Form it 249 Claim for Long Term Care Insurance Credit Tax Year 2021

What is the Form IT 249 Claim For Long Term Care Insurance Credit Tax Year

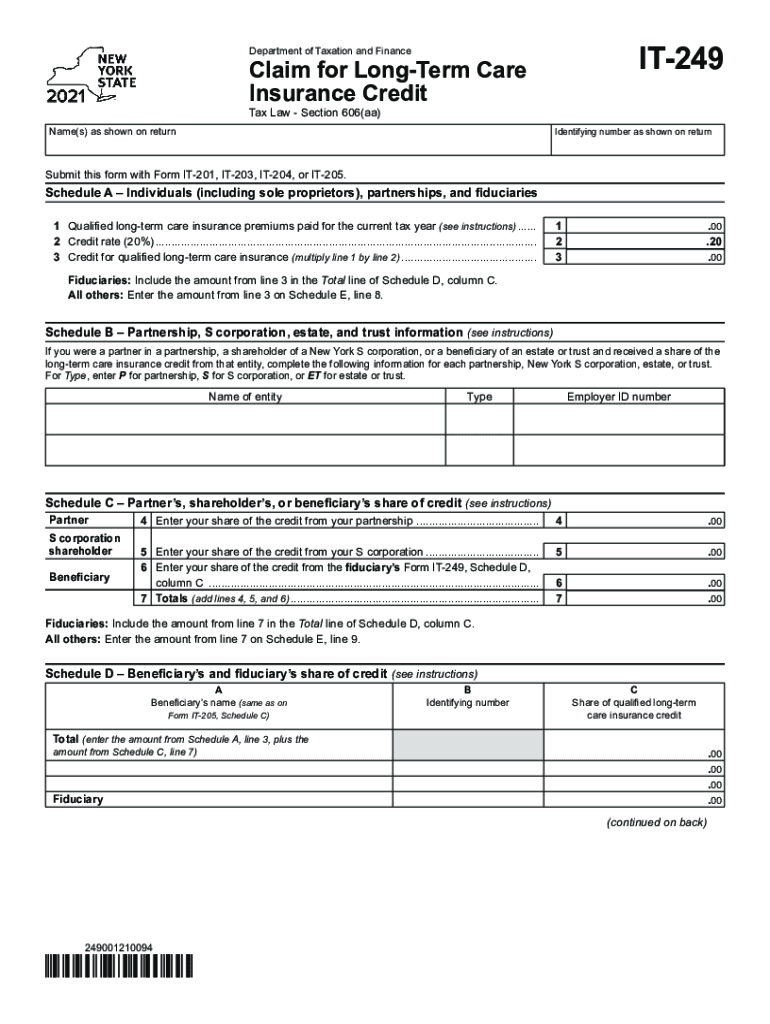

The IT 249 form is a tax document used in the United States for claiming a credit for long-term care insurance expenses. This form is specifically designed for taxpayers who have incurred costs related to long-term care insurance premiums. By filling out the IT 249, individuals can potentially reduce their tax liability, making it an important tool for those managing healthcare costs associated with aging or chronic illnesses. The form is applicable for various tax years, allowing taxpayers to claim credits for eligible expenses incurred during those periods.

How to use the Form IT 249 Claim For Long Term Care Insurance Credit Tax Year

Using the IT 249 form involves several steps to ensure accurate completion and submission. First, gather all necessary documentation related to long-term care insurance premiums, including payment records and policy details. Next, download the IT 249 form from the appropriate state tax authority's website or obtain a physical copy. Fill out the form by providing personal information, details about the insurance policy, and the total amount of premiums paid during the tax year. Once completed, review the information for accuracy before submitting it with your tax return.

Steps to complete the Form IT 249 Claim For Long Term Care Insurance Credit Tax Year

Completing the IT 249 form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant documentation, including insurance policy information and premium payment records.

- Download or obtain the IT 249 form.

- Fill in your personal information, including name, address, and Social Security number.

- Provide details about your long-term care insurance policy, including the insurer's name and policy number.

- Enter the total amount of premiums paid during the applicable tax year.

- Review the completed form for accuracy and completeness.

- Attach the IT 249 form to your tax return before submitting it to the IRS or your state tax authority.

Eligibility Criteria

To qualify for the credit claimed on the IT 249 form, taxpayers must meet specific eligibility criteria. Generally, the individual must have purchased a qualified long-term care insurance policy. The policy must provide coverage for necessary long-term care services, including assistance with daily living activities. Additionally, the taxpayer must have paid premiums for the policy during the tax year for which they are filing. It is essential to review the specific requirements outlined by the state tax authority to ensure compliance and eligibility for the credit.

Required Documents

When filing the IT 249 form, certain documents are necessary to substantiate the claim. These include:

- Proof of payment for long-term care insurance premiums, such as receipts or bank statements.

- Policy documentation that outlines the coverage provided by the insurance.

- Any additional forms or schedules required by the state tax authority that may accompany the IT 249.

Form Submission Methods (Online / Mail / In-Person)

The IT 249 form can be submitted through various methods, depending on the preferences of the taxpayer and the regulations of the state tax authority. Common submission methods include:

- Online submission via the state tax authority's electronic filing system.

- Mailing a physical copy of the completed form along with the tax return to the designated address.

- In-person submission at local tax offices, if available.

Quick guide on how to complete form it 249 claim for long term care insurance credit tax year 2021

Easily Prepare Form IT 249 Claim For Long Term Care Insurance Credit Tax Year on Any Device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without holdups. Manage Form IT 249 Claim For Long Term Care Insurance Credit Tax Year on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

Effortlessly Edit and eSign Form IT 249 Claim For Long Term Care Insurance Credit Tax Year

- Locate Form IT 249 Claim For Long Term Care Insurance Credit Tax Year and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form IT 249 Claim For Long Term Care Insurance Credit Tax Year to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 249 claim for long term care insurance credit tax year 2021

Create this form in 5 minutes!

How to create an eSignature for the form it 249 claim for long term care insurance credit tax year 2021

The best way to create an e-signature for your PDF in the online mode

The best way to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an e-signature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The best way to make an e-signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to IT 249?

airSlate SignNow is a powerful eSignature solution that simplifies document management. In relation to IT 249, it provides businesses with an easy-to-use platform to send, sign, and manage documents efficiently, ensuring compliance and enhancing operational workflows.

-

How much does airSlate SignNow cost with IT 249 features?

The pricing for airSlate SignNow varies based on the selected plan, but it generally offers competitive rates for its IT 249 features. These features include advanced security protocols and extensive integrations, ensuring that businesses can find a plan that fits their budget while still offering robust functionalities.

-

What are the key features of airSlate SignNow related to IT 249?

Key features of airSlate SignNow related to IT 249 include customizable eSignature workflows, secure document storage, and real-time collaboration tools. These functionalities help businesses streamline their document processes, making it easier to manage approvals and signatures from anywhere.

-

What benefits does airSlate SignNow provide for IT 249 users?

For IT 249 users, airSlate SignNow offers numerous benefits, such as increased efficiency, reduced paper usage, and enhanced security for transactions. This translates into savings on costs and time, enabling businesses to focus on more critical tasks.

-

Can airSlate SignNow integrate with other software necessary for IT 249?

Yes, airSlate SignNow is designed to integrate seamlessly with a variety of software commonly used in IT 249 environments. This ensures that data flows smoothly between applications, enhancing efficiency and reducing the likelihood of errors in document handling.

-

Is airSlate SignNow secure for handling IT 249 documents?

Absolutely! airSlate SignNow employs advanced encryption methods and compliance with relevant regulations to ensure that all IT 249 documents are secure. Users can trust that their sensitive information is protected throughout the entire signing process.

-

How does airSlate SignNow enhance collaboration for IT 249 projects?

airSlate SignNow enhances collaboration for IT 249 projects by enabling team members to review, comment, and sign documents in real-time. This collaborative feature minimizes delays in project timelines and ensures that all stakeholders are on the same page.

Get more for Form IT 249 Claim For Long Term Care Insurance Credit Tax Year

- Restraining order violence form

- 497299669 form

- Wv 150 instructions form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497299671 form

- Bill of sale of automobile and odometer statement colorado form

- Bill of sale for automobile or vehicle including odometer statement and promissory note colorado form

- Promissory note for car sale form

- Bill of sale for watercraft or boat colorado form

Find out other Form IT 249 Claim For Long Term Care Insurance Credit Tax Year

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure