Get Form it 601 Claim for EZ Wage Tax Credit Tax Year Fill 2023

What is the Get Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill

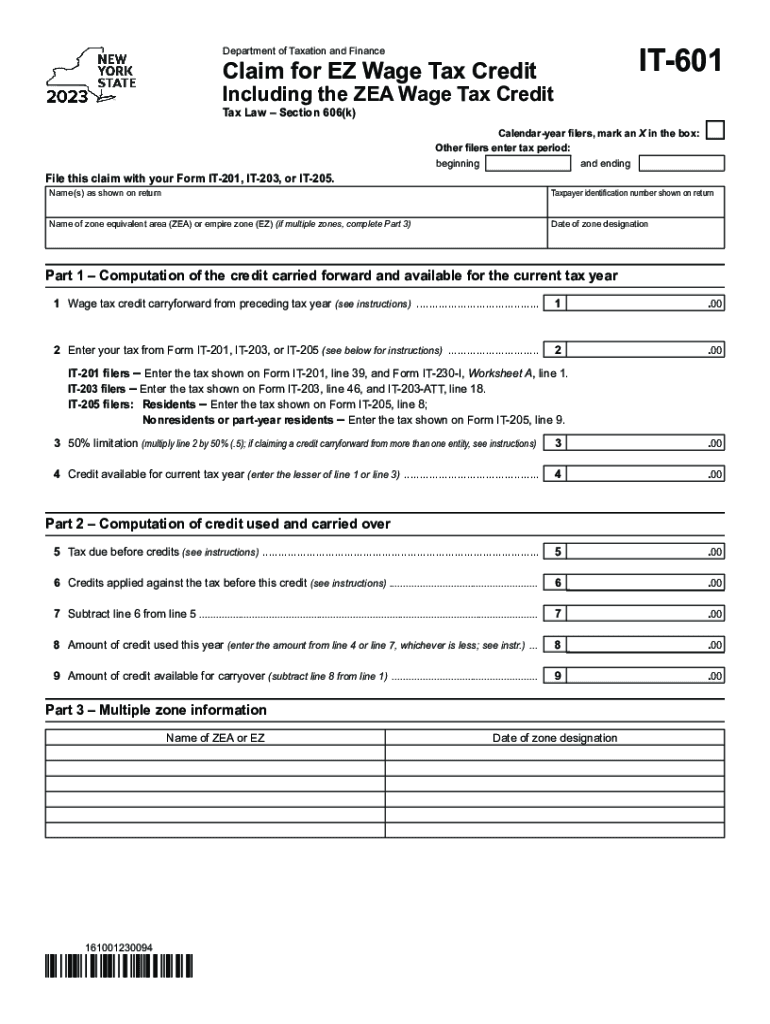

The Get Form IT 601 Claim For EZ Wage Tax Credit is a specific tax form used in the United States to claim the EZ Wage Tax Credit. This credit is designed to assist eligible businesses in reducing their tax liability based on the wages paid to employees. The form is particularly relevant for businesses that have hired new employees or increased their workforce during the tax year. By completing this form, businesses can potentially receive a credit that directly lowers their overall tax burden.

Steps to complete the Get Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill

Completing the Get Form IT 601 requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including your business details and employee wage records.

- Access the form through the appropriate state tax authority’s website or other official sources.

- Fill out the required fields, ensuring accuracy in reporting wages and employee information.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or via mail.

Eligibility Criteria

To qualify for the EZ Wage Tax Credit, businesses must meet specific eligibility criteria. Generally, these include:

- Being a registered business entity in the state where the credit is claimed.

- Having paid wages to eligible employees during the tax year.

- Meeting any additional state-specific requirements related to workforce size or industry.

Required Documents

When preparing to submit the Get Form IT 601, certain documents are essential for supporting your claim. These may include:

- Payroll records that detail wages paid to employees.

- Tax identification numbers for your business and employees.

- Any previous tax filings that may relate to the credit claim.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Get Form IT 601. Typically, the deadline aligns with the general tax filing date for businesses, which is usually April 15. However, specific states may have different deadlines, so it is advisable to check with local tax authorities for the most accurate information.

Form Submission Methods

The Get Form IT 601 can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state tax authority's e-filing system.

- Mailing a printed copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices or service centers.

IRS Guidelines

While the Get Form IT 601 is a state-specific form, it is essential to adhere to IRS guidelines when claiming any tax credits. This includes understanding how the credit interacts with federal tax obligations and ensuring compliance with all relevant tax laws. Businesses should consult IRS publications or a tax professional for guidance on federal implications related to the EZ Wage Tax Credit.

Quick guide on how to complete get form it 601 claim for ez wage tax credit tax year fill

Complete Get Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely keep it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage Get Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Get Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill effortlessly

- Find Get Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or mask sensitive information with tools that airSlate SignNow offers specifically for this task.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious document searches, or errors that require reprinting. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Get Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get form it 601 claim for ez wage tax credit tax year fill

Create this form in 5 minutes!

How to create an eSignature for the get form it 601 claim for ez wage tax credit tax year fill

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Form IT 601 Claim For EZ Wage Tax Credit?

The Form IT 601 Claim For EZ Wage Tax Credit is designed for businesses seeking to claim a tax credit for qualified wages paid to employees during the pandemic. Completing this form accurately can help your business benefit from financial relief. With airSlate SignNow, you can get Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill seamlessly and efficiently.

-

How can I access and fill out the Form IT 601 using airSlate SignNow?

To get Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill using airSlate SignNow, simply sign up for our service, access the template library, and select the form. The platform allows you to fill it out directly online, ensuring you can enter all necessary information without hassle. Plus, you can save and share your completed form easily.

-

What are the key features of airSlate SignNow for completing tax forms?

airSlate SignNow offers several key features, including eSigning, document sharing, and automated workflows. By using our platform, you can streamline the process of filling out and submitting the Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill. These features help ensure you avoid common pitfalls associated with paperwork and ensure compliance.

-

Is there a cost associated with using airSlate SignNow for tax form completion?

Yes, there is a cost for using airSlate SignNow, but it is competitively priced and offers various plans to suit different business needs. The pricing includes access to features that simplify document handling, such as getting Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill. The potential tax savings from credits can often outweigh the service fees.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, like the Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill, provides numerous benefits. These include increased efficiency through automation, reduced paperwork errors, and secure electronic signatures. Additionally, it keeps your documents organized and easily accessible, which is crucial during tax season.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow offers integrations with several popular accounting software platforms. By integrating these tools, you can easily manage documents and retrieve forms, such as the Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill, directly alongside your accounting data. This makes it easier to keep track of finances and tax obligations.

-

How secure is my information when using airSlate SignNow?

airSlate SignNow prioritizes the security of your information with industry-standard encryption and compliance with data protection regulations. When you get Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill, you can trust that your data and signatures are kept safe. Regular security audits also ensure the platform maintains high security standards.

Get more for Get Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill

- Local court rules ingov in form

- Instructions divisions certification for division use in form

- Indiana form certificate service

- Policy regarding senior judges serving as mediators ingov form

- As a foreigner am suppose to join hcsbc form

- Protective order forms court

- Petition to modify an order for protection and request for a ingov in form

- Court reporters handbook ingov in form

Find out other Get Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors