New York State E File Signature Authorization for Tax Year for Forms it 201, it 201 X, it 203, it 203 X, it 214, and NYC 210 2020

Understanding the New York State E File Signature Authorization

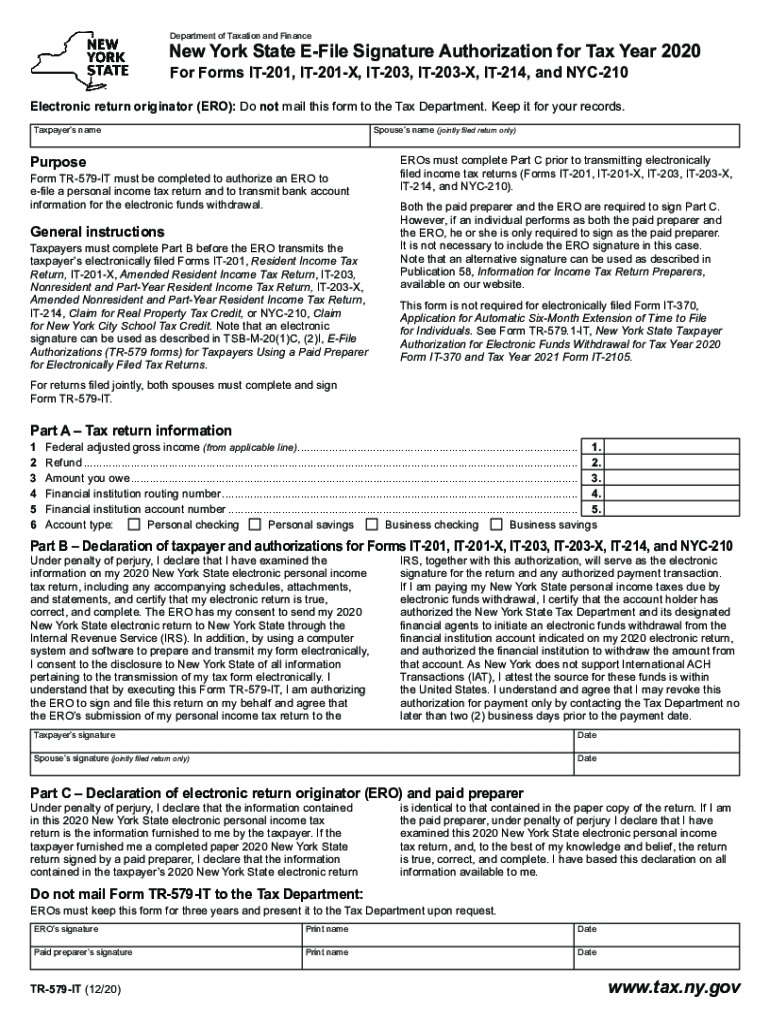

The New York State E File Signature Authorization is a crucial document for taxpayers filing electronically. It allows taxpayers to authorize their tax preparers to file their returns on their behalf. This form is particularly relevant for various tax forms, including IT 201, IT 201 X, IT 203, IT 203 X, IT 214, and NYC 210. Understanding this authorization ensures that taxpayers can navigate the e-filing process smoothly and comply with state regulations.

Steps to Complete the New York State E File Signature Authorization

Completing the New York State E File Signature Authorization involves several straightforward steps:

- Gather necessary information, including Social Security numbers and tax details.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Sign the form electronically if using a digital method, or print and sign if submitting by mail.

- Submit the form according to the instructions provided, either online or by mail.

Legal Use of the New York State E File Signature Authorization

The legal validity of the New York State E File Signature Authorization hinges on compliance with state laws regarding electronic signatures. This authorization must meet the requirements set forth by the Electronic Signatures and Records Act (ESRA), ensuring that the signatures are recognized as legally binding. Taxpayers should ensure that their electronic signatures are properly authenticated to avoid any legal complications.

Filing Deadlines for the New York State E File Signature Authorization

Timely submission of the New York State E File Signature Authorization is essential for ensuring that tax returns are filed on time. The deadlines typically align with the federal tax filing deadlines, which are usually April 15 for individual returns. However, taxpayers should check for any specific state extensions or changes that may affect the filing timeline.

Required Documents for the New York State E File Signature Authorization

When completing the New York State E File Signature Authorization, taxpayers must have several documents on hand:

- Previous year’s tax return for reference.

- W-2 forms or 1099 forms for income verification.

- Any relevant documentation for deductions or credits being claimed.

Examples of Using the New York State E File Signature Authorization

Taxpayers can utilize the New York State E File Signature Authorization in various scenarios. For instance, a self-employed individual may authorize their tax preparer to file their quarterly estimated taxes electronically. Similarly, a married couple filing jointly can use the form to allow one spouse to handle the e-filing process on behalf of both. These examples illustrate the flexibility and utility of the form in different tax situations.

Quick guide on how to complete new york state e file signature authorization for tax year 2020 for forms it 201 it 201 x it 203 it 203 x it 214 and nyc 210

Complete New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210 on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The simplest way to alter and electronically sign New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210 with ease

- Find New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210 and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210 while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york state e file signature authorization for tax year 2020 for forms it 201 it 201 x it 203 it 203 x it 214 and nyc 210

Create this form in 5 minutes!

How to create an eSignature for the new york state e file signature authorization for tax year 2020 for forms it 201 it 201 x it 203 it 203 x it 214 and nyc 210

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the form tr 579 it 2018 and why is it important?

The form tr 579 it 2018 is a crucial document used for tax purposes, specifically for reporting income. Understanding its requirements can help individuals avoid penalties and ensure compliance with tax regulations. With airSlate SignNow, you can easily eSign and share this form securely with minimal hassle.

-

How can airSlate SignNow help me with the form tr 579 it 2018?

airSlate SignNow provides a streamlined platform for you to fill out, review, and eSign your form tr 579 it 2018. Our user-friendly interface ensures that you can complete necessary documents efficiently, allowing for quick submission and processing. Enjoy the convenience of electronic signatures that save time and reduce paperwork.

-

Is airSlate SignNow a cost-effective solution for managing the form tr 579 it 2018?

Yes, airSlate SignNow offers a cost-effective solution for managing the form tr 579 it 2018. With competitive pricing plans, you can choose the package that fits your business needs while enjoying essential features tailored for document management. This ensures you can handle your tax documents without breaking the bank.

-

What features does airSlate SignNow offer for the form tr 579 it 2018?

In addition to electronic signatures, airSlate SignNow includes features like document templates, customizable workflows, and real-time tracking. These tools make it easier to manage the form tr 579 it 2018 efficiently while ensuring that all information is accurate and completed on time. Maximizing these features can signNowly streamline your filing process.

-

Can I integrate airSlate SignNow with other software for handling the form tr 579 it 2018?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM systems and cloud storage services. This integration capability allows you to import and manage your data more effectively, making the handling of the form tr 579 it 2018 simpler and more automated, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for the form tr 579 it 2018?

Using airSlate SignNow for the form tr 579 it 2018 offers several benefits, including improved efficiency, enhanced security, and organizational flexibility. You can sign and send documents anytime, anywhere, which is especially beneficial for businesses with remote teams. This ensures that you meet deadlines while keeping all your sensitive information secure.

-

How does airSlate SignNow ensure the security of my form tr 579 it 2018?

AirSlate SignNow employs advanced security measures, including encryption and secure connections, to protect all documents, including your form tr 579 it 2018. Regular audits and compliance with industry standards further guarantee that your data remains safe. You can focus on your business without worrying about the integrity of your sensitive information.

Get more for New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210

Find out other New York State E File Signature Authorization For Tax Year For Forms IT 201, IT 201 X, IT 203, IT 203 X, IT 214, And NYC 210

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself