Form it 641 Manufacturer's Real Property Tax Credit Tax Year 2023

Understanding the 641 Tax Form

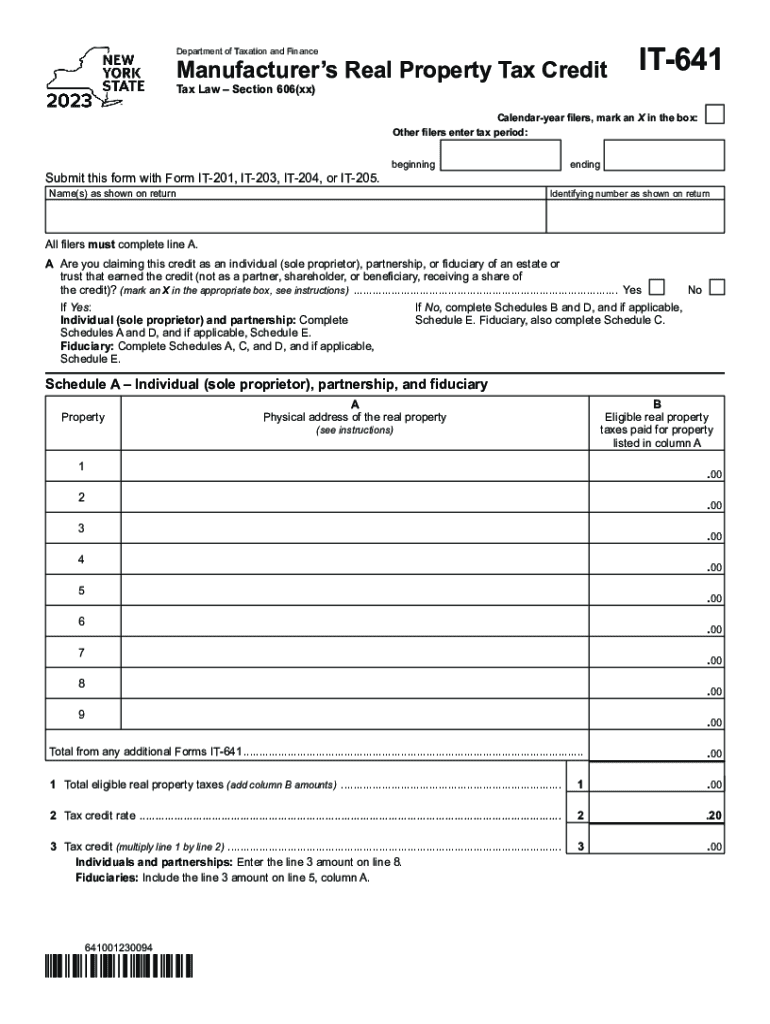

The 641 tax form, also known as the IT-641 Manufacturer's Real Property Tax Credit, is a crucial document for manufacturers in New York. This form allows eligible businesses to claim a tax credit for real property taxes paid on certain manufacturing facilities. The primary aim is to support the manufacturing sector by reducing the financial burden associated with property taxes.

To qualify for this tax credit, businesses must meet specific criteria set by the New York State Department of Taxation and Finance. This includes having a qualifying manufacturing facility and adhering to the regulations outlined in the tax code.

Steps to Complete the 641 Tax Form

Filling out the 641 tax form requires careful attention to detail. Here are the essential steps to ensure accurate completion:

- Gather necessary documentation, including property tax bills and proof of manufacturing operations.

- Provide business information, including the legal name, address, and identification number.

- Detail the property for which the credit is being claimed, including location and type of manufacturing activities.

- Calculate the eligible tax credit based on the guidelines provided by the state.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the 641 Tax Form

Eligibility for the 641 tax form is primarily determined by the nature of the business and the property in question. To qualify:

- The business must be classified as a manufacturer under New York law.

- The property must be used exclusively for manufacturing purposes.

- The business must have paid real property taxes on the eligible property during the tax year in question.

Meeting these criteria is vital to ensure that the tax credit can be claimed without issues during the review process.

Obtaining the 641 Tax Form

The 641 tax form can be obtained through the New York State Department of Taxation and Finance website. It is available in a downloadable format, allowing businesses to print and fill it out at their convenience. Additionally, physical copies may be available at local tax offices or through tax professionals who assist with filing.

Filing Deadlines for the 641 Tax Form

Timely submission of the 641 tax form is essential to avoid penalties. The filing deadline typically aligns with the due date for the business's annual tax return. It is important to check the specific deadlines for the tax year in question, as they may vary. Filing late can result in the loss of the tax credit and potential fines.

Form Submission Methods

Businesses have several options for submitting the 641 tax form. The form can be filed:

- Online through the New York State Department of Taxation and Finance e-filing system.

- By mail, ensuring that it is sent to the correct address as specified in the form instructions.

- In person at designated tax offices, which may provide immediate assistance and confirmation of receipt.

Quick guide on how to complete form it 641 manufacturers real property tax credit tax year

Complete Form IT 641 Manufacturer's Real Property Tax Credit Tax Year effortlessly on any device

Online document management has gained signNow traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage Form IT 641 Manufacturer's Real Property Tax Credit Tax Year on any platform using airSlate SignNow’s Android or iOS applications, and enhance any document-related process today.

How to edit and eSign Form IT 641 Manufacturer's Real Property Tax Credit Tax Year with ease

- Obtain Form IT 641 Manufacturer's Real Property Tax Credit Tax Year and click Get Form to begin.

- Leverage the tools we provide to finish your document.

- Emphasize important sections of your documents or conceal sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or errors requiring new document prints. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Form IT 641 Manufacturer's Real Property Tax Credit Tax Year and ensure clear communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 641 manufacturers real property tax credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 641 manufacturers real property tax credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 641 tax form and why is it important?

The 641 tax form is a document used for reporting specific financial information, often required by various states for tax purposes. Understanding the 641 tax form is crucial for ensuring compliance with state tax regulations. Filing this form accurately can prevent unnecessary penalties and ensure proper tax obligations are met.

-

How can airSlate SignNow help with the 641 tax form?

airSlate SignNow allows users to easily eSign and manage their 641 tax form electronically. Using our platform, you can send the 641 tax form to co-signers quickly and track the document’s progress in real time. This efficiency saves time and ensures the form is accurately filled and submitted.

-

Is airSlate SignNow suitable for small businesses needing the 641 tax form?

Absolutely! airSlate SignNow offers an affordable solution tailored for small businesses that need to handle the 641 tax form efficiently. With user-friendly features, small businesses can streamline their document signing processes without overwhelming costs.

-

What are the main features of airSlate SignNow for handling tax forms?

Key features of airSlate SignNow include document templates, customizable workflows, and powerful integrations that simplify the handling of the 641 tax form. Additionally, our platform supports real-time collaboration and secure cloud storage, ensuring your tax documents are safe and accessible.

-

Does airSlate SignNow integrate with accounting software for the 641 tax form?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage the 641 tax form and other financial documents. These integrations enhance your workflow by automatically syncing data and reducing manual entry errors, leading to greater efficiency.

-

What security measures are in place for the 641 tax form on airSlate SignNow?

airSlate SignNow employs advanced security measures to protect sensitive information within the 641 tax form. Our platform utilizes encryption and secure signing protocols to ensure that your documents are safe from unauthorized access. You can confidently manage your tax forms with peace of mind.

-

Can I track the status of my 641 tax form in airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your 641 tax form throughout the eSigning process. You will receive notifications when the document is viewed, signed, or completed, giving you full control over your document workflow.

Get more for Form IT 641 Manufacturer's Real Property Tax Credit Tax Year

- Cdph c form

- Experience verification forms bbs 2011

- How do i keep getting calfresh cdss ca form

- Support questionnaire california department of social cdss ca form

- Application for license and certificate of marriage 101305403 form

- Application for medi cal form

- Boe 261 g form

- What is a supervision agreement form

Find out other Form IT 641 Manufacturer's Real Property Tax Credit Tax Year

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF