Department of Taxation and Finance Instructions for Form Department of Taxation and Finance Instructions for Form Department of 2021

What is the CT-3M Form?

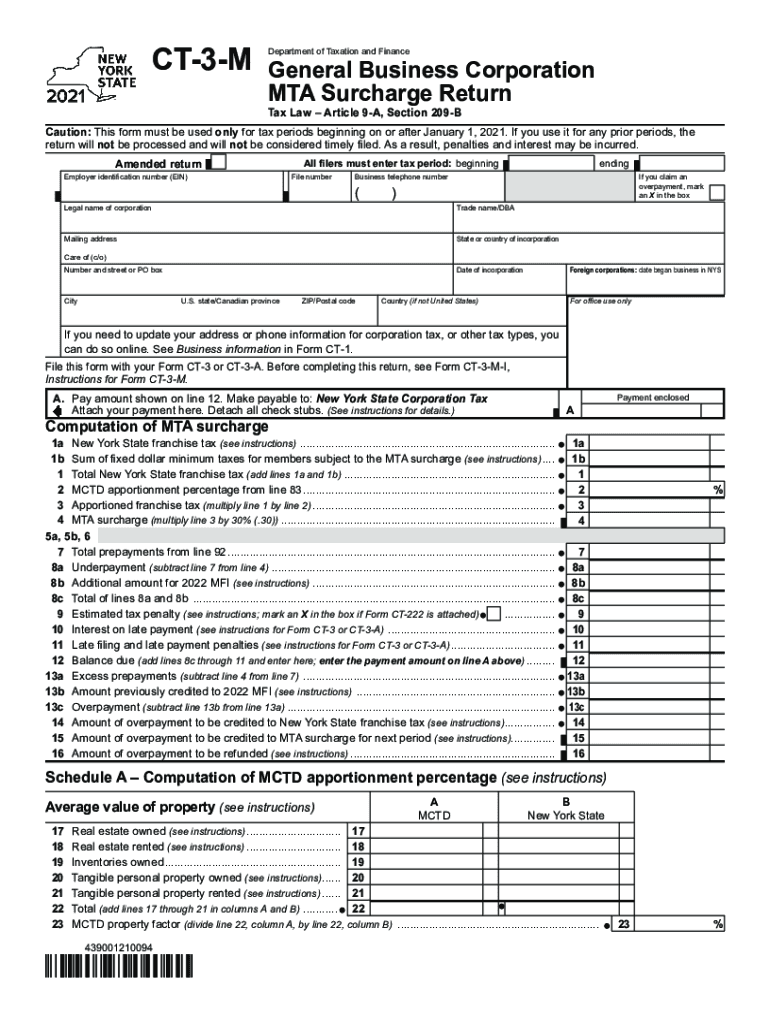

The CT-3M form, also known as the New York State MTA Surcharge Return, is a tax document used by businesses operating in New York City. This form is specifically designed for corporations that are subject to the Metropolitan Transportation Authority (MTA) surcharge. The CT-3M is essential for reporting the corporation's income and calculating the surcharge owed to the MTA, which helps fund public transportation in the region.

Steps to Complete the CT-3M Form

Filling out the CT-3M form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary financial documents, including income statements and previous tax returns.

- Fill in the basic information about your corporation, including the name, address, and federal employer identification number (EIN).

- Report your total income and any applicable deductions to calculate your taxable income.

- Calculate the MTA surcharge based on the taxable income using the rates provided by the New York State Department of Taxation and Finance.

- Review the completed form for accuracy before submission.

Legal Use of the CT-3M Form

The CT-3M form is legally binding when completed and submitted according to state regulations. It is crucial for corporations to adhere to the guidelines set forth by the New York State Department of Taxation and Finance to avoid penalties. Properly filing this form ensures compliance with state tax laws and contributes to the funding of essential public services.

Filing Deadlines for the CT-3M Form

Corporations must be aware of the filing deadlines for the CT-3M form to avoid late fees and penalties. Typically, the form is due on the fifteenth day of the third month following the end of the corporation's fiscal year. It is advisable to check the New York State Department of Taxation and Finance website for any updates or changes to deadlines.

