Schedule 2 Form 1040 Sp Additional Taxes Spanish Version 2024-2026

Understanding the 1040 Schedule 2 Form

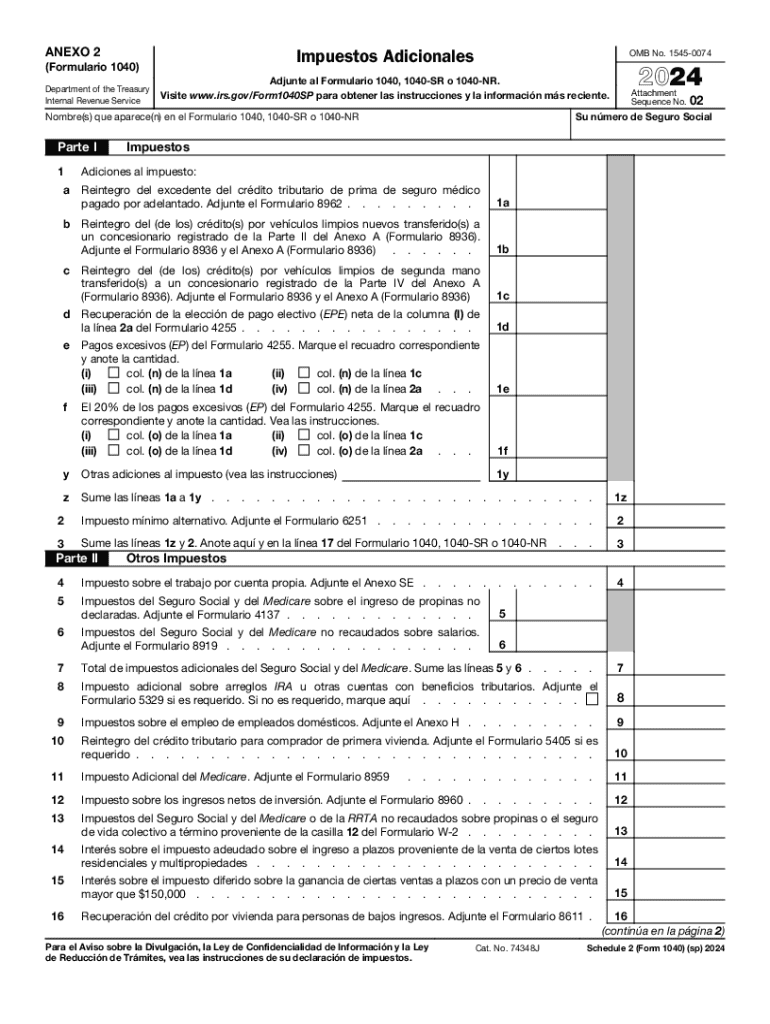

The 1040 Schedule 2 form is used to report additional taxes that are not included on the main Form 1040. This form is essential for taxpayers who may owe specific taxes, such as the Alternative Minimum Tax (AMT) or additional taxes on retirement distributions. It is crucial for ensuring compliance with IRS regulations and accurately calculating total tax liabilities. Understanding the purpose of Schedule 2 helps taxpayers avoid potential penalties and ensures that all tax obligations are met.

Steps to Complete the 1040 Schedule 2 Form

Completing the 1040 Schedule 2 form involves several key steps:

- Gather necessary information: Collect all relevant financial documents, including income statements and any previous tax forms.

- Identify applicable taxes: Determine which additional taxes apply to your situation, such as AMT or taxes on health savings accounts.

- Fill out the form: Enter the required information in the appropriate sections of Schedule 2, ensuring accuracy to avoid errors.

- Calculate total additional taxes: Sum the additional taxes owed as indicated on the form.

- Attach to Form 1040: Include Schedule 2 with your main tax return when filing.

Legal Use of the 1040 Schedule 2 Form

The 1040 Schedule 2 form is legally required for taxpayers who meet specific criteria regarding additional taxes. Failing to file this form when necessary can lead to penalties and interest on unpaid taxes. It is essential to understand the legal implications of not reporting additional taxes accurately. Taxpayers should consult IRS guidelines or a tax professional if unsure about their obligations regarding this form.

Filing Deadlines for the 1040 Schedule 2 Form

The filing deadline for the 1040 Schedule 2 form aligns with the standard tax return deadline, typically April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of these deadlines to avoid late fees and ensure timely compliance with tax obligations. Extensions for filing can be requested, but any taxes owed must still be paid by the original deadline to avoid penalties.

Examples of Using the 1040 Schedule 2 Form

There are various scenarios in which a taxpayer might need to use the 1040 Schedule 2 form. For example:

- A self-employed individual who owes the self-employment tax will need to report this on Schedule 2.

- A taxpayer who has taken early distributions from a retirement account may need to report additional taxes on those distributions.

- Individuals subject to the Alternative Minimum Tax must complete Schedule 2 to calculate their AMT liability.

Obtaining the 1040 Schedule 2 Form

The 1040 Schedule 2 form can be obtained directly from the IRS website or through tax preparation software. It is advisable to ensure you are using the most current version of the form to comply with any recent tax law changes. Additionally, tax professionals can provide copies of the form and assist with its completion if needed.

Create this form in 5 minutes or less

Find and fill out the correct schedule 2 form 1040 sp additional taxes spanish version 770493947

Create this form in 5 minutes!

How to create an eSignature for the schedule 2 form 1040 sp additional taxes spanish version 770493947

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040 Schedule 2 and why is it important?

The 1040 Schedule 2 is a form used by taxpayers to report additional taxes owed, such as self-employment tax or alternative minimum tax. Understanding this form is crucial for accurate tax filing and ensuring compliance with IRS regulations. Using airSlate SignNow can simplify the process of signing and submitting your 1040 Schedule 2.

-

How can airSlate SignNow help with completing the 1040 Schedule 2?

airSlate SignNow provides an easy-to-use platform for electronically signing and managing your 1040 Schedule 2 documents. With its intuitive interface, you can quickly fill out and eSign your forms, ensuring that your tax documents are processed efficiently. This streamlines your tax preparation process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the 1040 Schedule 2?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. The cost is competitive and reflects the value of a secure, efficient solution for managing your 1040 Schedule 2 and other documents. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the 1040 Schedule 2?

airSlate SignNow includes features such as document templates, secure eSigning, and real-time tracking for your 1040 Schedule 2. These tools enhance your workflow by allowing you to manage your tax documents seamlessly. Additionally, you can collaborate with tax professionals directly within the platform.

-

Can I integrate airSlate SignNow with other software for my 1040 Schedule 2?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax software, making it easier to manage your 1040 Schedule 2 alongside your other financial documents. This connectivity ensures that all your data is synchronized and accessible, streamlining your overall tax preparation process.

-

What are the benefits of using airSlate SignNow for my 1040 Schedule 2?

Using airSlate SignNow for your 1040 Schedule 2 provides numerous benefits, including enhanced security, ease of use, and time savings. The platform allows you to sign documents from anywhere, reducing the hassle of printing and mailing. This efficiency can lead to faster processing of your tax returns.

-

Is airSlate SignNow secure for handling sensitive documents like the 1040 Schedule 2?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your 1040 Schedule 2 and other sensitive documents are protected. The platform employs advanced encryption and security protocols to safeguard your information. You can trust that your data is safe while using our services.

Get more for Schedule 2 Form 1040 sp Additional Taxes Spanish Version

- Sbcusd office referral revised 7 09doc form

- Vial of life form

- Applicant id form opening ceremony

- Jsa parental permission form jsa junior state of america

- Howard college transcript request form

- Embassy of pakistan paris photos form

- Wsdots safety rest area coffee program returns may 20 form

- Glar1 application form nyidanmark

Find out other Schedule 2 Form 1040 sp Additional Taxes Spanish Version

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word