Form it 238 Claim for Rehabilitation of Historic Properties Credit Tax Year 2023

Understanding the IT 238 Claim for Rehabilitation of Historic Properties Credit

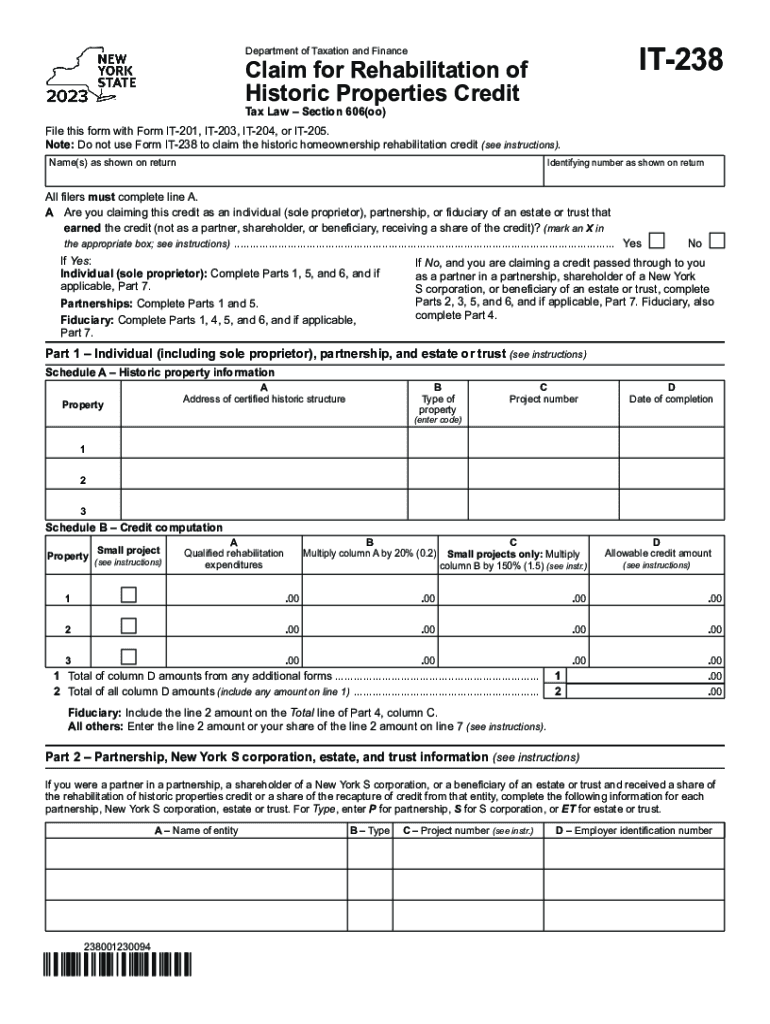

The IT 238 form is specifically designed for claiming tax credits related to the rehabilitation of historic properties in New York. This form allows property owners to receive financial benefits for restoring and preserving historic buildings. The credit is typically a percentage of the qualified rehabilitation expenditures incurred during the restoration process. To qualify, the property must meet certain criteria defined by the state, including being listed on the National Register of Historic Places or being part of a registered historic district.

Steps to Complete the IT 238 Form

Completing the IT 238 form involves several key steps. First, gather all necessary documentation that supports your claim, including receipts and descriptions of the rehabilitation work completed. Next, accurately fill out the form, ensuring that all required fields are completed. Pay close attention to the sections detailing your expenditures and the nature of the rehabilitation work. After completing the form, review it for accuracy before submitting it to the appropriate tax authority.

Eligibility Criteria for the IT 238 Claim

To be eligible for the IT 238 claim, the property must be a certified historic structure. This includes buildings that are listed on the National Register of Historic Places or located within a designated historic district. Additionally, the rehabilitation work must meet specific standards set by the National Park Service. Property owners must also ensure that their expenditures qualify under the guidelines established for the tax credit program. It's essential to keep detailed records of all expenses related to the rehabilitation project.

Required Documents for the IT 238 Claim

When filing the IT 238 claim, several documents are required to substantiate your application. These typically include:

- Receipts for all rehabilitation expenditures

- Photographs of the property before, during, and after rehabilitation

- Documentation proving the property’s historic status

- A detailed description of the work completed

Having these documents ready will help ensure a smooth application process and support your claim for tax credits.

Filing Deadlines for the IT 238 Claim

Filing deadlines for the IT 238 claim are critical to ensure that property owners receive their tax credits in a timely manner. Generally, the form must be submitted by the tax filing deadline for the year in which the rehabilitation work was completed. It is advisable to check for any specific extensions or changes to deadlines that may occur due to state regulations or special circumstances.

Form Submission Methods for the IT 238 Claim

The IT 238 form can be submitted through various methods. Property owners have the option to file online, which is often the quickest way to ensure receipt and processing. Alternatively, the form can be mailed to the appropriate tax authority. In some cases, in-person submissions may also be accepted, depending on local regulations and office availability. It is important to confirm the preferred submission method to avoid delays in processing your claim.

Quick guide on how to complete form it 238 claim for rehabilitation of historic properties credit tax year

Easily Prepare Form IT 238 Claim For Rehabilitation Of Historic Properties Credit Tax Year on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Form IT 238 Claim For Rehabilitation Of Historic Properties Credit Tax Year seamlessly on any device using airSlate SignNow's Android or iOS applications and simplify your document operations today.

The Easiest Way to Alter and eSign Form IT 238 Claim For Rehabilitation Of Historic Properties Credit Tax Year Effortlessly

- Locate Form IT 238 Claim For Rehabilitation Of Historic Properties Credit Tax Year and select Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize relevant sections of your documents or redact sensitive information using the tools that airSlate SignNow provides for this purpose.

- Generate your electronic signature with the Sign feature, which takes only seconds and holds the same legal value as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form IT 238 Claim For Rehabilitation Of Historic Properties Credit Tax Year and ensure superior communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 238 claim for rehabilitation of historic properties credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 238 claim for rehabilitation of historic properties credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of new york rehabilitation services?

New York rehabilitation services play a crucial role in helping individuals regain their health and functionality after injuries or surgeries. These services assist clients in achieving their personal goals through tailored treatment plans. With the right rehabilitation support, patients in New York can improve their quality of life signNowly.

-

How does airSlate SignNow improve the documentation process for new york rehabilitation centers?

AirSlate SignNow streamlines the documentation process for New York rehabilitation centers by providing a user-friendly platform for sending and signing documents electronically. This enhances efficiency and reduces the time spent on paperwork, allowing rehabilitation professionals to focus more on patient care. With eSigning capabilities, compliance and record-keeping becomes much easier.

-

What features does airSlate SignNow offer for new york rehabilitation facilities?

AirSlate SignNow offers a range of features that benefit New York rehabilitation facilities, including customizable templates, secure document storage, and real-time tracking. These features ensure that all necessary documentation is efficiently managed and readily accessible. Rehabilitation professionals can streamline their workflow and improve communication with patients through these capabilities.

-

What are the pricing options for using airSlate SignNow in new york rehabilitation?

AirSlate SignNow offers flexible pricing options designed to accommodate the needs of New York rehabilitation centers, ranging from small practices to large facilities. Different plans are available based on usage and features, ensuring that every rehabilitation center can find a suitable option. The cost-effectiveness of this solution allows for budget-friendly implementation in rehabilitation settings.

-

How can airSlate SignNow enhance patient experience in new york rehabilitation?

By using airSlate SignNow, New York rehabilitation centers can enhance the patient experience with quick and easy document signing processes. This reduces the frustration of paperwork for patients and allows them to focus more on their recovery. Enhanced communication features also ensure that patients receive timely updates regarding their rehabilitation progress.

-

Does airSlate SignNow integrate with other services commonly used in new york rehabilitation?

Yes, airSlate SignNow integrates seamlessly with various platforms commonly used by New York rehabilitation centers, including CRM systems, practice management software, and more. These integrations help streamline operations, allowing rehabilitation professionals to manage documentation alongside other critical processes. This versatility supports a more cohesive workflow within rehabilitation settings.

-

What benefits do electronic signatures offer for new york rehabilitation paperwork?

Electronic signatures provided by airSlate SignNow bring numerous benefits to New York rehabilitation paperwork, including enhanced security, reduced processing time, and improved accuracy. This eliminates the hassle of printing, scanning, or mailing documents, resulting in faster turnarounds for critical forms. The legal validity of eSignatures also ensures that all agreements are compliant and secure.

Get more for Form IT 238 Claim For Rehabilitation Of Historic Properties Credit Tax Year

Find out other Form IT 238 Claim For Rehabilitation Of Historic Properties Credit Tax Year

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later