Required Documents for Filing the CT-3M Form

To complete the CT-3M form accurately, several documents are necessary:

- Income statements detailing revenue and expenses.

- Previous tax returns for reference.

- Records of any deductions or credits claimed.

- Documentation supporting the calculation of the MTA surcharge.

Penalties for Non-Compliance with the CT-3M Form

Failure to file the CT-3M form on time can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action. It is essential for corporations to prioritize timely and accurate submissions to avoid these consequences.

Quick guide on how to complete department of taxation and finance instructions for form department of taxation and finance instructions for form department of

Easily Prepare Department Of Taxation And Finance Instructions For Form Department Of Taxation And Finance Instructions For Form Department Of on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can easily find the necessary form and safely store it online. airSlate SignNow provides all the tools required to create, alter, and electronically sign your documents rapidly without delays. Handle Department Of Taxation And Finance Instructions For Form Department Of Taxation And Finance Instructions For Form Department Of on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

Effortlessly Modify and eSign Department Of Taxation And Finance Instructions For Form Department Of Taxation And Finance Instructions For Form Department Of

- Find Department Of Taxation And Finance Instructions For Form Department Of Taxation And Finance Instructions For Form Department Of and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Department Of Taxation And Finance Instructions For Form Department Of Taxation And Finance Instructions For Form Department Of and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of taxation and finance instructions for form department of taxation and finance instructions for form department of

Create this form in 5 minutes!

How to create an eSignature for the department of taxation and finance instructions for form department of taxation and finance instructions for form department of

The way to make an e-signature for a PDF file online

The way to make an e-signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to make an e-signature straight from your mobile device

The way to make an e-signature for a PDF file on iOS

The way to make an e-signature for a PDF document on Android devices

People also ask

-

What is ct 3m and how does it relate to airSlate SignNow?

ct 3m is a powerful feature within airSlate SignNow that enables users to create and manage contracts efficiently. By utilizing ct 3m, businesses can streamline their eSigning process, ensuring faster turnaround times and improved compliance.

-

How much does it cost to use airSlate SignNow with ct 3m?

The pricing for airSlate SignNow's ct 3m feature varies depending on the subscription plan you choose. Pricing is tiered to accommodate different business sizes and needs, ensuring an affordable solution for everyone. To get detailed pricing information, visit our pricing page.

-

What are the key features of ct 3m in airSlate SignNow?

ct 3m includes features such as customizable templates, user-friendly dashboard, and multi-party signing capabilities. These features make it easier for businesses to manage their documentation and improve the overall signing experience for all parties involved.

-

How can ct 3m benefit my business?

By adopting airSlate SignNow's ct 3m, your business can enhance operational efficiency, reduce paperwork, and ensure compliance with legal standards. The seamless integration of ct 3m streamlines your workflow and allows you to focus on growing your business instead of getting bogged down by paperwork.

-

Does airSlate SignNow with ct 3m support integrations with other software?

Yes, airSlate SignNow with ct 3m supports extensive integrations with various applications, including CRM and project management tools. This enables businesses to incorporate eSigning capabilities directly into the software they already use, enhancing productivity and reducing friction.

-

Is it easy to use ct 3m for document signing?

Absolutely! AirSlate SignNow’s ct 3m is designed with user experience in mind, making document signing straightforward for both senders and signers. With an intuitive interface, users can quickly navigate the signing process without any technical challenges.

-

What types of documents can be signed using ct 3m?

ct 3m supports a wide variety of document types, from contracts and agreements to forms and letters. Whether you are in real estate, finance, or any other industry, airSlate SignNow's ct 3m can accommodate your document signing needs effortlessly.

Get more for Department Of Taxation And Finance Instructions For Form Department Of Taxation And Finance Instructions For Form Department Of

Find out other Department Of Taxation And Finance Instructions For Form Department Of Taxation And Finance Instructions For Form Department Of

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free