Fiduciary Allocation it 205 a Department of Taxation and 2020

Understanding the Fiduciary Allocation IT 205 A Department of Taxation

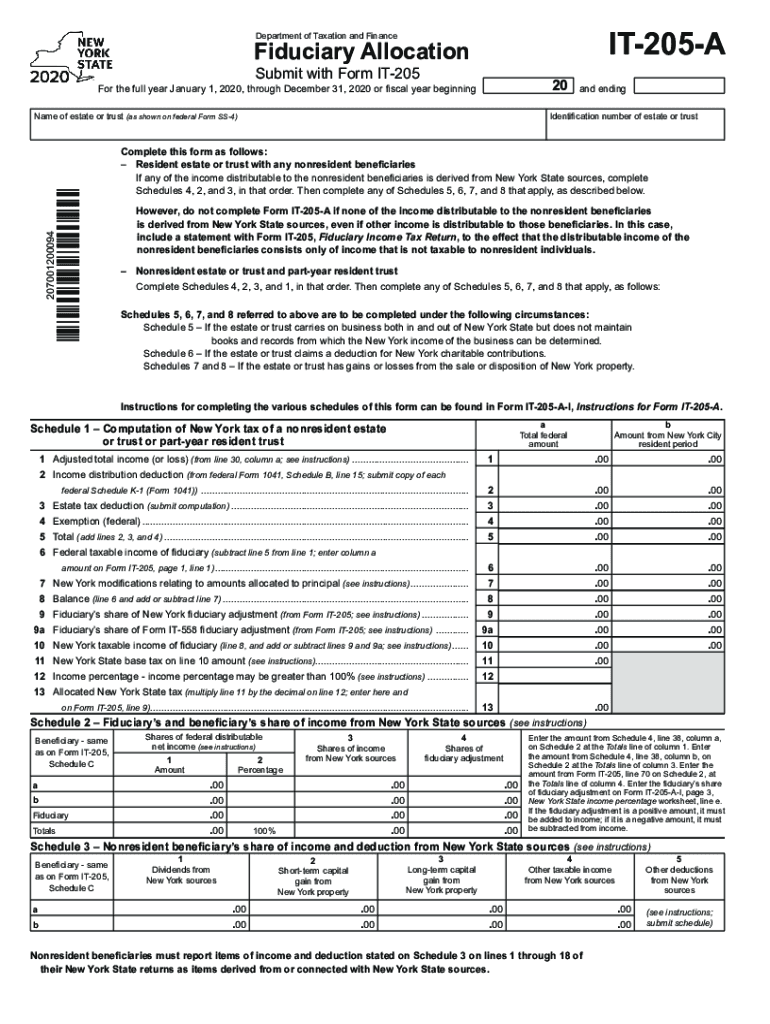

The Fiduciary Allocation IT 205 A is a specific form used by fiduciaries in New York to report income and deductions for estates and trusts. This form is essential for ensuring that the income generated by the estate or trust is correctly allocated to beneficiaries. It plays a crucial role in the tax compliance process, allowing fiduciaries to fulfill their obligations under state tax laws. The form includes detailed sections for reporting various types of income, deductions, and credits, making it vital for accurate tax reporting.

Steps to Complete the Fiduciary Allocation IT 205 A

Completing the Fiduciary Allocation IT 205 A involves several key steps:

- Gather necessary documentation, including income statements, deduction records, and any relevant tax documents.

- Fill out the identification section, providing details about the estate or trust, including its name and taxpayer identification number.

- Report income sources, including interest, dividends, and capital gains, ensuring accuracy in the amounts reported.

- Detail deductions, such as administrative expenses and distributions to beneficiaries, to determine the taxable income.

- Review the completed form for accuracy and ensure all required signatures are included.

Legal Use of the Fiduciary Allocation IT 205 A

The Fiduciary Allocation IT 205 A is legally binding when completed correctly and submitted to the New York Department of Taxation and Finance. To ensure its legal standing, fiduciaries must adhere to the guidelines set forth by state tax laws. This includes accurate reporting of income and deductions, as well as compliance with deadlines. Failure to comply with these regulations can result in penalties or legal repercussions.

Filing Deadlines for the Fiduciary Allocation IT 205 A

Filing deadlines for the Fiduciary Allocation IT 205 A are critical to maintaining compliance with state tax regulations. Typically, the form must be submitted by the fifteenth day of the fourth month following the close of the estate's or trust's tax year. It is essential for fiduciaries to be aware of these deadlines to avoid late filing penalties and ensure timely processing of the form.

Required Documents for the Fiduciary Allocation IT 205 A

When preparing to file the Fiduciary Allocation IT 205 A, fiduciaries should gather the following documents:

- Income statements for the estate or trust, including bank statements and investment income records.

- Records of deductions, such as receipts for administrative expenses and distributions made to beneficiaries.

- Previous tax returns for the estate or trust, if applicable, to ensure consistency in reporting.

- Any correspondence from the New York Department of Taxation and Finance regarding the estate or trust.

Who Issues the Fiduciary Allocation IT 205 A

The Fiduciary Allocation IT 205 A is issued by the New York Department of Taxation and Finance. This state agency is responsible for overseeing tax compliance and ensuring that fiduciaries adhere to the relevant tax laws. The department provides resources and guidance for fiduciaries to assist in the accurate completion and submission of the form.

Quick guide on how to complete fiduciary allocation it 205 a department of taxation and

Effortlessly Prepare Fiduciary Allocation IT 205 A Department Of Taxation And on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can easily access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents promptly without delays. Manage Fiduciary Allocation IT 205 A Department Of Taxation And on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign Fiduciary Allocation IT 205 A Department Of Taxation And with Ease

- Find Fiduciary Allocation IT 205 A Department Of Taxation And and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional pen-and-ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Fiduciary Allocation IT 205 A Department Of Taxation And and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fiduciary allocation it 205 a department of taxation and

Create this form in 5 minutes!

How to create an eSignature for the fiduciary allocation it 205 a department of taxation and

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What is it 205 a in relation to airSlate SignNow?

It 205 a refers to our dedicated solution that enhances document management and eSignature capabilities. With airSlate SignNow, users can streamline document workflows, making it easier to obtain signatures and send documents securely.

-

How does pricing work for it 205 a?

Our pricing for it 205 a is designed to be cost-effective and competitive. Customers can choose from various plans that cater to different business needs, ensuring that they only pay for the features they require.

-

What key features does it 205 a offer?

It 205 a includes essential features such as smart templates, automated workflows, and real-time notifications for document status. These features allow businesses to efficiently manage their signing processes, saving both time and resources.

-

What are the benefits of using it 205 a for businesses?

By implementing it 205 a, businesses experience improved efficiency in their document management processes. It dramatically reduces turnaround times for documents and enhances overall productivity, contributing to a smoother business operation.

-

Can I integrate it 205 a with other tools?

Yes, it 205 a can be seamlessly integrated with various CRM and project management tools you may already be using. This allows for better workflow automation and synchronization across different platforms, ensuring cohesive operation.

-

Is there a mobile app for it 205 a?

Absolutely! airSlate SignNow offers a mobile app for it 205 a that enables users to manage documents and collect signatures on the go. This mobility ensures you can stay productive and responsive, regardless of your location.

-

How secure is it 205 a for sending documents?

Security is a top priority for it 205 a. We utilize advanced encryption protocols and provide compliance with major regulations to ensure your documents are transmitted safely and remain intact throughout the signing process.

Get more for Fiduciary Allocation IT 205 A Department Of Taxation And

- To access a maine transfer tax declaration form

- Youve asked to add an adult household member form

- Free maine commercial lease agreement formslegal

- Application for homestead and farmstead beaver county form

- Beaver county homestead exemption form

- In accordance with state laws located in sections 47 8 1 through 47 8 52 form

- Regional manager email contact number dbhdsvirginiagov form

- Defective drywall disclosure statement dpor virginiagov form

Find out other Fiduciary Allocation IT 205 A Department Of Taxation And

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online