Form 8453 OL Irs 2007-2026

What is the Form 8453 OL?

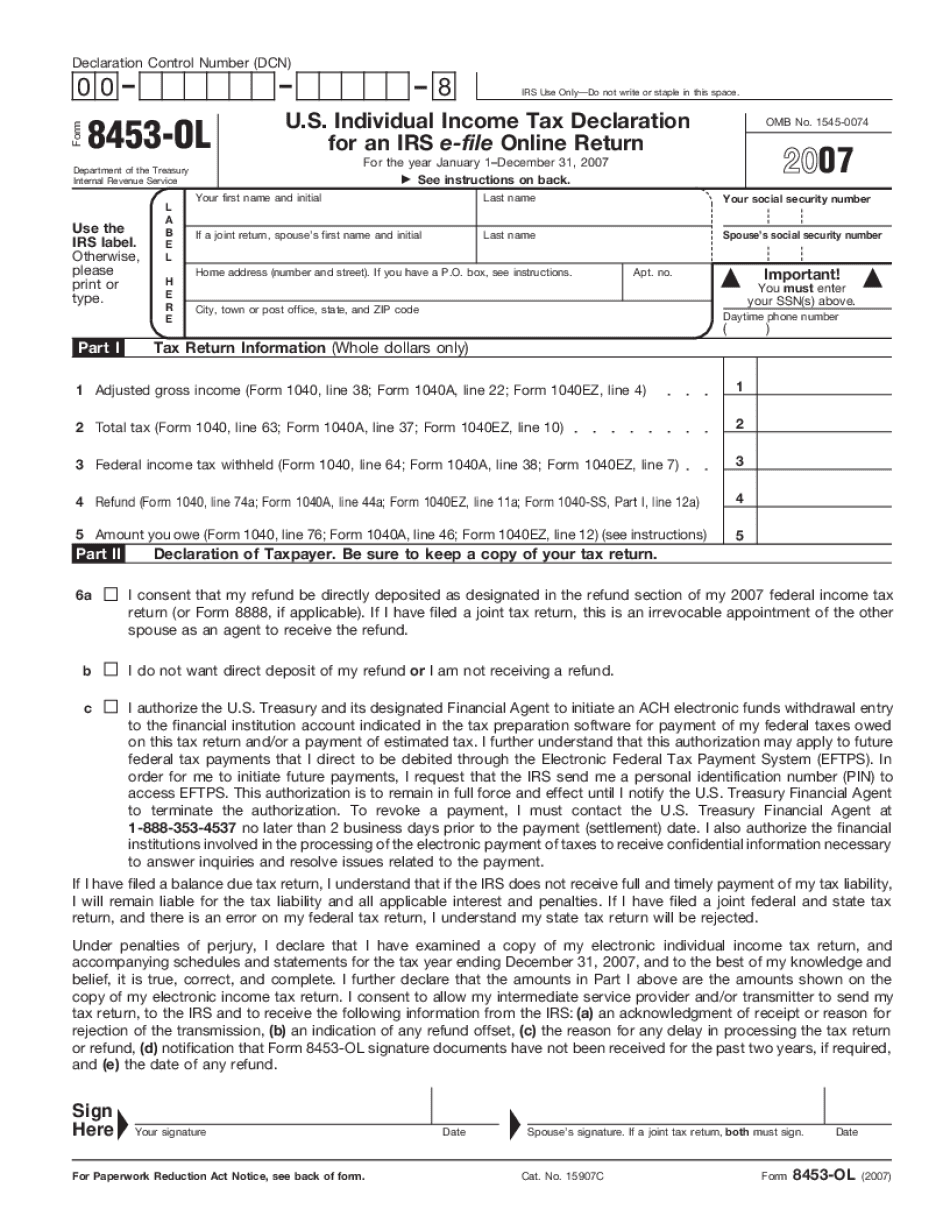

The Form 8453 OL is an Internal Revenue Service (IRS) document specifically designed for taxpayers who e-file their federal tax returns using online software. This form serves as a declaration that the taxpayer has reviewed their return and is authorizing the electronic submission. It is crucial for ensuring the integrity of the e-filing process and provides a means for taxpayers to confirm their identity and consent to the electronic filing of their tax information.

Steps to Complete the Form 8453 OL

Completing the Form 8453 OL involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Review the tax return information to ensure accuracy before submission.

- Sign and date the form to confirm your authorization for e-filing.

- Submit the completed form along with your electronic tax return through your chosen e-filing software.

It is essential to follow these steps carefully to avoid any delays in processing your tax return.

How to Obtain the Form 8453 OL

The Form 8453 OL can be easily obtained through various means:

- Download directly from the IRS website, where it is available in PDF format.

- Access it through tax preparation software that includes the form as part of their e-filing package.

- Request a copy from a tax professional who can assist you with your filing needs.

Having the correct version of the form is vital for ensuring compliance with IRS regulations.

IRS Guidelines for Form 8453 OL

The IRS provides specific guidelines for the use of Form 8453 OL. These include:

- Ensuring that the form is signed electronically as part of the e-filing process.

- Retaining a copy of the signed form for your records, as it may be required for future reference or audits.

- Submitting the form only when e-filing your tax return; it is not necessary for paper filings.

Following these guidelines helps maintain compliance with IRS requirements and supports a smooth filing experience.

Legal Use of the Form 8453 OL

The Form 8453 OL is legally binding, confirming that the taxpayer has authorized the e-filing of their tax return. It is important to understand that by signing this form, you are affirming that:

- The information provided in your tax return is accurate and complete to the best of your knowledge.

- You are aware of the penalties for filing false information.

- You consent to the electronic submission of your tax return.

Understanding the legal implications of this form is crucial for all taxpayers who choose to e-file their returns.

Form Submission Methods

The Form 8453 OL is submitted electronically alongside your e-filed tax return. It is important to note that:

- The form must be submitted through an authorized e-filing method, typically via tax preparation software.

- Do not send the form separately to the IRS; it is automatically included in the e-filing process.

- Ensure that your e-filing software is compatible and up to date to avoid any submission issues.

Utilizing the correct submission methods ensures that your tax return is processed efficiently and accurately.

Quick guide on how to complete form 8453 ol irs

Prepare Form 8453 OL Irs effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain necessary forms and securely save them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Form 8453 OL Irs on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to alter and eSign Form 8453 OL Irs with ease

- Locate Form 8453 OL Irs and then click Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign Form 8453 OL Irs and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8453 ol irs

Create this form in 5 minutes!

How to create an eSignature for the form 8453 ol irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8453 ol and how does it work?

Form 8453 ol is a document used for electronic signature purposes in tax filing. It allows taxpayers to authorize the electronic filing of their tax returns, ensuring compliance with IRS regulations. Using airSlate SignNow, you can easily eSign and submit this form securely.

-

How much does it cost to use airSlate SignNow for form 8453 ol?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose a monthly or annual subscription that includes features tailored for handling documents like form 8453 ol. Visit our pricing page for detailed options.

-

What features does airSlate SignNow provide for managing form 8453 ol?

With airSlate SignNow, you can effortlessly create, send, and eSign form 8453 ol. Our platform supports real-time collaboration, document tracking, and secure storage to ensure your forms are handled efficiently and securely.

-

How does eSigning form 8453 ol benefit businesses?

eSigning form 8453 ol streamlines the filing process and reduces turnaround time. Businesses can eliminate the hassle of paper documents, speed up approval workflows, and ensure secure compliance with electronic signatures using airSlate SignNow.

-

Can I integrate airSlate SignNow with other tools for handling form 8453 ol?

Yes, airSlate SignNow offers seamless integrations with various platforms, including CRM systems and cloud storage services. This allows you to manage your form 8453 ol alongside other business processes, improving efficiency and data synchronization.

-

Is airSlate SignNow secure for signing form 8453 ol?

Absolutely! airSlate SignNow employs industry-standard encryption and security protocols to protect your sensitive data. When signing form 8453 ol, you can be confident that your information is secure and compliant with regulations.

-

What support is available for users of form 8453 ol on airSlate SignNow?

airSlate SignNow provides excellent customer support through various channels, including live chat, email, and help documentation. If you have questions about using form 8453 ol, our resources are readily available to assist you.

Get more for Form 8453 OL Irs

Find out other Form 8453 OL Irs

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy