New Trust Reporting Requirements for T3 Returns Filed for Tax 2023

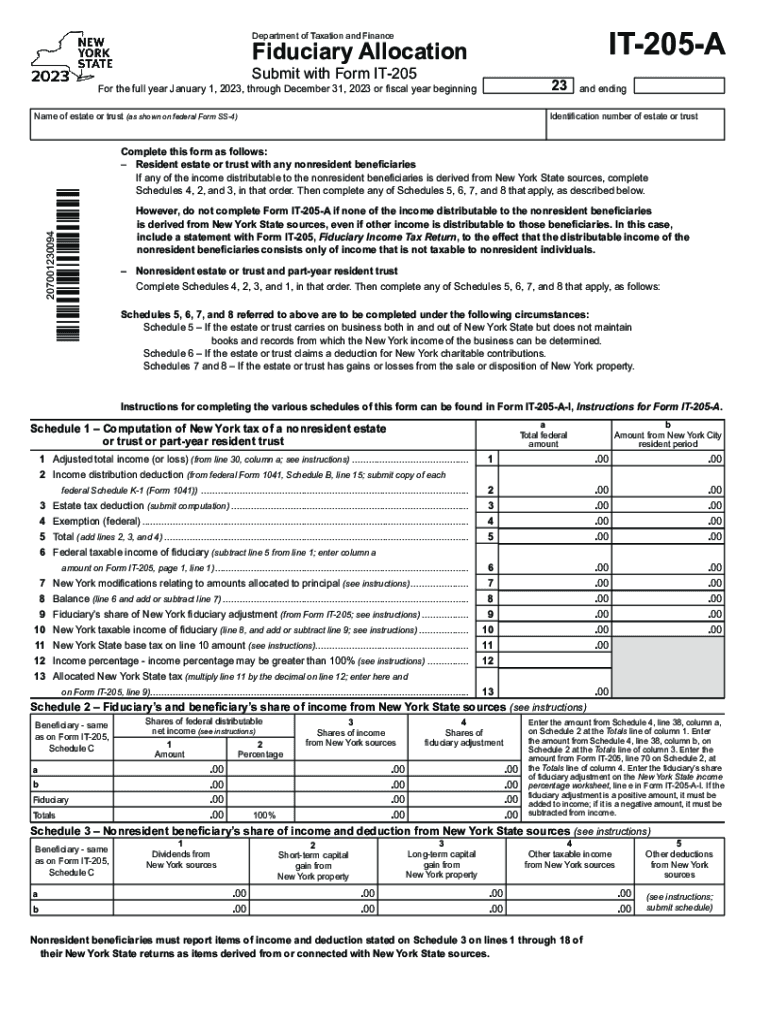

Overview of the IT-205 Form

The IT-205 form, also known as the New York State Fiduciary Income Tax Return, is essential for fiduciaries managing estates or trusts. This form allows fiduciaries to report the income, deductions, and credits of the estate or trust for tax purposes. Understanding the requirements and processes involved in filing this form is crucial for compliance with New York tax laws.

Steps to Complete the IT-205 Form

Completing the IT-205 form involves several key steps:

- Gather all necessary financial documents related to the estate or trust.

- Complete the identification section, including the name and address of the estate or trust.

- Report the income earned by the estate or trust, including interest, dividends, and capital gains.

- Deduct any allowable expenses, such as administrative costs and legal fees.

- Calculate the total taxable income and determine the tax owed.

- Sign and date the form, ensuring all information is accurate before submission.

Required Documents for Filing IT-205

To successfully file the IT-205 form, certain documents are necessary:

- Financial statements detailing income and expenses for the estate or trust.

- Documentation of any deductions claimed.

- Prior year tax returns, if applicable.

- Any supporting schedules or forms that provide additional information.

Filing Deadlines for the IT-205 Form

Filing deadlines for the IT-205 form are critical to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the close of the tax year. For estates or trusts with a calendar year-end, this means the form is generally due by April 15. It is important to check for any specific extensions or changes in deadlines that may apply.

Penalties for Non-Compliance with IT-205

Failure to file the IT-205 form on time or inaccuracies in reporting can lead to penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid taxes.

- Potential legal repercussions for fraudulent reporting.

Submission Methods for the IT-205 Form

The IT-205 form can be submitted through various methods:

- Online filing through approved tax software.

- Mailing a paper copy to the appropriate New York State tax office.

- In-person submission at designated tax offices, if applicable.

IRS Guidelines for Fiduciary Returns

While the IT-205 form is specific to New York State, it is essential to also consider IRS guidelines for fiduciary returns. The IRS requires fiduciaries to file Form 1041 for federal tax purposes. Understanding both state and federal obligations ensures compliance and avoids potential issues with tax authorities.

Quick guide on how to complete new trust reporting requirements for t3 returns filed for tax

Complete New Trust Reporting Requirements For T3 Returns Filed For Tax seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage New Trust Reporting Requirements For T3 Returns Filed For Tax on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign New Trust Reporting Requirements For T3 Returns Filed For Tax effortlessly

- Obtain New Trust Reporting Requirements For T3 Returns Filed For Tax and then click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form-finding, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign New Trust Reporting Requirements For T3 Returns Filed For Tax and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new trust reporting requirements for t3 returns filed for tax

Create this form in 5 minutes!

How to create an eSignature for the new trust reporting requirements for t3 returns filed for tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is it 205 and how does it relate to airSlate SignNow?

The term 'it 205' refers to the streamlined digital transformation processes that airSlate SignNow supports. By leveraging eSignature technology, businesses can enhance their workflow efficiency and reduce paper usage. With airSlate SignNow, it 205 becomes a reality as you automate and manage your documents seamlessly.

-

What are the key features of it 205 in airSlate SignNow?

AirSlate SignNow offers robust features under the it 205 initiative, including customizable templates, team collaboration tools, and comprehensive document tracking. These features are designed to simplify the eSigning process and ensure that every document is handled efficiently. Furthermore, it 205 emphasizes user-friendliness, making it easy for everyone in your organization to adopt.

-

How does airSlate SignNow's pricing model work for it 205?

The pricing structure for airSlate SignNow, particularly under the it 205 initiative, is competitive and flexible, catering to various business sizes. Customers can choose from several plans based on their document needs and team size, ensuring they only pay for what they use. To explore more about pricing for it 205, visit our pricing page for detailed information.

-

What are the benefits of using it 205 with airSlate SignNow?

Implementing it 205 with airSlate SignNow brings numerous benefits, such as signNow time savings, improved accuracy, and enhanced compliance. By eliminating manual processes, businesses can focus on core operations while ensuring documents are securely signed and stored. This not only boosts productivity but also promotes environmental sustainability.

-

Can airSlate SignNow integrate with other tools for it 205?

Yes, airSlate SignNow supports seamless integrations with a variety of applications under the it 205 framework. Whether you use CRM software, accounting tools, or project management platforms, airSlate SignNow can connect with these systems to streamline your workflow. This flexibility ensures that your eSigning processes fit perfectly within your existing business ecosystem.

-

Is airSlate SignNow suitable for small businesses under it 205?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, making it an excellent choice for small businesses operating under the it 205 model. Its cost-effective solutions and user-friendly interface allow small teams to optimize their document management without breaking the bank. This empowers them to compete effectively in the digital landscape.

-

How secure is airSlate SignNow in the context of it 205?

Security is a priority for airSlate SignNow, particularly in initiatives like it 205, where document integrity is crucial. The platform employs advanced encryption and compliance standards to protect user data and ensure secure transactions. Rest assured that your documents and signatures are safe with airSlate SignNow’s stringent security measures.

Get more for New Trust Reporting Requirements For T3 Returns Filed For Tax

- Form a request and authorization to travel form salem state salemstate

- Business privilege tax form allentownpa

- Subpoena for witness civil va form

- Can i fill out and pay an st 7r in mass form

- Gfg comercio digital ltda nota fiscal eletrnica form

- Section 1 taxpayer information

- Tax form tax tableamarta karya

- A social security number refund total 12 reason 1 form

Find out other New Trust Reporting Requirements For T3 Returns Filed For Tax

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract