Form it 205 a Fiduciary Allocation Tax Year 2024-2026

What is the Form IT 205 A Fiduciary Allocation Tax Year

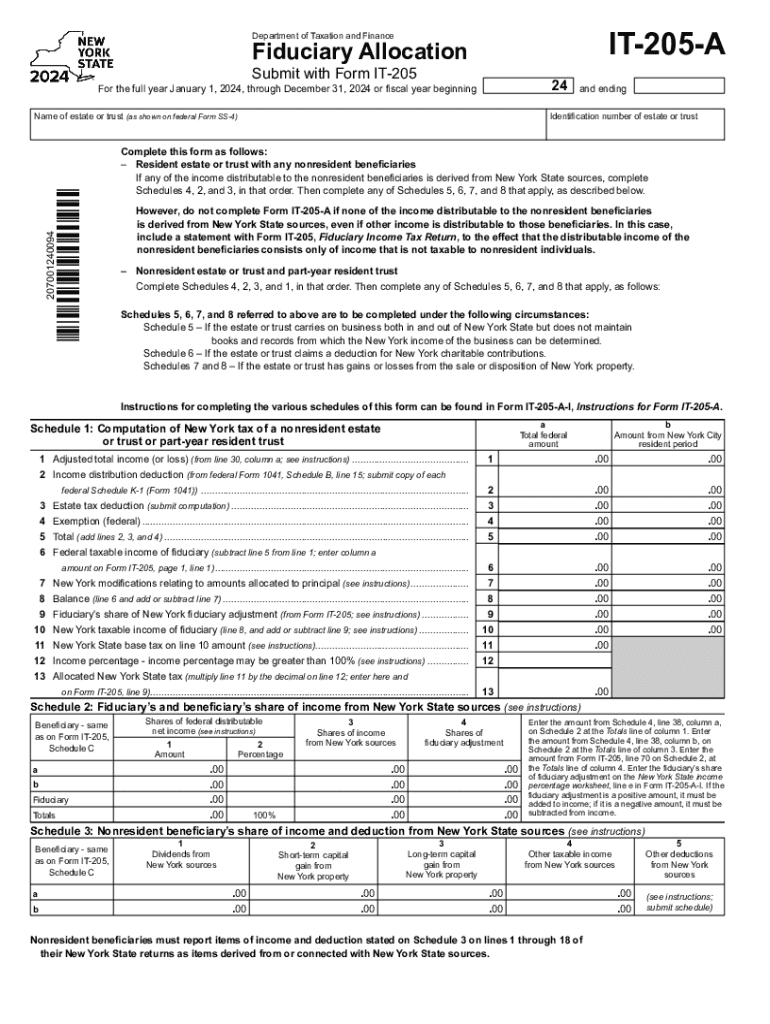

The Form IT 205 is a tax form used in New York State for fiduciaries to report the allocation of income, deductions, and credits for the tax year. This form is specifically designed for estates and trusts that need to distribute income to beneficiaries. By filing this form, fiduciaries can ensure that the income is properly allocated among beneficiaries, which is essential for accurate tax reporting and compliance with state regulations.

How to use the Form IT 205 A Fiduciary Allocation Tax Year

Using the Form IT 205 involves several steps. First, fiduciaries must gather all relevant financial information related to the estate or trust, including income generated and deductions incurred during the tax year. Next, they will fill out the form, detailing how the income is allocated to each beneficiary. It is important to ensure that all figures are accurate and reflect the actual distributions made. Finally, the completed form must be submitted to the New York State Department of Taxation and Finance as part of the fiduciary's tax obligations.

Steps to complete the Form IT 205 A Fiduciary Allocation Tax Year

Completing the Form IT 205 involves a systematic approach:

- Gather all financial documents related to the estate or trust.

- Identify the total income earned during the tax year.

- Determine the deductions applicable to the estate or trust.

- Allocate income and deductions to each beneficiary according to the trust or estate agreement.

- Fill out the form with accurate figures and required information.

- Review the completed form for accuracy.

- Submit the form by the designated filing deadline.

Key elements of the Form IT 205 A Fiduciary Allocation Tax Year

The Form IT 205 includes several key elements that are essential for proper completion:

- Identification Information: This includes the name and taxpayer identification number of the fiduciary, as well as the estate or trust name.

- Income and Deductions: Detailed sections for reporting total income and allowable deductions.

- Beneficiary Allocations: A breakdown of how income and deductions are allocated to each beneficiary.

- Signature Section: The fiduciary must sign the form, certifying that the information provided is accurate and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 205 are crucial for compliance. Generally, the form must be filed by the fifteenth day of the fourth month following the close of the tax year. For estates and trusts with a fiscal year, the deadline will vary accordingly. Fiduciaries should keep track of these dates to avoid penalties and ensure timely processing of their tax filings.

Required Documents

To complete the Form IT 205, fiduciaries should prepare the following documents:

- Financial statements for the estate or trust, including income and expense reports.

- Records of distributions made to beneficiaries throughout the tax year.

- Any relevant tax documents, such as prior year returns or schedules.

- Trust or estate agreements that outline the allocation of income and deductions.

Create this form in 5 minutes or less

Find and fill out the correct form it 205 a fiduciary allocation tax year 772088707

Create this form in 5 minutes!

How to create an eSignature for the form it 205 a fiduciary allocation tax year 772088707

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 205?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. It 205 refers to the specific features and capabilities that enhance document management and streamline workflows, making it an ideal choice for organizations looking to improve efficiency.

-

How much does airSlate SignNow cost for users interested in it 205?

The pricing for airSlate SignNow varies based on the plan you choose, but it offers competitive rates that cater to businesses of all sizes. For those focusing on it 205, the plans include essential features that ensure you get the best value for your investment.

-

What features does airSlate SignNow offer that support it 205?

airSlate SignNow includes a range of features such as customizable templates, real-time tracking, and secure cloud storage, all of which support the it 205 framework. These features help businesses manage their documents more effectively and enhance collaboration among team members.

-

What are the benefits of using airSlate SignNow for it 205?

Using airSlate SignNow for it 205 provides numerous benefits, including increased efficiency, reduced turnaround times, and improved document security. By leveraging this solution, businesses can streamline their signing processes and focus on core operations.

-

Can airSlate SignNow integrate with other tools for it 205?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing its functionality for it 205 users. This allows businesses to connect their existing tools and create a more cohesive workflow, improving overall productivity.

-

Is airSlate SignNow suitable for small businesses focusing on it 205?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an excellent choice for small businesses interested in it 205. Its scalable features allow small teams to benefit from advanced document management without breaking the bank.

-

How secure is airSlate SignNow for handling it 205 documents?

Security is a top priority for airSlate SignNow, especially for it 205 documents. The platform employs advanced encryption and compliance with industry standards to ensure that your sensitive information remains protected throughout the signing process.

Get more for Form IT 205 A Fiduciary Allocation Tax Year

Find out other Form IT 205 A Fiduciary Allocation Tax Year

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word