New York State E File Signature Authorization for Tax Year for Forms it 201, it 201 X, it 203, it 203 X, it 214, and NYC 210 2022

Understanding the New York State E File Signature Authorization

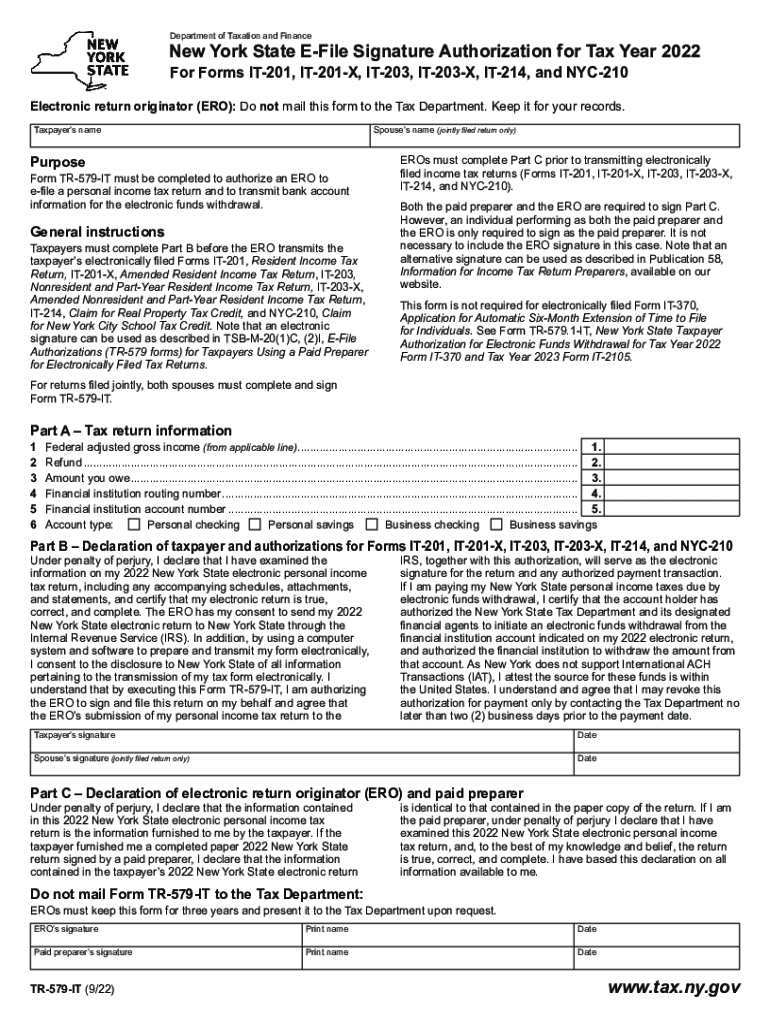

The New York State E File Signature Authorization is a crucial document for taxpayers who wish to electronically file their tax returns. This form allows taxpayers to authorize their tax preparers to file their returns on their behalf. It is applicable for various tax forms, including IT 201, IT 201 X, IT 203, IT 203 X, IT 214, and NYC 210. The authorization ensures that the tax preparer has the necessary permission to submit the tax return electronically, streamlining the filing process and enhancing efficiency.

Steps to Complete the New York State E File Signature Authorization

Completing the New York State E File Signature Authorization involves several key steps:

- Gather necessary information, including your Social Security number, tax preparer's information, and details of the tax forms being filed.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed form for accuracy and completeness.

- Sign the form to provide your authorization for electronic filing.

- Submit the form to your tax preparer, who will then file it along with your tax return.

Legal Use of the New York State E File Signature Authorization

The New York State E File Signature Authorization is legally recognized for electronic filing purposes. It complies with state regulations governing e-signatures and ensures that the electronic submission of tax returns is valid and enforceable. Taxpayers should retain a copy of the signed authorization for their records, as it may be required for future reference or in case of audits.

Required Documents for the New York State E File Signature Authorization

To complete the New York State E File Signature Authorization, taxpayers need to provide specific documents and information:

- Personal identification, such as a driver's license or Social Security card.

- Tax preparer's information, including name, address, and preparer tax identification number (PTIN).

- Details of the tax forms being filed, including any relevant schedules or attachments.

Filing Deadlines for the New York State E File Signature Authorization

It is essential to be aware of filing deadlines when submitting the New York State E File Signature Authorization. Typically, this form must be submitted by the same deadline as the associated tax return to ensure timely filing. For most individuals, this deadline falls on April 15. However, it is advisable to check for any extensions or specific deadlines that may apply to your situation.

Examples of Using the New York State E File Signature Authorization

There are various scenarios in which taxpayers may utilize the New York State E File Signature Authorization:

- A self-employed individual authorizes a tax preparer to file their business and personal tax returns electronically.

- A retired taxpayer allows a tax professional to handle their tax filings, ensuring compliance with all applicable laws.

- A student uses the authorization to enable their parents or guardians to file their tax returns on their behalf.

Eligibility Criteria for the New York State E File Signature Authorization

To be eligible to use the New York State E File Signature Authorization, taxpayers must meet certain criteria:

- Must be a resident of New York State or have income sourced from New York.

- Must have a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

- Must be filing one of the specified tax forms, such as IT 201 or NYC 210.

Quick guide on how to complete new york state e file signature authorization for tax year 2022 for forms it 201 it 201 x it 203 it 203 x it 214 and nyc 210

Complete New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210 easily on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210 on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

Steps to modify and eSign New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210 effortlessly

- Locate New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210 and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and press the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Update and eSign New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210 and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york state e file signature authorization for tax year 2022 for forms it 201 it 201 x it 203 it 203 x it 214 and nyc 210

Create this form in 5 minutes!

People also ask

-

What is tr 579 it in the context of eSigning?

The tr 579 it refers to a specific regulatory framework that governs electronic signatures. Understanding tr 579 it is essential for businesses looking to ensure compliance when using eSignature solutions like airSlate SignNow. Our platform adheres to these guidelines, providing secure and compliant document signing.

-

How does airSlate SignNow integrate with tr 579 it requirements?

airSlate SignNow integrates seamlessly with tr 579 it requirements by embedding compliance measures directly into our eSigning process. We ensure that all signatures captured meet the necessary legal standards outlined in tr 579 it. This allows businesses to use our solution confidently, knowing they are meeting regulatory demands.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing tiers that cater to different business needs, making it a cost-effective solution for eSigning. Our packages are designed to be accessible while ensuring compliance with regulations like tr 579 it. Customers can select a plan that best fits their volume and features required.

-

What features does airSlate SignNow provide for managing documents?

With airSlate SignNow, users can enjoy a robust set of features designed for efficient document management. Our platform supports real-time collaboration, extensive audit trails, and integrations with various applications, ensuring all processes align with tr 579 it standards. This empowers businesses to streamline their workflows effectively.

-

Can airSlate SignNow help businesses comply with tr 579 it regulations?

Yes, airSlate SignNow is designed to help businesses comply with tr 579 it regulations. Our platform incorporates security features and practices that meet or exceed regulatory standards, ensuring that all electronic signatures are legally binding. Businesses can trust our solution for their compliance needs.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved compliance with regulations like tr 579 it. Our user-friendly interface allows for quick document preparation and signing, transforming your workflow into a faster and more streamlined process. This results in signNow time and cost savings.

-

How can I integrate airSlate SignNow with other software tools?

airSlate SignNow provides integration capabilities with a wide range of software tools, enhancing your overall workflow efficiency. Our API allows for easy integration, enabling businesses to seamlessly connect with applications while ensuring compliance with tr 579 it. These integrations help you manage documents more effectively across platforms.

Get more for New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210

- New mexico agreement form 497320147

- Commercial lease assignment from tenant to new tenant new mexico form

- Tenant consent to background and reference check new mexico form

- New mexico lease form

- Residential rental lease agreement new mexico form

- Tenant welcome letter new mexico form

- Warning of default on commercial lease new mexico form

- Warning of default on residential lease new mexico form

Find out other New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy