Form it 601 Claim for EZ Wage Tax Credit Including the ZEA 2022

What is the Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA

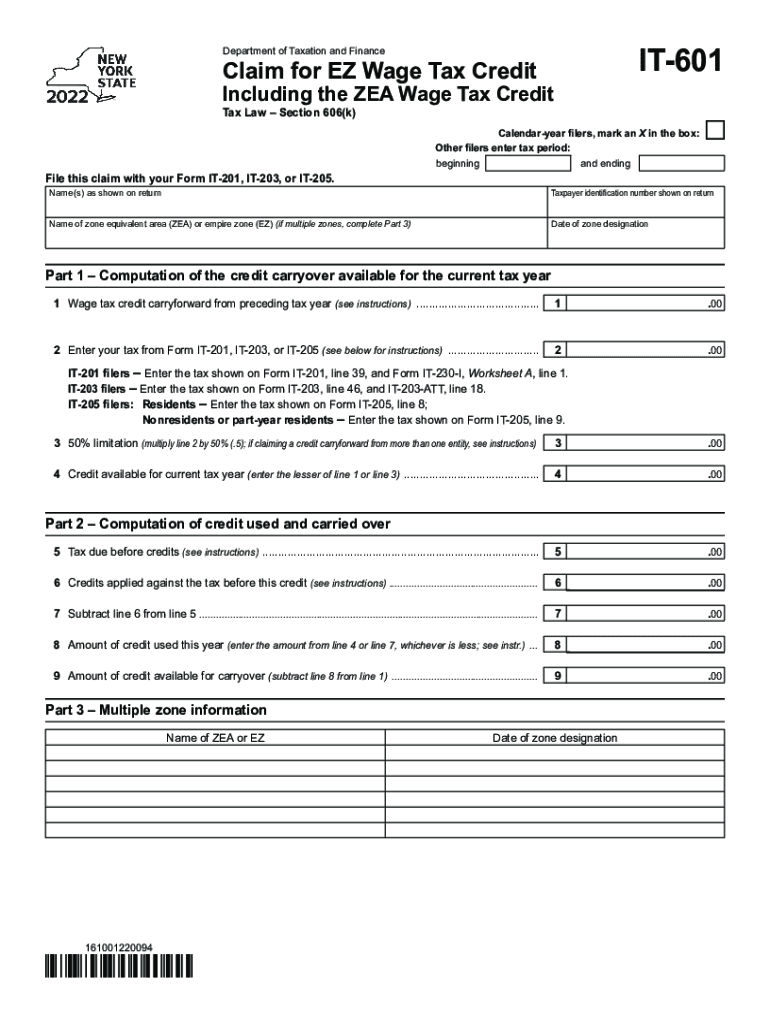

The Form IT 601 is a specific document used to claim the EZ Wage Tax Credit, which is designed to provide tax relief for eligible employers in the United States. This credit is particularly beneficial for businesses that hire employees from certain targeted groups, including those who may face barriers to employment. The ZEA, or Zone Employment Area, is a critical component of this credit, as it identifies geographic areas where the credit is applicable. Understanding this form is essential for businesses looking to maximize their tax benefits and support workforce development initiatives.

Steps to Complete the Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA

Completing the Form IT 601 involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your business and employees, including Social Security numbers and employment dates. Next, accurately fill in the required sections of the form, paying close attention to the eligibility criteria related to the EZ Wage Tax Credit. After completing the form, review it for any errors or omissions. Finally, submit the form to the appropriate tax authority, ensuring that you adhere to any specific filing guidelines provided.

Eligibility Criteria

To qualify for the EZ Wage Tax Credit, businesses must meet specific eligibility criteria. Employers must operate within designated Zone Employment Areas and hire employees who belong to targeted groups, such as veterans or individuals receiving public assistance. Additionally, businesses must demonstrate that they have maintained adequate records of their employees' eligibility for the credit. Understanding these criteria is crucial for employers to effectively utilize the tax benefits associated with the EZ Wage Tax Credit.

Required Documents

When filing the Form IT 601, certain documents are necessary to support your claim for the EZ Wage Tax Credit. These may include employee payroll records, proof of residency for employees, and documentation verifying their eligibility for the targeted groups. It is important to maintain accurate records to substantiate your claim and ensure compliance with tax regulations. Having these documents readily available can streamline the filing process and enhance the credibility of your submission.

Form Submission Methods

The Form IT 601 can be submitted through various methods, depending on the preferences of the business and the requirements of the tax authority. Common submission methods include online filing through designated tax platforms, mailing a physical copy of the form, or delivering it in person to the appropriate office. Each method has its own advantages, such as speed and convenience, so businesses should choose the one that best fits their operational needs.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is essential for businesses claiming the EZ Wage Tax Credit. Typically, the Form IT 601 must be submitted by a specific date, often aligned with the overall tax filing deadlines for businesses. Late submissions may result in the denial of the credit, so it is advisable to mark important dates on your calendar and prepare the necessary documentation in advance to avoid any last-minute issues.

Quick guide on how to complete form it 601 claim for ez wage tax credit including the zea

Complete Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA seamlessly on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to easily access the required form and securely store it online. airSlate SignNow provides all the necessary tools to quickly create, modify, and eSign your documents without any hassles. Handle Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA with ease

- Find Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA and click on Get Form to begin.

- Use the tools provided to fill out your document.

- Emphasize important sections of the document or obscure sensitive data with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 601 claim for ez wage tax credit including the zea

Create this form in 5 minutes!

How to create an eSignature for the form it 601 claim for ez wage tax credit including the zea

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ez zea wage tax credit and how can airSlate SignNow help?

The ez zea wage tax credit is a tax incentive designed to encourage businesses to hire and retain employees. By using airSlate SignNow, businesses can effortlessly manage the documentation required to claim this credit, ensuring compliance and maximizing potential savings.

-

How much does airSlate SignNow cost for businesses looking to utilize the ez zea wage tax credit?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs. With our cost-effective solution, businesses can streamline processes related to the ez zea wage tax credit without breaking the bank.

-

What features does airSlate SignNow provide for managing the ez zea wage tax credit?

With airSlate SignNow, businesses gain access to features like customizable templates, automated workflows, and secure eSigning capabilities. These tools simplify the process of handling documents relevant to the ez zea wage tax credit.

-

How does airSlate SignNow ensure compliance with the ez zea wage tax credit requirements?

airSlate SignNow keeps users informed with the latest updates on tax regulations, including those related to the ez zea wage tax credit. Our platform is designed to help businesses stay compliant while managing documentation efficiently.

-

Can airSlate SignNow integrate with other software when claiming the ez zea wage tax credit?

Yes, airSlate SignNow offers seamless integrations with popular accounting and HR software. This ensures that businesses can easily manage their workflows related to the ez zea wage tax credit alongside their existing systems.

-

What are the benefits of using airSlate SignNow for the ez zea wage tax credit process?

Using airSlate SignNow for managing the ez zea wage tax credit process allows businesses to save time and reduce human error. Our easy-to-use platform enhances efficiency by simplifying document handling and eSigning.

-

Is there support available for questions about the ez zea wage tax credit on airSlate SignNow?

Absolutely! airSlate SignNow provides dedicated customer support to help users with any inquiries regarding the ez zea wage tax credit. Our knowledgeable team is here to assist you throughout the process.

Get more for Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA

- Limited liability company llc operating agreement south dakota form

- Single member limited liability company llc operating agreement south dakota form

- Sd limited company form

- South dakota property search form

- South dakota form

- Quitclaim deed from individual to husband and wife south dakota form

- Warranty deed from individual to husband and wife south dakota form

- Warranty deed from corporation to husband and wife south dakota form

Find out other Form IT 601 Claim For EZ Wage Tax Credit Including The ZEA

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free