Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year 2023-2026

What is the Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

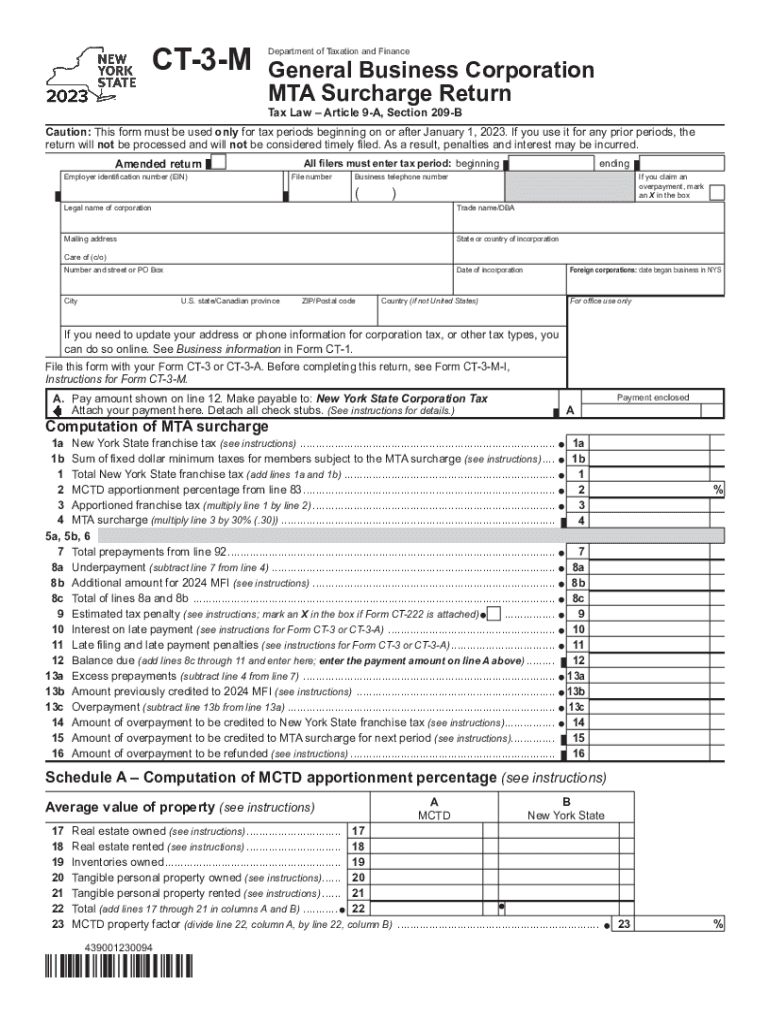

The Form CT 3 M is a tax return specifically designed for general business corporations in New York that are subject to the Metropolitan Transportation Authority (MTA) surcharge. This form is used to report the corporation's income, calculate the MTA surcharge, and ensure compliance with New York state tax laws. The MTA surcharge is an additional tax imposed on businesses operating within the metropolitan area to support public transportation infrastructure.

Steps to Complete the Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

Completing the Form CT 3 M involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Calculate the corporation's total income and any applicable deductions.

- Determine the MTA surcharge based on the income calculated.

- Fill out the form accurately, ensuring that all figures are correct and consistent.

- Review the completed form for any errors or omissions before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Form CT 3 M to avoid penalties. Generally, the form must be filed by the 15th day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this typically falls on April 15. Extensions may be available, but they must be requested in advance.

Legal Use of the Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

The Form CT 3 M serves a legal purpose in the context of New York state taxation. It is required for compliance with state laws regarding the MTA surcharge. Filing this form accurately ensures that corporations fulfill their tax obligations and avoid legal repercussions, such as fines or audits.

Key Elements of the Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

Several key elements must be included when completing the Form CT 3 M:

- Business Information: Name, address, and Employer Identification Number (EIN) of the corporation.

- Income Calculation: Total gross income and any applicable deductions.

- MTA Surcharge Calculation: The amount of surcharge owed based on the income reported.

- Signature: Authorized representative must sign the form, certifying its accuracy.

How to Obtain the Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

The Form CT 3 M can be obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing businesses to print and fill it out manually. Additionally, the form may be accessible through various tax preparation software, which can streamline the filing process.

Quick guide on how to complete form ct 3 m general business corporation mta surcharge return tax year

Effortlessly Prepare Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year on any system using the airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

How to Modify and eSign Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year with Ease

- Find Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Select how you wish to send your form: via email, SMS, or invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searching, or errors that necessitate printing new versions. airSlate SignNow caters to your document management requirements in just a few clicks from any device you prefer. Revise and eSign Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 3 m general business corporation mta surcharge return tax year

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 m general business corporation mta surcharge return tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 3 m and how does it relate to airSlate SignNow?

The ct 3 m is a key factor in assessing the efficiency of document signing processes in your business. With airSlate SignNow, the ct 3 m allows companies to streamline eSigning and document management, ensuring quicker turnaround times and improved productivity.

-

How much does airSlate SignNow cost, and does it offer a free trial?

airSlate SignNow offers competitive pricing plans designed to fit various business needs. There's also a free trial available for potential users to explore its features, including efficiencies related to the ct 3 m, before committing to a paid plan.

-

What key features does airSlate SignNow provide for enhancing ct 3 m?

AirSlate SignNow includes essential features such as customizable templates, real-time tracking, and automated workflows that directly impact the ct 3 m. These features help businesses manage their signing processes more effectively and efficiently.

-

How does airSlate SignNow improve the overall eSigning experience?

By focusing on improving the ct 3 m, airSlate SignNow enhances the eSigning experience through intuitive design and user-friendly interfaces. Users can easily create, send, and sign documents, which signNowly reduces delays and increases satisfaction.

-

Can airSlate SignNow integrate with other business tools?

Yes, airSlate SignNow offers seamless integration with a variety of business applications, enhancing the ct 3 m for organizations. This includes CRM, project management tools, and cloud storage services, making it a versatile solution for document management.

-

What benefits does airSlate SignNow provide for small businesses?

Small businesses can greatly benefit from airSlate SignNow by optimizing their document signing processes, which positively affects the ct 3 m. With its cost-effective pricing and easy-to-use features, it helps businesses save time and resources when managing eSignatures.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow is designed with robust security measures to protect sensitive information. The platform adheres to strict compliance standards, ensuring that your ct 3 m documents are securely managed and signed.

Get more for Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

- Florida vechs waiver form

- Employers wage claim response form iowa workforce iowaworkforce

- Publication 1854 form

- New mexico public regulation commission application for a nmprc state nm form

- Swan scale 200210102 doc form

- Lancaster county handgun permit form

- Database change request form in word

- Or fax form to 1 207 771 4019

Find out other Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter