Form it 641 Manufacturer's Real Property Tax Credit Tax Year 2022

What is the Form IT 641 Manufacturer's Real Property Tax Credit Tax Year

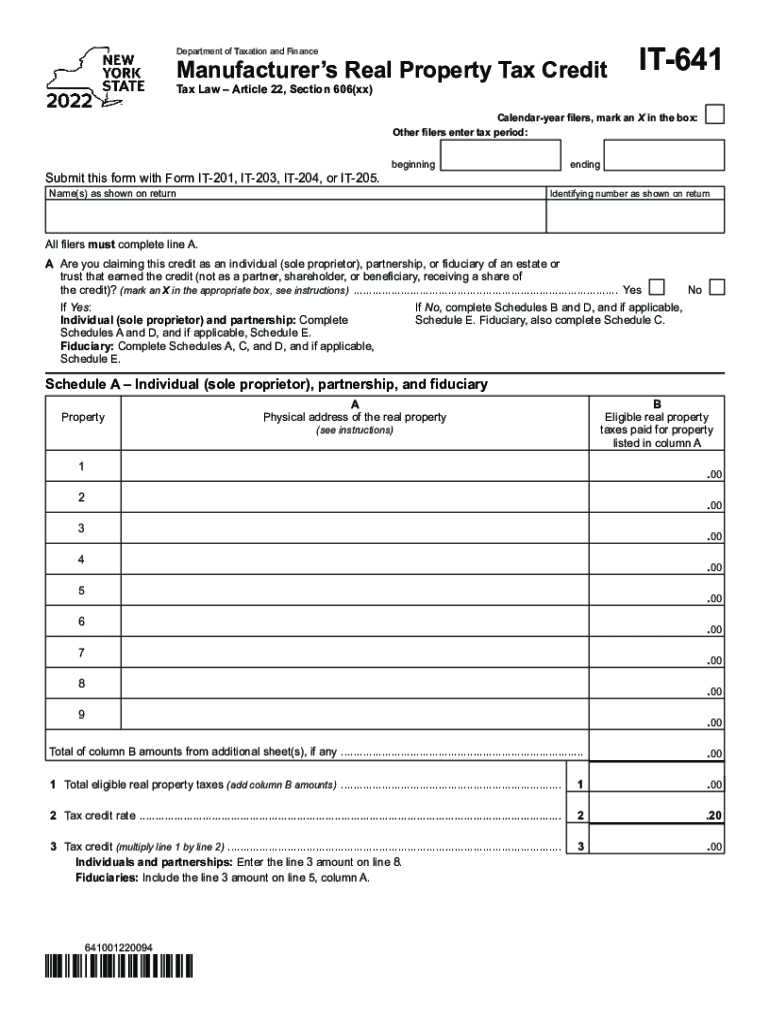

The Form IT 641 is a tax document used in New York State for claiming the Manufacturer's Real Property Tax Credit. This credit is designed to provide financial relief to manufacturers by reducing the property tax burden on real property used in manufacturing activities. The form is applicable for specific tax years, and understanding its purpose is crucial for eligible manufacturers seeking to optimize their tax liabilities.

Steps to complete the Form IT 641 Manufacturer's Real Property Tax Credit Tax Year

Completing the Form IT 641 involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation, including property tax bills and any relevant financial records. Next, fill out the form by providing detailed information about the property, including location and usage. Be sure to calculate the credit amount correctly based on the guidelines provided by the New York State Department of Taxation and Finance. Finally, review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the Manufacturer's Real Property Tax Credit using Form IT 641, certain eligibility criteria must be met. Primarily, the property must be used for manufacturing purposes, and the taxpayer must be a qualified manufacturer as defined by state regulations. Additionally, the property must meet specific assessment requirements and must not have been subject to any disqualifying events during the tax year in question. Understanding these criteria is essential for successful application.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 641 are critical for ensuring that manufacturers receive their tax credits in a timely manner. Typically, the form must be submitted by the due date of the tax return for the year in which the credit is being claimed. It is advisable to check the New York State Department of Taxation and Finance website for specific dates and any updates related to filing requirements, as these can vary from year to year.

Required Documents

When completing the Form IT 641, several documents are required to substantiate the claim. These may include copies of property tax bills, proof of manufacturing activity, and financial statements that demonstrate eligibility for the credit. Having all necessary documents organized and readily available will facilitate the completion process and help avoid delays in processing the claim.

Legal use of the Form IT 641 Manufacturer's Real Property Tax Credit Tax Year

The legal use of the Form IT 641 is governed by New York State tax laws that outline the parameters for claiming the Manufacturer's Real Property Tax Credit. It is essential that all information provided on the form is accurate and truthful, as any discrepancies can lead to penalties or denial of the credit. Compliance with these regulations not only ensures the legal validity of the claim but also protects the taxpayer from potential legal repercussions.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form IT 641 can be done through various methods, depending on the preferences of the taxpayer. The form can be submitted online through the New York State Department of Taxation and Finance website, allowing for quicker processing. Alternatively, taxpayers may choose to mail the completed form to the appropriate tax office or deliver it in person. Each submission method has its own advantages, and selecting the right one can enhance the efficiency of the filing process.

Quick guide on how to complete form it 641 manufacturers real property tax credit tax year

Complete Form IT 641 Manufacturer's Real Property Tax Credit Tax Year seamlessly on any device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as it allows you to access the necessary form and securely save it online. airSlate SignNow offers you all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Form IT 641 Manufacturer's Real Property Tax Credit Tax Year on any device with airSlate SignNow's Android or iOS applications and streamline any document-based task today.

The easiest way to modify and eSign Form IT 641 Manufacturer's Real Property Tax Credit Tax Year effortlessly

- Find Form IT 641 Manufacturer's Real Property Tax Credit Tax Year and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your updates.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from any device you prefer. Edit and eSign Form IT 641 Manufacturer's Real Property Tax Credit Tax Year and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 641 manufacturers real property tax credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 641 manufacturers real property tax credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the taxation 641 form and why is it important?

The taxation 641 form is a crucial document used in tax reporting, particularly for specific industries. Its importance lies in ensuring compliance with IRS regulations and helping businesses accurately report their tax obligations. Understanding the taxation 641 form is essential for avoiding penalties and ensuring proper accounting.

-

How can airSlate SignNow help with the taxation 641 form?

airSlate SignNow provides an efficient way to prepare and eSign the taxation 641 form electronically. Our platform streamlines paperwork processes, allowing you to fill out and send the form securely. By using our service, you can save time and reduce errors associated with manual forms.

-

What are the pricing options for using airSlate SignNow for taxation 641 form?

airSlate SignNow offers various pricing plans to accommodate different business needs when dealing with the taxation 641 form. Our plans are designed to be cost-effective, allowing you to choose the right features for your organization. You can explore monthly and annual subscriptions with full access to our signing features.

-

Are there any integrations available for managing the taxation 641 form?

Yes, airSlate SignNow integrates seamlessly with a range of applications useful for handling the taxation 641 form. These integrations enhance productivity by allowing easy access to your documents across various platforms. Our API also enables custom integrations to suit your specific business needs.

-

What features does airSlate SignNow offer for the taxation 641 form?

airSlate SignNow includes features like document templates, eSignature capabilities, and document tracking that are particularly beneficial for the taxation 641 form. These tools not only simplify the signing process but also help you manage your documents effectively. Additionally, real-time notifications keep you informed about the status of your forms.

-

Can I use airSlate SignNow to store my taxation 641 form securely?

Absolutely! airSlate SignNow offers secure cloud storage for all your documentation, including the taxation 641 form. This ensures that your sensitive information is protected with top-notch security measures. You can access your stored documents anytime, enhancing convenience without compromising safety.

-

How does eSigning the taxation 641 form work with airSlate SignNow?

eSigning the taxation 641 form using airSlate SignNow is straightforward. After preparing the form, you can invite signers via email to review and sign it electronically. The process is fast, secure, and legally recognized, ensuring that all parties can complete their actions efficiently.

Get more for Form IT 641 Manufacturer's Real Property Tax Credit Tax Year

- Site work contractor package south carolina form

- Siding contractor package south carolina form

- Refrigeration contractor package south carolina form

- Drainage contractor package south carolina form

- Tax free exchange package south carolina form

- Landlord tenant sublease package south carolina form

- Buy sell agreement package south carolina form

- Option to purchase package south carolina form

Find out other Form IT 641 Manufacturer's Real Property Tax Credit Tax Year

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast