Form it 601 Claim for EZ Wage Tax Credit Tax Year 2020

What is the Form IT 601 Claim For EZ Wage Tax Credit Tax Year

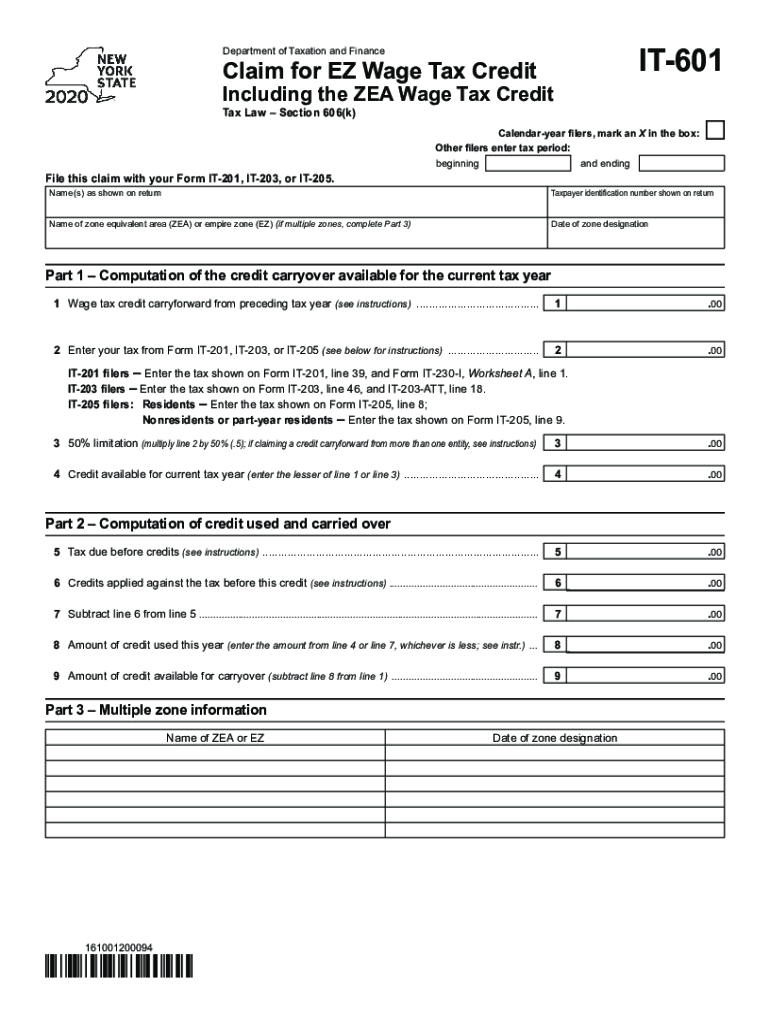

The Form IT 601 is a specific document used by businesses in New York to claim the EZ Wage Tax Credit for a given tax year. This form is designed to assist eligible employers in reducing their tax liability by providing a credit for wages paid to employees. The EZ Wage Tax Credit aims to encourage job creation and retention within the state, making it an essential tool for businesses looking to optimize their tax obligations.

How to use the Form IT 601 Claim For EZ Wage Tax Credit Tax Year

Using the Form IT 601 involves several steps to ensure accurate completion and submission. First, gather all necessary information, including employee wage details and business identification numbers. Next, fill out the form with the required data, ensuring that all entries are accurate to avoid delays. After completing the form, it can be submitted either electronically or via mail, depending on the preferred submission method. Keeping a copy of the submitted form for your records is advisable for future reference.

Steps to complete the Form IT 601 Claim For EZ Wage Tax Credit Tax Year

Completing the Form IT 601 requires careful attention to detail. Follow these steps:

- Begin by entering your business information, including name, address, and identification number.

- Provide details of the wages paid to eligible employees during the specified tax year.

- Calculate the total credit amount based on the guidelines provided for the EZ Wage Tax Credit.

- Review the form for accuracy, ensuring all required fields are filled out correctly.

- Sign and date the form before submission.

Eligibility Criteria

To qualify for the EZ Wage Tax Credit using the Form IT 601, businesses must meet specific eligibility criteria. Generally, the business must be located in New York and have paid wages to eligible employees during the tax year in question. Additionally, the employees must meet certain requirements, such as being full-time and not exceeding a specified wage limit. It is essential for businesses to review these criteria carefully to ensure compliance and maximize their potential credit.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 601 are crucial for businesses to keep in mind. Generally, the form must be submitted by the due date of the tax return for the year in which the credit is claimed. This typically aligns with the standard tax filing deadlines set by the IRS. Businesses should also be aware of any state-specific deadlines that may apply, as timely submission is key to receiving the tax credit.

Required Documents

When completing the Form IT 601, certain documents are necessary to support the claim. These may include:

- Payroll records detailing wages paid to employees.

- Business identification documents, such as the Employer Identification Number (EIN).

- Any additional documentation required by the state to verify eligibility for the EZ Wage Tax Credit.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 601 can be submitted through various methods, providing flexibility for businesses. Options typically include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing the completed form to the designated address provided in the instructions.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete form it 601 claim for ez wage tax credit tax year 2020

Complete Form IT 601 Claim For EZ Wage Tax Credit Tax Year effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Form IT 601 Claim For EZ Wage Tax Credit Tax Year on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form IT 601 Claim For EZ Wage Tax Credit Tax Year with ease

- Obtain Form IT 601 Claim For EZ Wage Tax Credit Tax Year and then click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a standard wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form IT 601 Claim For EZ Wage Tax Credit Tax Year and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 601 claim for ez wage tax credit tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form it 601 claim for ez wage tax credit tax year 2020

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is NY IT 601 and how does it relate to airSlate SignNow?

NY IT 601 refers to New York’s tax document that businesses need to file. airSlate SignNow can help streamline this process by allowing you to securely sign and send necessary documents electronically, saving time and reducing paper usage. With its user-friendly interface, it’s an ideal solution for managing your NY IT 601 requirements.

-

How much does airSlate SignNow cost compared to other eSignature solutions?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. Our pricing structure provides cost-effective solutions to meet your needs, especially when managing documents like the NY IT 601. This affordability combined with advanced features makes it a smart choice for any business.

-

What features does airSlate SignNow offer for completing the NY IT 601 form?

airSlate SignNow provides a variety of features that facilitate the completion of the NY IT 601 form, such as templates, reusable fields, and multi-party signing. These tools help ensure accuracy and efficiency, allowing users to complete their documents quickly and effectively. This streamlines your workflow, particularly for tax season.

-

Can I integrate airSlate SignNow with my existing applications for tax filing?

Yes, airSlate SignNow offers seamless integration with a variety of popular applications used for tax filing and document management. This includes tools specifically designed for handling forms like NY IT 601. By integrating these applications, you can enhance your productivity and create a more cohesive workflow.

-

What benefits does airSlate SignNow provide for businesses handling the NY IT 601?

Using airSlate SignNow to handle the NY IT 601 offers numerous benefits, including increased efficiency, enhanced security, and reduced paper waste. Our platform ensures that your documents are signed and processed quickly while maintaining compliance with state regulations. This efficiency can lead to timely tax submissions and fewer headaches for your finance team.

-

Is airSlate SignNow compliant with legal eSignature regulations for the NY IT 601?

Absolutely! airSlate SignNow is compliant with all relevant legal eSignature regulations, including the ESIGN Act and UETA. This means that your eSigned documents, like the NY IT 601, are legally binding and accepted by the state of New York. This compliance gives you peace of mind that your electronic signatures are valid and secure.

-

How can I get started using airSlate SignNow for my NY IT 601 needs?

Getting started with airSlate SignNow is simple; you can sign up for a free trial on our website. Once registered, you can immediately start creating and sending documents, including your NY IT 601 forms. Our user-friendly platform is designed to get you up and running quickly, even if you are new to eSigning.

Get more for Form IT 601 Claim For EZ Wage Tax Credit Tax Year

Find out other Form IT 601 Claim For EZ Wage Tax Credit Tax Year

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors