Form Tr 579 it 2023-2026

What is the Form Tr 579 It

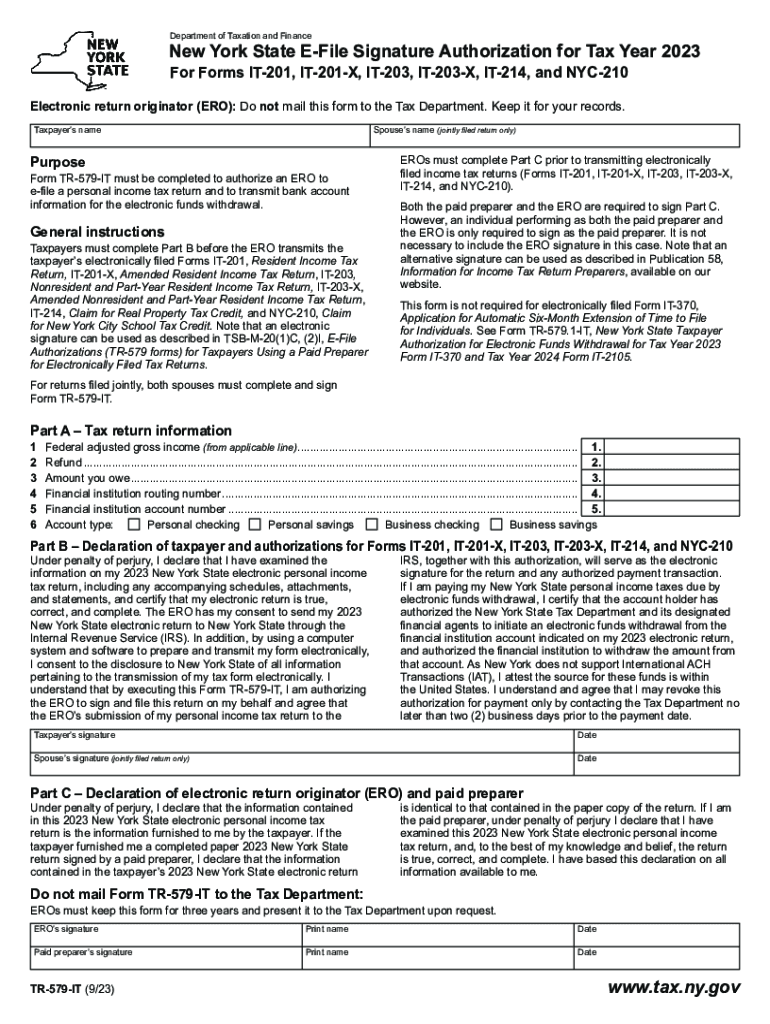

The Form Tr 579 It is a state-specific tax form used in New York for various tax reporting purposes. Primarily, it assists individuals and businesses in reporting income, deductions, and credits accurately to the New York State Department of Taxation and Finance. This form is essential for ensuring compliance with state tax laws and helps taxpayers calculate their tax liability effectively.

How to use the Form Tr 579 It

Using the Form Tr 579 It involves several steps to ensure accurate completion. Taxpayers should first gather all necessary financial documents, including income statements, previous tax returns, and any relevant supporting documentation. Once all information is compiled, individuals can fill out the form, ensuring that all sections are completed accurately. After filling out the form, it must be submitted to the appropriate state tax authority by the designated deadline.

Steps to complete the Form Tr 579 It

Completing the Form Tr 579 It requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including W-2s, 1099s, and receipts for deductions.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring to include all sources of revenue.

- Detail any deductions you are eligible for, such as business expenses or educational credits.

- Review the form for accuracy before submission, checking for any errors or omissions.

Legal use of the Form Tr 579 It

The Form Tr 579 It is legally recognized by the New York State Department of Taxation and Finance. It is crucial for taxpayers to use this form correctly to avoid potential legal issues, such as penalties or audits. Proper use of the form ensures compliance with state tax regulations and helps maintain accurate tax records.

Filing Deadlines / Important Dates

Filing deadlines for the Form Tr 579 It typically align with the annual tax filing season. Taxpayers should be aware of the specific dates each year, as they can vary. Generally, the deadline for submitting this form is April fifteenth for individual taxpayers. It is essential to keep track of these dates to avoid late fees and penalties.

Who Issues the Form

The Form Tr 579 It is issued by the New York State Department of Taxation and Finance. This state agency is responsible for collecting taxes and ensuring compliance with tax laws. Taxpayers can obtain the form directly from the agency’s website or through authorized distribution centers.

Quick guide on how to complete form tr 579 it

Complete Form Tr 579 It effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an excellent environmentally-friendly substitute for conventional printed and signed paperwork, as you can find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without delays. Handle Form Tr 579 It on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Form Tr 579 It with ease

- Find Form Tr 579 It and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, exhausting searches for forms, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Form Tr 579 It to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form tr 579 it

Create this form in 5 minutes!

How to create an eSignature for the form tr 579 it

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tr 579 it and how does it relate to airSlate SignNow?

The tr 579 it is a specific document that can be easily managed through airSlate SignNow's eSignature platform. By using airSlate SignNow, businesses can streamline the signing process for tr 579 it, ensuring quick and secure transactions.

-

What features does airSlate SignNow offer for managing tr 579 it documents?

airSlate SignNow offers a range of features for tr 579 it documents, including customizable templates, automated workflows, and real-time notifications. This ensures that every aspect of your document management is efficient and trackable.

-

Is airSlate SignNow cost-effective for managing tr 579 it forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing tr 579 it forms. With various pricing plans available, businesses can choose an option that fits their budget while still obtaining comprehensive document management capabilities.

-

Can airSlate SignNow integrate with other software for handling tr 579 it?

Absolutely! airSlate SignNow can seamlessly integrate with a variety of software solutions, allowing you to handle tr 579 it documents within your existing workflows. This flexibility enhances productivity and reduces disruptions to your usual operations.

-

What benefits does airSlate SignNow provide for businesses dealing with tr 579 it?

Using airSlate SignNow for tr 579 it offers numerous benefits, such as reduced turnaround times and improved accuracy in document handling. The platform's easy-to-use interface also fosters user adoption and satisfaction, making it a preferred choice for businesses.

-

How secure is airSlate SignNow when handling tr 579 it?

airSlate SignNow prioritizes security, ensuring that all tr 579 it documents are protected with advanced encryption technologies. This safeguards sensitive information while promoting trust and compliance with various regulatory standards.

-

What support options are available for customers using airSlate SignNow for tr 579 it?

Customers using airSlate SignNow for tr 579 it have access to various support options, including a comprehensive knowledge base, live chat, and dedicated customer service. This ensures that help is readily available when needed, promoting a smooth user experience.

Get more for Form Tr 579 It

Find out other Form Tr 579 It

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors