Form it 205 a Fiduciary Allocation Tax Year 2022

What is the Form IT 205 A Fiduciary Allocation Tax Year

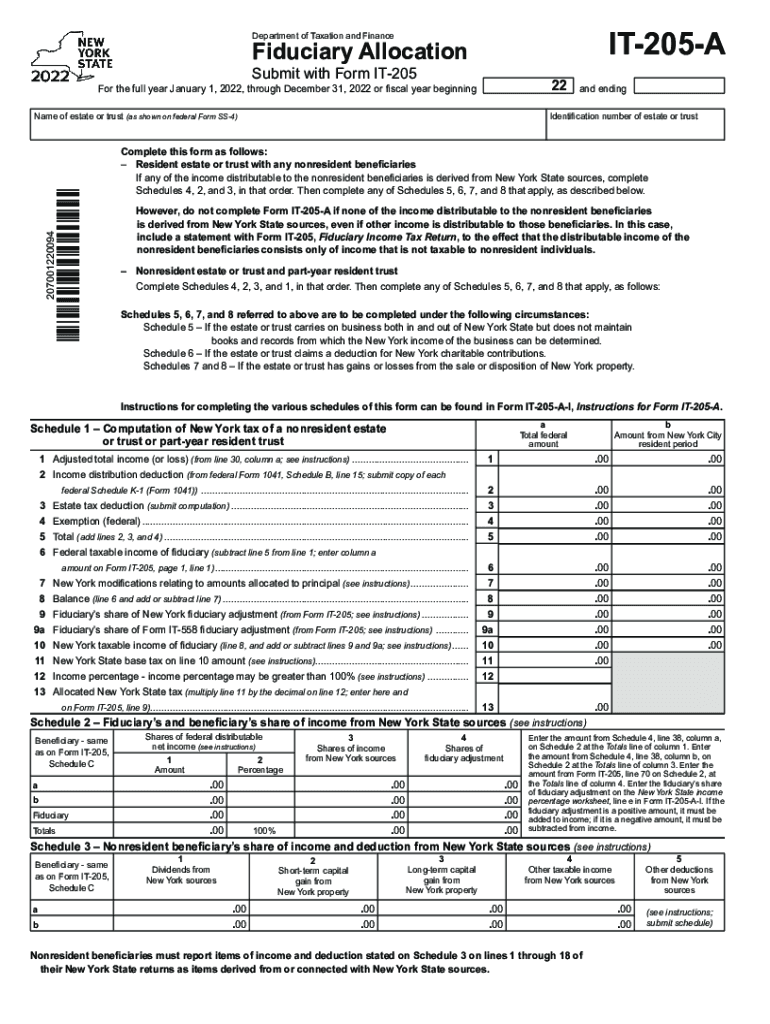

The Form IT 205 A is a fiduciary allocation form utilized in New York for tax purposes. It is specifically designed for estates and trusts to report the income earned and allocate it to beneficiaries. The form is essential for ensuring that the income is taxed appropriately, reflecting the distribution of funds among the beneficiaries. By using the IT 205 A, fiduciaries can accurately report the income received by the trust or estate during the tax year, ensuring compliance with state tax regulations.

How to use the Form IT 205 A Fiduciary Allocation Tax Year

Using the Form IT 205 A involves several steps to ensure proper completion and submission. First, the fiduciary must gather all necessary financial documents related to the estate or trust income. This includes bank statements, investment income reports, and any other relevant financial records. Next, the fiduciary should fill out the form by providing details about the income earned, expenses incurred, and distributions made to beneficiaries. It is crucial to ensure that all information is accurate to avoid potential penalties. Once completed, the form can be submitted to the New York State Department of Taxation and Finance.

Steps to complete the Form IT 205 A Fiduciary Allocation Tax Year

Completing the Form IT 205 A requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents related to the estate or trust.

- Fill in the basic information, including the name and address of the fiduciary and the estate or trust.

- Report the total income earned by the estate or trust during the tax year.

- Detail any deductions or expenses that apply.

- Allocate the income to beneficiaries as per the trust or estate agreement.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate tax authority by the filing deadline.

Legal use of the Form IT 205 A Fiduciary Allocation Tax Year

The legal use of the Form IT 205 A is governed by New York state tax laws. It is essential for fiduciaries to understand that this form must be completed accurately to ensure compliance with state regulations. Failure to properly report income or allocate it to beneficiaries can lead to penalties or audits. The form serves as an official document that helps establish the fiduciary's responsibility in managing the estate or trust's finances, making it a critical component of fiduciary duties.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 205 A are typically aligned with the tax year. Fiduciaries must be aware that the form is due on or before the fifteenth day of the fourth month following the close of the tax year. For example, if the tax year ends on December thirty-first, the form must be filed by April fifteenth of the following year. It is important to stay informed about any changes in deadlines or extensions that may be applicable, as these can affect compliance and potential penalties.

Required Documents

To complete the Form IT 205 A, several documents are necessary. These include:

- Financial statements detailing income generated by the estate or trust.

- Records of all expenses incurred during the tax year.

- Documentation of distributions made to beneficiaries.

- Any prior year tax returns that may provide context for current filings.

Having these documents ready will streamline the process of completing the form and ensure that all information is accurate and compliant with legal requirements.

Quick guide on how to complete form it 205 a fiduciary allocation tax year 2022

Make Form IT 205 A Fiduciary Allocation Tax Year effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-conscious alternative to traditional printed and signed documents, as you can access the appropriate template and securely store it online. airSlate SignNow equips you with everything necessary to create, adjust, and electronically sign your documents quickly without delays. Manage Form IT 205 A Fiduciary Allocation Tax Year on any gadget with airSlate SignNow Android or iOS applications and enhance any document-oriented procedure today.

The easiest method to edit and electronically sign Form IT 205 A Fiduciary Allocation Tax Year without hassle

- Locate Form IT 205 A Fiduciary Allocation Tax Year and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight essential parts of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Form IT 205 A Fiduciary Allocation Tax Year and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 205 a fiduciary allocation tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form it 205 a fiduciary allocation tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is it 205 a in relation to airSlate SignNow?

IT 205 A refers to an essential feature of airSlate SignNow, designed to streamline document management and eSigning processes. This function allows users to efficiently handle documents, ensuring they stay organized and easily accessible throughout the signing process.

-

How much does airSlate SignNow cost with the it 205 a feature?

airSlate SignNow offers competitive pricing plans that include access to the IT 205 A capability. Depending on the plan you choose, monthly subscription fees provide full access to signing, document creation, and management features tailored for businesses of all sizes.

-

What are the key features of airSlate SignNow's it 205 a?

The key features of IT 205 A in airSlate SignNow include easy document uploads, customizable templates, and secure eSigning solutions. These tools simplify the process of obtaining signatures while ensuring compliance and security for all types of documents.

-

How can airSlate SignNow's it 205 a benefit my business?

IT 205 A can signNowly enhance your business operations by reducing the time spent on document handling and improving workflow efficiency. By utilizing airSlate SignNow's features, businesses can ensure faster turnaround times on contracts and agreements, leading to increased productivity.

-

Does airSlate SignNow's it 205 a integrate with other software?

Yes, airSlate SignNow's IT 205 A seamlessly integrates with a variety of popular business applications, including CRM and project management tools. This allows your team to synchronize documents and workflow processes across different platforms, enhancing overall efficiency.

-

Is airSlate SignNow's it 205 a secure for handling sensitive documents?

Absolutely. IT 205 A in airSlate SignNow adheres to strict security protocols, including data encryption and secure access controls. This ensures that sensitive documents are protected throughout the signing process, giving you peace of mind when handling confidential information.

-

Can I customize the features of airSlate SignNow's it 205 a?

Yes, airSlate SignNow allows users to customize various features related to IT 205 A based on their specific business needs. Whether it’s setting up document templates or automating workflows, you can tailor the solution to fit your operational requirements.

Get more for Form IT 205 A Fiduciary Allocation Tax Year

- Letter from landlord to tenant as notice of default on commercial lease south carolina form

- Residential or rental lease extension agreement south carolina form

- Commercial rental lease application questionnaire south carolina form

- Apartment lease rental application questionnaire south carolina form

- Sc lease form

- Salary verification form for potential lease south carolina

- South carolina agreement pdf form

- Notice of default on residential lease south carolina form

Find out other Form IT 205 A Fiduciary Allocation Tax Year

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed