Printable New York Form it 641 Manufacturer's Real Property Tax Credit 2020

What is the Printable New York Form IT 641 Manufacturer's Real Property Tax Credit

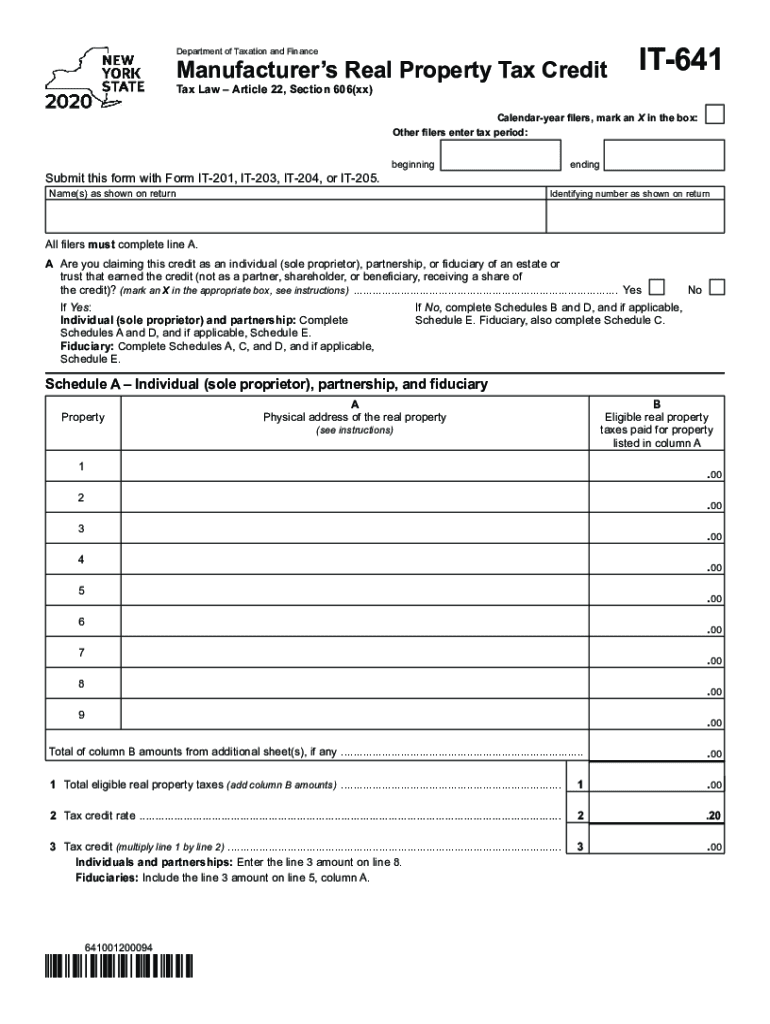

The Printable New York Form IT 641 is a tax form used by manufacturers to claim the Manufacturer's Real Property Tax Credit. This credit is designed to incentivize manufacturing activities within New York State by providing a reduction in property taxes for eligible businesses. The form outlines the necessary information required to determine eligibility and calculate the amount of credit that can be claimed. By filling out this form accurately, manufacturers can benefit from significant tax savings, contributing to their overall financial health.

Steps to complete the Printable New York Form IT 641 Manufacturer's Real Property Tax Credit

Completing the Printable New York Form IT 641 involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary documentation that supports your claim, including financial statements and property tax bills. Next, fill out the form by providing detailed information about your business, including its location, the type of manufacturing activities conducted, and the property tax amounts paid. Make sure to calculate the credit amount based on the guidelines provided in the form. Finally, review the completed form for accuracy before submission to avoid any delays or issues with your claim.

Eligibility Criteria for the Printable New York Form IT 641 Manufacturer's Real Property Tax Credit

To qualify for the Manufacturer's Real Property Tax Credit using Form IT 641, certain eligibility criteria must be met. Businesses must be classified as manufacturers under New York State law and actively engaged in manufacturing processes. Additionally, the property for which the credit is claimed must be used for manufacturing purposes. The business must also meet specific investment thresholds in real property improvements. It is essential to review these criteria thoroughly to ensure that your business qualifies before submitting the form.

Required Documents for the Printable New York Form IT 641 Manufacturer's Real Property Tax Credit

When filing the Printable New York Form IT 641, several documents are required to support your claim. These include:

- Property tax bills that detail the amounts paid.

- Financial statements demonstrating the business's manufacturing activities.

- Documentation of any investments made in real property improvements.

- Proof of business classification as a manufacturer.

Having these documents ready will facilitate a smoother filing process and help substantiate your eligibility for the tax credit.

Form Submission Methods for the Printable New York Form IT 641 Manufacturer's Real Property Tax Credit

The Printable New York Form IT 641 can be submitted through various methods. Businesses have the option to file the form online using the New York State Department of Taxation and Finance's website. Alternatively, the form can be mailed directly to the appropriate tax office. In some cases, in-person submissions may also be accepted, depending on local regulations. It is important to check the latest guidelines to determine the most suitable submission method for your needs.

Filing Deadlines for the Printable New York Form IT 641 Manufacturer's Real Property Tax Credit

Filing deadlines for the Printable New York Form IT 641 are critical to ensure timely processing of your tax credit claim. Typically, the form must be submitted by a specific date each year, often aligned with the annual tax filing deadlines. It is advisable to check the New York State Department of Taxation and Finance's official communications for the exact dates and any potential extensions that may apply. Adhering to these deadlines is essential to avoid penalties and ensure that you receive the credit you are entitled to.

Quick guide on how to complete printable 2020 new york form it 641 manufacturers real property tax credit

Effortlessly complete Printable New York Form IT 641 Manufacturer's Real Property Tax Credit on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents promptly without delays. Manage Printable New York Form IT 641 Manufacturer's Real Property Tax Credit on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Printable New York Form IT 641 Manufacturer's Real Property Tax Credit with ease

- Obtain Printable New York Form IT 641 Manufacturer's Real Property Tax Credit and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and then click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in a few clicks from any device you choose. Modify and eSign Printable New York Form IT 641 Manufacturer's Real Property Tax Credit and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 new york form it 641 manufacturers real property tax credit

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 new york form it 641 manufacturers real property tax credit

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to 2020 641?

airSlate SignNow is a comprehensive online solution that allows businesses to send and eSign documents seamlessly. It is specially designed to meet the needs of businesses looking for an efficient way to manage documentation, including those relying on 2020 641 features.

-

What are the pricing plans available for airSlate SignNow related to 2020 641?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, specifically accommodating those focused on the 2020 641 functionalities. Users can choose from various tiers that provide the best features tailored to their needs, ensuring cost-effectiveness.

-

What key features does airSlate SignNow provide for 2020 641 users?

For users interested in 2020 641, airSlate SignNow includes features such as customizable templates, real-time collaboration, and seamless integrations with other tools. These features streamline the documentation process and improve overall efficiency in managing electronic signatures.

-

How can airSlate SignNow benefit my business focusing on 2020 641?

By utilizing airSlate SignNow, businesses can enhance their document workflow specific to 2020 641, ultimately increasing productivity and reducing turnaround times. Its user-friendly interface allows for greater accessibility and simplicity in executing documents securely.

-

Are there any integrations available with airSlate SignNow for the 2020 641 framework?

Yes, airSlate SignNow provides various integrations that complement the 2020 641 framework. Whether you use CRM systems, cloud storage services, or other business applications, its robust API facilitates seamless connectivity, enhancing your overall document management experience.

-

Is it easy to set up airSlate SignNow for 2020 641?

Setting up airSlate SignNow for use with 2020 641 is straightforward and user-friendly. The platform offers guided tutorials and resources to help users quickly adapt and start leveraging its features without extensive training or technical skills.

-

What security measures does airSlate SignNow implement for 2020 641 documents?

airSlate SignNow employs advanced security measures to protect 2020 641 documents, including end-to-end encryption and secure access controls. This ensures that sensitive information remains confidential and that your business complies with industry standards.

Get more for Printable New York Form IT 641 Manufacturer's Real Property Tax Credit

- Mississippi revocable living trust form

- F0015 page 1 of 1 office of the mississippi secretary of form

- Consumer registration agreement montana department of justice doj mt form

- Order changing name child form

- Montana revocable living trust form eformscom

- Summons for publication montana courts form

- Motion for bond reduction form texas

- Divorce in nc form

Find out other Printable New York Form IT 641 Manufacturer's Real Property Tax Credit

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement