Www Tax Ny GovpitefileNew York State Taxpayer Authorization for Tax Ny Gov 2021

Understanding the New York State Form TR-579 IT

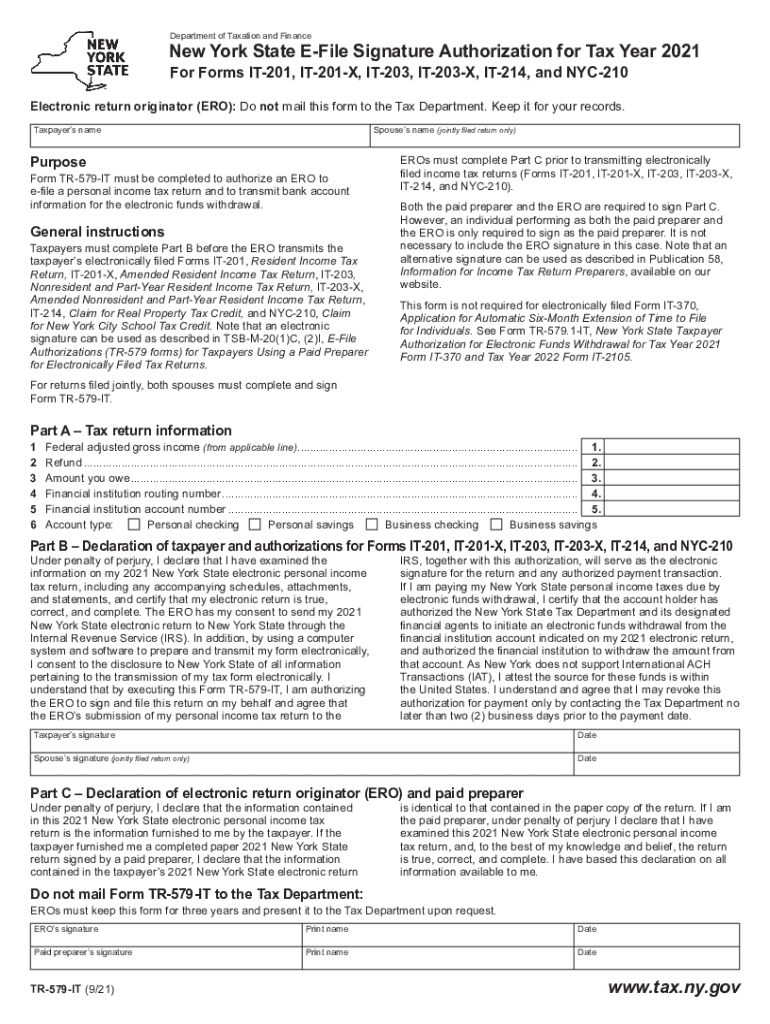

The New York State Form TR-579 IT is a Taxpayer Authorization for e-filing. This form allows taxpayers to authorize a tax professional or a tax preparation service to e-file their state tax returns on their behalf. It is essential for ensuring that the tax professional has the necessary permissions to submit tax documents electronically, streamlining the filing process.

Steps to Complete the TR-579 IT

Completing the TR-579 IT involves several straightforward steps:

- Gather necessary information, including your Social Security number, tax year, and details about your tax preparer.

- Fill out the form with accurate information, ensuring that all fields are completed as required.

- Review the completed form for any errors or omissions to avoid delays in processing.

- Sign and date the form to validate your authorization.

- Submit the form to your tax preparer, who will then e-file your tax return.

Legal Use of the TR-579 IT

The TR-579 IT is legally binding when completed correctly. It complies with New York State eSignature laws, ensuring that your authorization for e-filing is recognized by the state tax authority. This form must be signed by the taxpayer and can be submitted electronically, which enhances its validity and security.

Key Elements of the TR-579 IT

Several key elements must be included in the TR-579 IT for it to be valid:

- Taxpayer's full name and Social Security number.

- Tax preparer's information, including their name and identification number.

- Tax year for which the authorization is granted.

- Signature of the taxpayer, indicating consent for e-filing.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the TR-579 IT. Typically, the form should be submitted alongside your tax return by the tax filing deadline, which is usually April 15 for most taxpayers. Missing this deadline may result in penalties or delays in processing your tax return.

Form Submission Methods

The TR-579 IT can be submitted in various ways, depending on your preference and the capabilities of your tax preparer:

- Electronically through your tax preparer’s e-filing system.

- By mail, if your tax preparer requires a physical copy.

- In-person, if you are meeting with your tax preparer directly.

Quick guide on how to complete wwwtaxnygovpitefilenew york state taxpayer authorization for taxnygov

Effortlessly Prepare Www tax ny govpitefileNew York State Taxpayer Authorization For Tax ny gov on Any Device

The management of online documents has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly and without complications. Manage Www tax ny govpitefileNew York State Taxpayer Authorization For Tax ny gov on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

The Easiest Method to Modify and eSign Www tax ny govpitefileNew York State Taxpayer Authorization For Tax ny gov with Ease

- Locate Www tax ny govpitefileNew York State Taxpayer Authorization For Tax ny gov and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes only seconds to create and carries the same legal authority as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you prefer. Modify and eSign Www tax ny govpitefileNew York State Taxpayer Authorization For Tax ny gov and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwtaxnygovpitefilenew york state taxpayer authorization for taxnygov

Create this form in 5 minutes!

How to create an eSignature for the wwwtaxnygovpitefilenew york state taxpayer authorization for taxnygov

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to create an e-signature from your smartphone

How to create an e-signature for a PDF file on iOS devices

The way to create an e-signature for a PDF file on Android

People also ask

-

What is the tr 579 it feature in airSlate SignNow?

The tr 579 it feature in airSlate SignNow allows users to easily integrate their document signing processes with existing workflows. This feature streamlines the signing experience, ensuring documents are signed promptly and securely. Companies can ensure compliance while saving time and resources.

-

How much does airSlate SignNow cost for using tr 579 it?

Pricing for airSlate SignNow with tr 579 it varies based on the plan selected. Each plan is designed to fit different business sizes and needs, offering scalable solutions. Contact our sales team for a custom quote based on your requirements and to maximize your investment.

-

What are the key benefits of using tr 579 it in airSlate SignNow?

Using tr 579 it in airSlate SignNow enhances the efficiency and security of document management. It helps reduce paperwork, speeds up the signing process, and ensures that documents are stored securely. Businesses will find that tr 579 it increases overall productivity and reduced operational costs.

-

Can tr 579 it integrate with other applications?

Yes, tr 579 it is designed to seamlessly integrate with a variety of applications including CRM systems and cloud storage solutions. This flexibility allows businesses to manage their documents and contracts more effectively. Integration with existing tools simplifies workflows and enhances overall efficiency.

-

Is there a mobile app for using tr 579 it?

Absolutely! airSlate SignNow offers a mobile app that enables users to access the tr 579 it features on the go. This means you can send and sign documents anytime, anywhere, enhancing convenience for busy professionals. The mobile app ensures you never miss an opportunity to get documents signed.

-

How secure is airSlate SignNow's tr 579 it feature?

Security is a top priority with airSlate SignNow's tr 579 it feature. The service utilizes bank-level encryption and complies with industry standards to protect sensitive documents. Users can trust that their information remains confidential and secure throughout the signing process.

-

What types of documents can I sign using tr 579 it?

With tr 579 it in airSlate SignNow, you can sign a wide range of documents, from contracts and agreements to consent forms and invoices. The platform supports various file formats, making it easy to manage all types of documentation. This versatility is ideal for any business that requires digital signatures.

Get more for Www tax ny govpitefileNew York State Taxpayer Authorization For Tax ny gov

- Notice of dishonored check criminal keywords bad check bounced check arkansas form

- Mutual wills containing last will and testaments for unmarried persons living together with no children arkansas form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children arkansas form

- Mutual wills or last will and testaments for unmarried persons living together with minor children arkansas form

- Non marital cohabitation living together agreement arkansas form

- Paternity law and procedure handbook arkansas form

- Bill of sale in connection with sale of business by individual or corporate seller arkansas form

- Civil cover sheet with instructions with or without children arkansas form

Find out other Www tax ny govpitefileNew York State Taxpayer Authorization For Tax ny gov

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word