Schedule 2 Form 1040 Sp Additional Taxes Spanish Version 2023

What is the Schedule 2 Form 1040 sp Additional Taxes Spanish Version

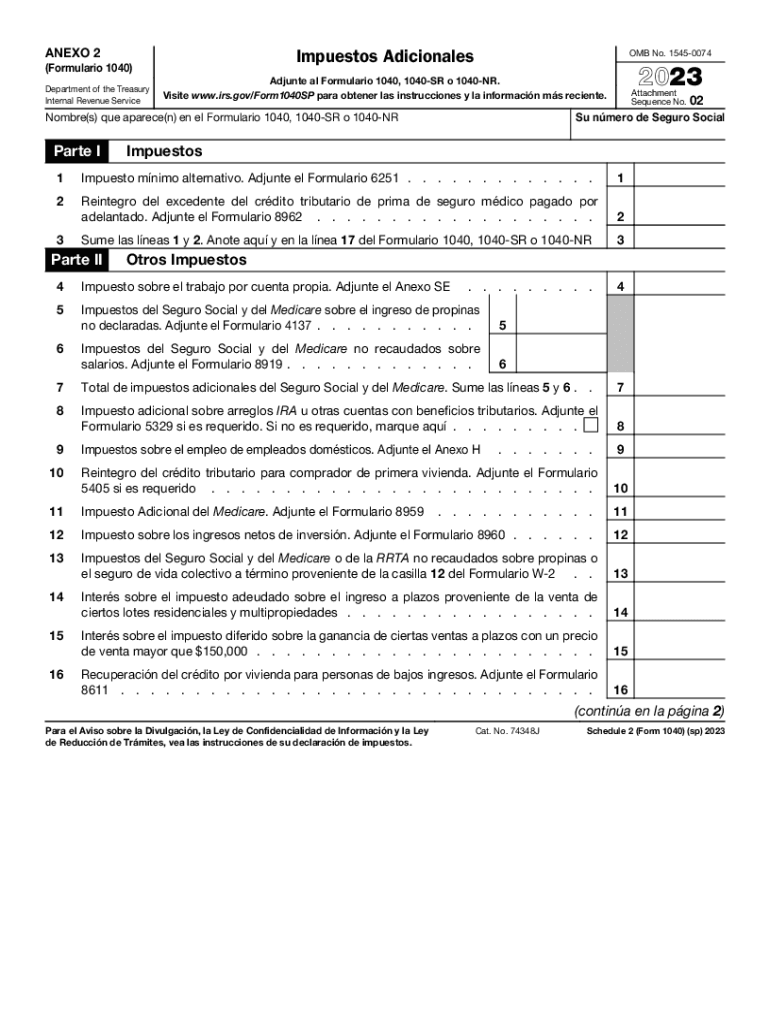

The Schedule 2 Form 1040 sp Additional Taxes Spanish Version is a tax form used by individuals in the United States to report additional taxes owed to the Internal Revenue Service (IRS). This form is essential for taxpayers who need to disclose specific tax liabilities that are not included on the standard Form 1040. It is particularly useful for those who may be subject to penalties, additional taxes on retirement distributions, or other specific tax situations. The Spanish version ensures accessibility for Spanish-speaking taxpayers, allowing them to understand their tax obligations clearly.

How to use the Schedule 2 Form 1040 sp Additional Taxes Spanish Version

Using the Schedule 2 Form 1040 sp Additional Taxes Spanish Version involves several straightforward steps. First, ensure you have the correct version of the form, which can be downloaded from the IRS website or obtained through tax preparation services. Next, carefully read the instructions provided in Spanish to understand the requirements and sections of the form. Fill out the necessary information, including your personal details and any applicable additional taxes. Once completed, this form should be attached to your Form 1040 when submitting your tax return.

Steps to complete the Schedule 2 Form 1040 sp Additional Taxes Spanish Version

Completing the Schedule 2 Form 1040 sp Additional Taxes Spanish Version involves the following steps:

- Download the form from the IRS website or obtain a physical copy.

- Read the instructions carefully to understand the sections applicable to your tax situation.

- Fill in your personal information, including your name, address, and Social Security number.

- Report any additional taxes owed, such as the alternative minimum tax or additional Medicare tax.

- Double-check your entries for accuracy before submitting.

- Attach the completed Schedule 2 to your Form 1040.

Legal use of the Schedule 2 Form 1040 sp Additional Taxes Spanish Version

The Schedule 2 Form 1040 sp Additional Taxes Spanish Version is legally recognized by the IRS as part of the tax filing process. Taxpayers are required to use this form to accurately report any additional taxes owed, ensuring compliance with federal tax laws. Failing to include this form when necessary can result in penalties or interest charges. It is crucial for Spanish-speaking taxpayers to utilize this version to fulfill their legal obligations effectively.

Key elements of the Schedule 2 Form 1040 sp Additional Taxes Spanish Version

Key elements of the Schedule 2 Form 1040 sp Additional Taxes Spanish Version include:

- Identification of the taxpayer, including name and Social Security number.

- Sections for reporting various additional taxes, such as the net investment income tax.

- Instructions in Spanish for clarity on how to fill out each section.

- Space for signatures and dates to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 2 Form 1040 sp Additional Taxes Spanish Version align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file their returns, but any taxes owed must still be paid by the original deadline to avoid penalties.

Quick guide on how to complete schedule 2 form 1040 sp additional taxes spanish version

Finish Schedule 2 Form 1040 sp Additional Taxes Spanish Version seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without obstacles. Manage Schedule 2 Form 1040 sp Additional Taxes Spanish Version on any device with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The most efficient method to alter and eSign Schedule 2 Form 1040 sp Additional Taxes Spanish Version effortlessly

- Acquire Schedule 2 Form 1040 sp Additional Taxes Spanish Version and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any chosen device. Edit and eSign Schedule 2 Form 1040 sp Additional Taxes Spanish Version and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule 2 form 1040 sp additional taxes spanish version

Create this form in 5 minutes!

How to create an eSignature for the schedule 2 form 1040 sp additional taxes spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule 2 Form 1040 sp Additional Taxes Spanish Version?

The Schedule 2 Form 1040 sp Additional Taxes Spanish Version is a tax form used by Spanish-speaking individuals to report additional taxes owed beyond the regular income tax. This version ensures compliance with IRS requirements while catering to the needs of Spanish-speaking taxpayers.

-

How can airSlate SignNow help with the Schedule 2 Form 1040 sp Additional Taxes Spanish Version?

airSlate SignNow streamlines the process of filling out and eSigning the Schedule 2 Form 1040 sp Additional Taxes Spanish Version. Our platform allows users to easily upload, fill, and securely send documents, making tax filing more efficient and less stressful.

-

Is there a cost for using airSlate SignNow to handle the Schedule 2 Form 1040 sp Additional Taxes Spanish Version?

AirSlate SignNow offers competitive pricing for our services, which include eSigning and document management tools for the Schedule 2 Form 1040 sp Additional Taxes Spanish Version. You can choose from various subscription plans to suit your business needs, ensuring affordability and value.

-

What features does airSlate SignNow provide for managing the Schedule 2 Form 1040 sp Additional Taxes Spanish Version?

With airSlate SignNow, you gain access to features such as real-time collaboration, templates for the Schedule 2 Form 1040 sp Additional Taxes Spanish Version, and secure cloud storage. These tools simplify the tax filing process and enhance document management for all users.

-

Can airSlate SignNow integrate with other software for the Schedule 2 Form 1040 sp Additional Taxes Spanish Version?

Yes, airSlate SignNow offers seamless integrations with various software applications, allowing users to efficiently manage the Schedule 2 Form 1040 sp Additional Taxes Spanish Version alongside other tools. This flexibility enhances your workflow and boosts productivity.

-

How secure is airSlate SignNow when using the Schedule 2 Form 1040 sp Additional Taxes Spanish Version?

Security is a top priority at airSlate SignNow. When handling the Schedule 2 Form 1040 sp Additional Taxes Spanish Version, our platform uses advanced encryption and compliance protocols to ensure that your sensitive tax information remains protected and confidential.

-

Do I need any special technical skills to use airSlate SignNow for the Schedule 2 Form 1040 sp Additional Taxes Spanish Version?

No special technical skills are required to use airSlate SignNow for the Schedule 2 Form 1040 sp Additional Taxes Spanish Version. Our intuitive interface is designed for users of all experience levels, making it easy to eSign and manage your documents effortlessly.

Get more for Schedule 2 Form 1040 sp Additional Taxes Spanish Version

- Kids cooking class registration form

- Adp commuter benefits enrollment form 1278370

- Banfield drop off form

- Who wants a spiny snack answer key form

- Abas 3 questions pdf form

- Nhics forms

- Taxpayer questionnaire please answer all questions tax year eic clients attach to form 8867 for due diligence taxpayer first

- Sampling and analysis of soluble metal compounds form

Find out other Schedule 2 Form 1040 sp Additional Taxes Spanish Version

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT