Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year 2022

What is the Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

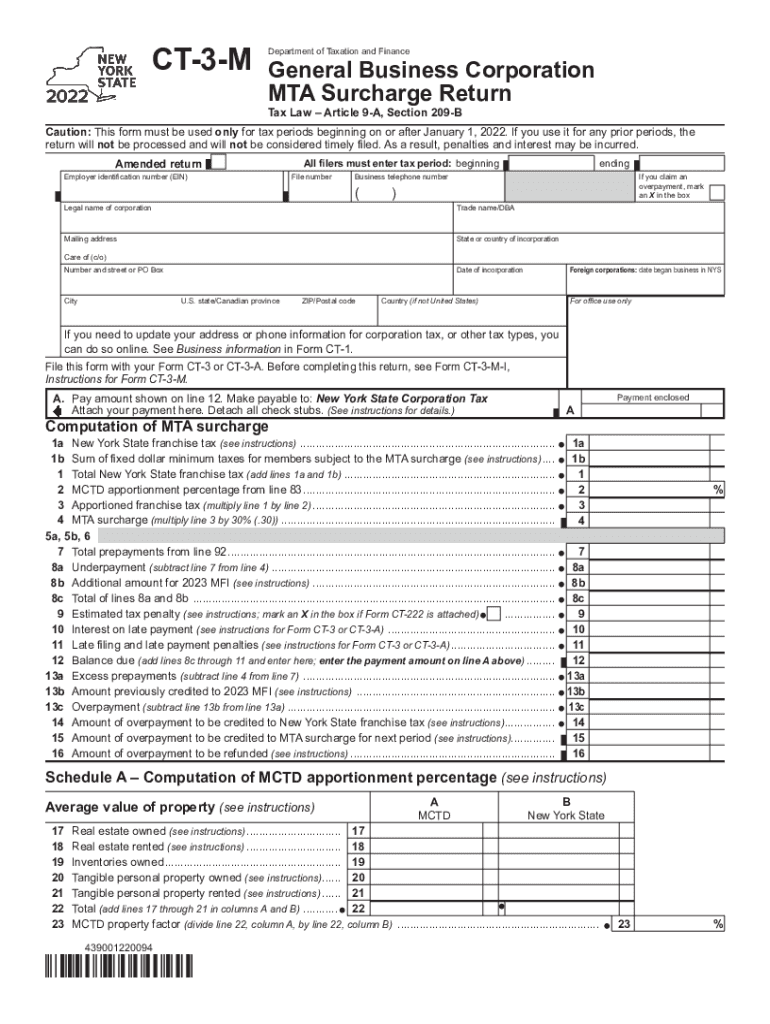

The Form CT 3 M is a tax document used by general business corporations in New York to report their Metropolitan Transportation Authority (MTA) surcharge. This form is specifically designed for corporations that are subject to the MTA surcharge, which is an additional tax imposed on businesses operating within the metropolitan area. The tax year for which the form is filed typically aligns with the corporation's fiscal year, and it is essential for compliance with state tax regulations.

How to use the Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

To effectively use the Form CT 3 M, corporations must first ensure they are eligible to file it based on their business activities and location. The form requires detailed information about the corporation's income, deductions, and the calculation of the MTA surcharge. It is important to accurately complete each section, as errors can lead to delays or penalties. Corporations should refer to the accompanying instructions for guidance on filling out the form correctly.

Steps to complete the Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

Completing the Form CT 3 M involves several key steps:

- Gather all necessary financial documents, including income statements and deduction records.

- Fill out the corporation's identifying information at the top of the form.

- Report total income and applicable deductions in the designated sections.

- Calculate the MTA surcharge based on the provided formulas.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

The legal use of Form CT 3 M is crucial for ensuring compliance with New York State tax laws. Properly completing and submitting this form allows corporations to fulfill their tax obligations and avoid potential penalties. The form must be filed by the deadline specified by the New York State Department of Taxation and Finance to maintain good standing. Additionally, the information provided on the form may be subject to audit, so accuracy is essential.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with Form CT 3 M to ensure timely submission. Generally, the form is due on the 15th day of the fourth month following the end of the tax year. For corporations operating on a calendar year basis, this typically means the form is due by April 15. It is advisable to check for any updates or changes to deadlines each tax year, as these can vary.

Penalties for Non-Compliance

Failure to file Form CT 3 M or inaccuracies in the submitted information can result in significant penalties. Corporations may face fines, interest on unpaid taxes, and additional scrutiny from tax authorities. It is important for businesses to adhere to filing requirements and deadlines to avoid these consequences. Consulting with a tax professional can help ensure compliance and mitigate risks associated with non-compliance.

Quick guide on how to complete form ct 3 m general business corporation mta surcharge return tax year 2022

Effortlessly Complete Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year on Any Device

The management of documents online has gained popularity among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary forms and securely store them digitally. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents promptly without delays. Manage Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year seamlessly on any platform using airSlate SignNow's Android or iOS applications, and simplify your document-related processes today.

Efficiently Edit and eSign Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year with Ease

- Locate Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year and click on Get Form to commence.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all details and click on the Done button to secure your changes.

- Select your preferred method for sharing your form, whether it be via email, text (SMS), an invitation link, or downloading it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year while ensuring excellent communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 3 m general business corporation mta surcharge return tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 m general business corporation mta surcharge return tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to ct 3 m instructions?

airSlate SignNow offers a streamlined interface for managing eSignatures and document workflows, specifically aligned with ct 3 m instructions. You can easily create, send, and track documents, ensuring compliance and efficiency in your business operations.

-

How user-friendly is the airSlate SignNow platform for following ct 3 m instructions?

The airSlate SignNow platform is designed with user-friendliness in mind, making it easy for anyone to follow ct 3 m instructions. The intuitive controls and clear guidance empower users to manage their documents confidently, without the need for extensive technical skills.

-

What pricing plans are available for airSlate SignNow regarding ct 3 m instructions?

airSlate SignNow offers several pricing plans to fit different business needs while following ct 3 m instructions. Each plan provides various features to enhance your document management experience, making it a cost-effective solution for any organization.

-

Are there any integrations available for airSlate SignNow that support ct 3 m instructions?

Yes, airSlate SignNow integrates seamlessly with a range of applications to support ct 3 m instructions. These integrations allow you to connect with your existing tools, enhancing your workflows and ensuring compliance throughout your document handling process.

-

What are the benefits of using airSlate SignNow for ct 3 m instructions?

Using airSlate SignNow for ct 3 m instructions allows businesses to streamline their signing processes, reduce errors, and save time. The platform also improves document security and compliance, giving users peace of mind in their transactions.

-

Is customer support available for queries related to ct 3 m instructions in airSlate SignNow?

Absolutely! airSlate SignNow provides excellent customer support for any inquiries related to ct 3 m instructions. Whether you need help with setup, troubleshooting, or best practices, their dedicated team is ready to assist you.

-

How does airSlate SignNow ensure security while managing ct 3 m instructions?

airSlate SignNow employs advanced security measures to ensure that all transactions, including those related to ct 3 m instructions, are protected. This includes data encryption, secure access controls, and compliance with industry standards, keeping your documents safe.

Get more for Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

- Contractors forms package rhode island

- Power of attorney for sale of motor vehicle rhode island form

- Rhode island power attorney form

- Wedding planning or consultant package rhode island form

- Hunting forms package rhode island

- Identity theft recovery package rhode island form

- Statutory durable power of attorney for health care rhode island form

- Ri statutory form

Find out other Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney