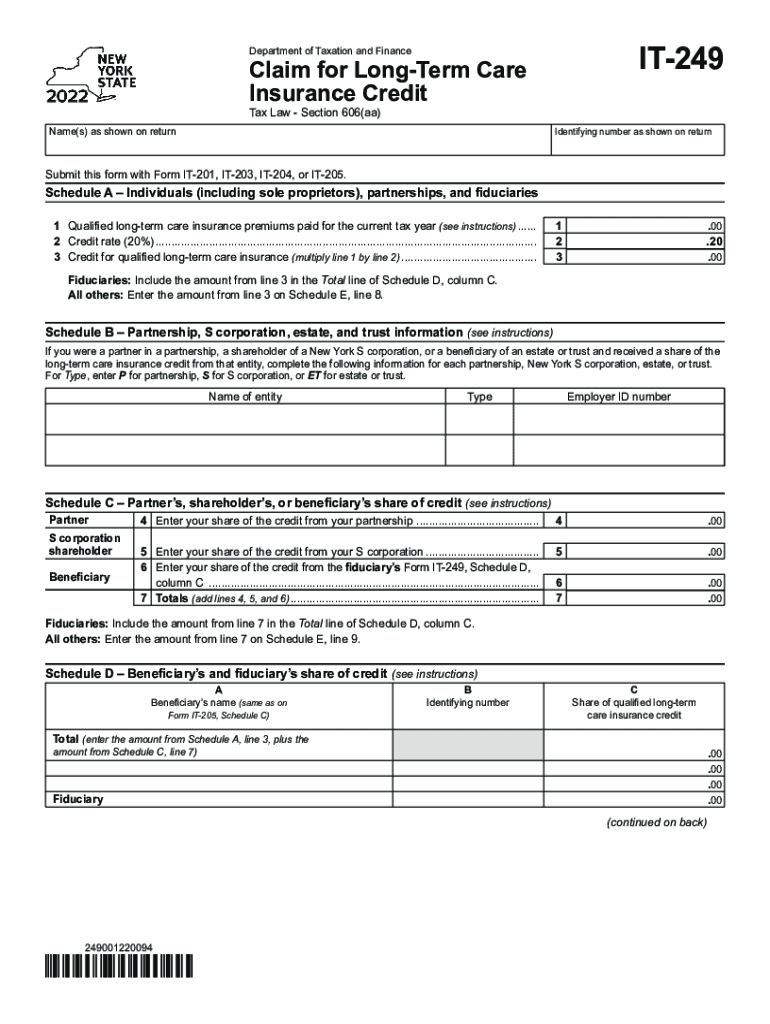

The Form IT 249 is a tax document used in the United States to claim a credit for long-term care insurance premiums. This form is specifically designed for taxpayers who have incurred expenses related to long-term care insurance, allowing them to receive a credit that can reduce their overall tax liability. The credit is applicable to individuals who meet certain eligibility criteria, including age and the type of care received. Understanding the purpose of this form is essential for taxpayers looking to maximize their tax benefits related to long-term care.

How to use the Form IT 249 Claim For Long Term Care Insurance Credit

Using the Form IT 249 involves several steps to ensure accurate completion and submission. Taxpayers should begin by gathering all necessary documentation related to their long-term care insurance premiums. This includes receipts and policy information. Once the information is collected, the taxpayer should carefully fill out the form, ensuring that all required fields are completed accurately. After filling out the form, it should be submitted alongside the annual tax return to the appropriate tax authority. Proper use of this form can lead to significant tax savings.

Steps to complete the Form IT 249 Claim For Long Term Care Insurance Credit

Completing the Form IT 249 involves a systematic approach to ensure all information is accurately reported. Here are the steps:

- Gather all relevant documents, including insurance policies and premium payment records.

- Fill out personal information, including name, address, and Social Security number.

- Report the total amount of long-term care insurance premiums paid during the tax year.

- Complete any additional sections that apply to your specific situation, such as details about the care received.

- Review the form for accuracy before submission.

Eligibility Criteria

To qualify for the credit claimed on Form IT 249, taxpayers must meet specific eligibility criteria. Generally, the individual must be a resident of the state where the form is filed and have paid long-term care insurance premiums for themselves or a qualified dependent. Additionally, the care must be provided by a licensed facility or professional. Age restrictions may also apply, as certain credits are available only to individuals over a specific age. Understanding these criteria is crucial for ensuring that the claim is valid and accepted.

Required Documents

When filing the Form IT 249, taxpayers must provide several supporting documents to substantiate their claim. These documents typically include:

- Proof of premium payments, such as receipts or bank statements.

- Copies of the long-term care insurance policy.

- Documentation of care received, if applicable.

- Any additional forms or schedules required by the state tax authority.

Having these documents ready can streamline the filing process and help avoid delays in processing the claim.

Filing Deadlines / Important Dates

Taxpayers should be aware of the important deadlines associated with filing the Form IT 249. Typically, the form must be submitted by the same deadline as the annual tax return, which is usually April 15th of each year. However, if taxpayers are filing for an extension, they should also ensure that the Form IT 249 is submitted by the extended deadline. Missing these deadlines can result in the loss of the credit, so it is important to stay informed about the specific dates each tax year.

Quick guide on how to complete form it 249 claim for long term care insurance credit

Effortlessly Prepare Form IT 249 Claim For Long Term Care Insurance Credit on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without any holdups. Manage Form IT 249 Claim For Long Term Care Insurance Credit on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Method to Edit and Electronically Sign Form IT 249 Claim For Long Term Care Insurance Credit Effortlessly

- Obtain Form IT 249 Claim For Long Term Care Insurance Credit and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your updates.

- Select how you wish to distribute your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form IT 249 Claim For Long Term Care Insurance Credit while ensuring strong communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 249 claim for long term care insurance credit

Create this form in 5 minutes!

How to create an eSignature for the form it 249 claim for long term care insurance credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is it 249 and how does it improve document signing?

It 249 refers to a specific pricing and feature tier for airSlate SignNow that empowers businesses to streamline their document signing processes. This plan provides users with an easy-to-use interface and essential features, ensuring efficient eSigning and document management. With it 249, businesses can enhance their workflows and reduce turnaround times signNowly.

-

What are the pricing options available for it 249?

The it 249 plan is designed to offer a cost-effective solution for businesses seeking robust eSigning capabilities. This plan typically includes a variety of features optimized for efficiency, making it suitable for teams of different sizes. For detailed pricing information and any potential promotional offers, please visit our pricing page.

-

What features come with the it 249 tier of airSlate SignNow?

The it 249 tier encompasses a range of features such as customizable templates, real-time tracking, and secure document storage. Additionally, users benefit from robust integrations with various third-party applications, ensuring a seamless experience. These features are tailored to meet the needs of businesses looking for efficiency and reliability in their document workflows.

-

How can it 249 benefit my business?

By choosing the it 249 plan, your business can streamline its document signing process, reduce paper clutter, and improve compliance. This plan offers an intuitive interface that makes it easy for team members to send and sign documents quickly. As a result, your organization can save time and resources, ultimately driving productivity.

-

Are there any integrations available with it 249?

Yes, it 249 offers a variety of integrations with popular software applications such as CRM systems, cloud storage services, and productivity tools. These integrations help businesses to centralize their operations and automate workflows, enhancing overall efficiency. Accessing these integrations is simple and adds signNow value to your eSigning experience.

-

Is it 249 suitable for small businesses?

Absolutely! The it 249 plan is specifically designed to cater to businesses of all sizes, including small enterprises. Its cost-effective nature and comprehensive features make it an ideal choice for small businesses looking to enhance their document signing capabilities without overspending.

-

What security measures are in place for it 249 users?

When using the it 249 plan, airSlate SignNow prioritizes your security with advanced encryption and compliance with industry standards. This ensures that all documents are securely stored and transmitted, protecting sensitive information from unauthorized access. You can confidently use it 249, knowing your data is safeguarded.

Get more for Form IT 249 Claim For Long Term Care Insurance Credit

- Warranty deed from husband and wife to corporation tennessee form

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form tennessee

- Tn notice completion form

- Notice of claim individual tennessee form

- Quitclaim deed from husband and wife to llc tennessee form

- Warranty deed from husband and wife to llc tennessee form

- Tennessee judgment form

- Notice of claim by corporation tennessee form

Find out other Form IT 249 Claim For Long Term Care Insurance Credit

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe