Form it 601 Claim for EZ Wage Tax Credit Including the ZEA Wage Tax CreditTax Year 2024-2026

Understanding the Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA Wage Tax Credit

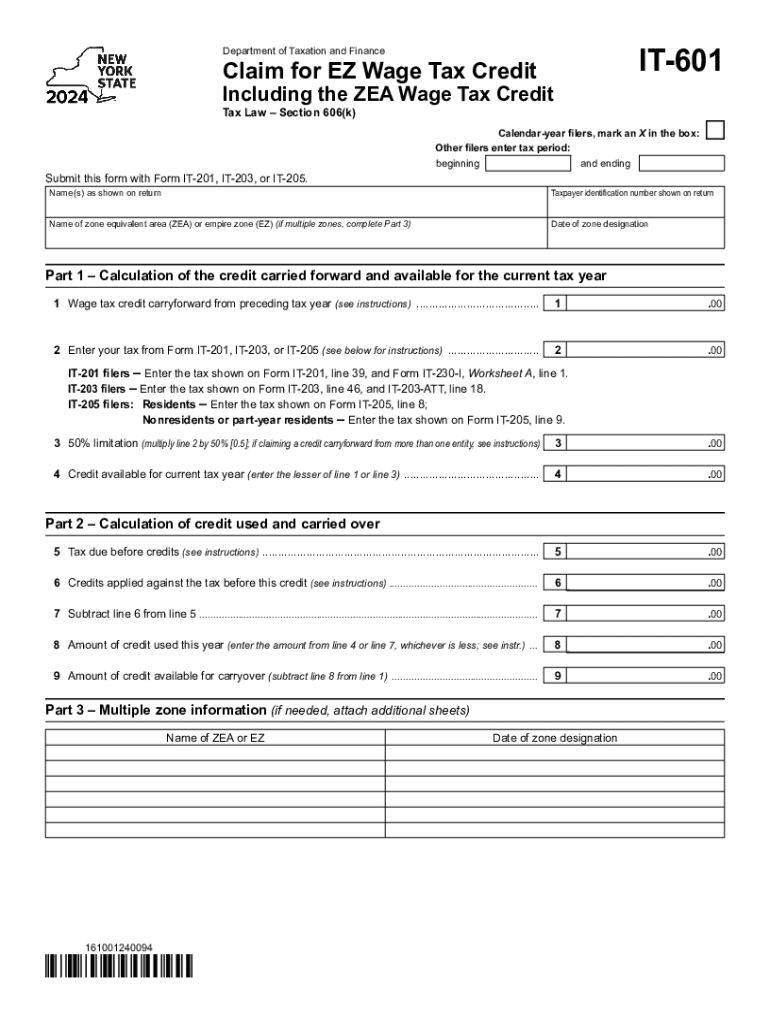

The Form IT 601 is a crucial document used to claim the EZ Wage Tax Credit and the ZEA Wage Tax Credit for a specific tax year. This form is primarily designed for businesses operating in the United States that qualify for these tax credits. The EZ Wage Tax Credit aims to incentivize employers to hire and retain employees, while the ZEA Wage Tax Credit provides additional benefits for businesses in designated areas. Understanding the purpose and eligibility criteria for these credits is essential for businesses looking to maximize their tax benefits.

Steps to Complete the Form IT 601

Completing the Form IT 601 involves several steps to ensure accuracy and compliance. Start by gathering all necessary information, including your business details, employee information, and any relevant financial records. Next, fill out the form by providing the required data in each section, ensuring that you accurately report the number of eligible employees and the corresponding wages. Review the completed form for any errors or omissions before submitting it. It’s important to keep a copy of the submitted form for your records, as it may be needed for future reference or audits.

Eligibility Criteria for the EZ Wage Tax Credit and ZEA Wage Tax Credit

To qualify for the EZ Wage Tax Credit and the ZEA Wage Tax Credit, businesses must meet specific eligibility criteria. Generally, employers must operate within designated geographic areas and hire eligible employees who meet certain qualifications. These may include factors such as income level, employment status, and residency. Additionally, businesses must comply with local and federal employment laws. It is advisable to review the specific guidelines provided by the state or local tax authority to confirm eligibility before filing the form.

Required Documents for Filing the Form IT 601

When filing the Form IT 601, businesses must prepare several documents to support their claims. Essential documents typically include payroll records, employee tax forms, and any other documentation that verifies the eligibility of employees for the EZ Wage Tax Credit and the ZEA Wage Tax Credit. Additionally, businesses may need to provide proof of their operational status within the designated areas. Ensuring that all required documents are accurate and complete will facilitate a smoother filing process and reduce the risk of delays or rejections.

Filing Methods for the Form IT 601

The Form IT 601 can be submitted through various methods, including online submission, mail, or in-person delivery to the relevant tax authority. Each method has its own guidelines and deadlines, so it is important to choose the most suitable option based on your business needs. Online submission is often the fastest and most efficient way to file, while mailing the form may require additional time for processing. In-person submissions can provide immediate confirmation but may involve waiting times at the tax office.

IRS Guidelines for Claiming Tax Credits

The IRS provides specific guidelines for claiming tax credits, including the EZ Wage Tax Credit and the ZEA Wage Tax Credit. These guidelines outline the necessary qualifications, documentation, and procedures for filing. It is essential for businesses to familiarize themselves with these regulations to ensure compliance and maximize their claims. Regularly checking the IRS website or consulting with a tax professional can help businesses stay updated on any changes to the guidelines that may affect their eligibility or filing process.

Create this form in 5 minutes or less

Find and fill out the correct form it 601 claim for ez wage tax credit including the zea wage tax credittax year

Create this form in 5 minutes!

How to create an eSignature for the form it 601 claim for ez wage tax credit including the zea wage tax credittax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA Wage Tax CreditTax Year?

The Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA Wage Tax CreditTax Year is a tax form used by businesses to claim tax credits for wages paid to eligible employees. This form helps businesses reduce their tax liability and is essential for maximizing potential savings during tax season.

-

How can airSlate SignNow assist with the Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA Wage Tax CreditTax Year?

airSlate SignNow simplifies the process of completing and submitting the Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA Wage Tax CreditTax Year by providing an intuitive platform for eSigning and document management. Our solution ensures that your forms are completed accurately and submitted on time, helping you avoid potential penalties.

-

What are the pricing options for using airSlate SignNow for the Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA Wage Tax CreditTax Year?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need basic eSigning features or advanced document workflows for the Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA Wage Tax CreditTax Year, we have a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for managing the Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA Wage Tax CreditTax Year?

Our platform includes features such as customizable templates, secure eSigning, and real-time tracking for the Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA Wage Tax CreditTax Year. These tools streamline the document process, making it easier for businesses to manage their tax credit claims efficiently.

-

Can airSlate SignNow integrate with other software for the Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA Wage Tax CreditTax Year?

Yes, airSlate SignNow offers integrations with various software applications, including accounting and payroll systems. This allows for seamless data transfer and ensures that your Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA Wage Tax CreditTax Year is processed efficiently without manual entry errors.

-

What are the benefits of using airSlate SignNow for the Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA Wage Tax CreditTax Year?

Using airSlate SignNow for the Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA Wage Tax CreditTax Year provides numerous benefits, including time savings, enhanced accuracy, and improved compliance. Our platform helps you manage your documents effectively, ensuring that you can focus on your business while maximizing your tax credits.

-

Is airSlate SignNow secure for handling the Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA Wage Tax CreditTax Year?

Absolutely! airSlate SignNow prioritizes security and compliance, utilizing advanced encryption and secure storage for all documents, including the Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA Wage Tax CreditTax Year. You can trust that your sensitive information is protected throughout the entire process.

Get more for Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA Wage Tax CreditTax Year

- Chapter 826 rcw relocation assistancereal form

- Optional form 1012 travel voucher

- Merit promotion referral form

- Certificate of inspection of pressure vessels form

- Standard form 1035 public voucher for purchases and

- Sec 169a60 mn statutes form

- Do you know about cut off timings in mutual funds the form

- Summary of major changes to under secretary of form

Find out other Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA Wage Tax CreditTax Year

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed