Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year 2020

What is the Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

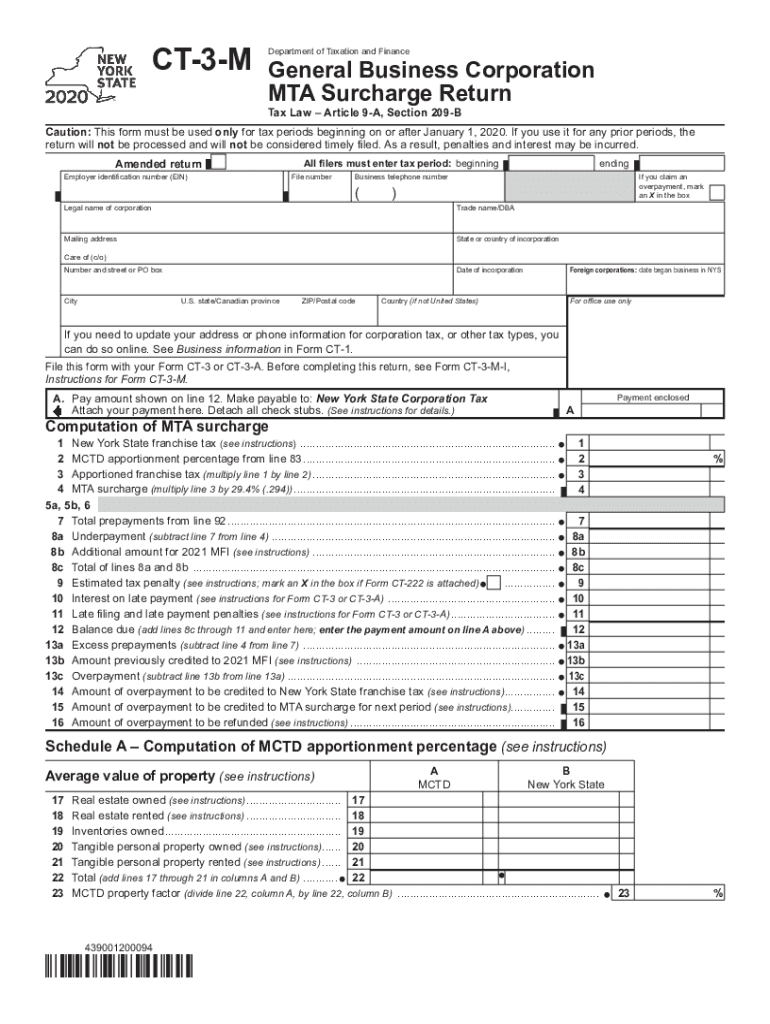

The Form CT 3 M is a tax document used by general business corporations in New York State to report their Metropolitan Transportation Authority (MTA) surcharge. This form is essential for corporations that are subject to the MTA surcharge, which is an additional tax applied to businesses operating within the MTA region. The form captures various financial details, including income, deductions, and the calculation of the MTA surcharge owed. Filing this form accurately ensures compliance with state tax regulations and helps avoid potential penalties.

Steps to complete the Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

Completing the Form CT 3 M involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the identification section, providing your corporation's name, address, and federal employer identification number (EIN). Then, report total income and calculate deductions according to the instructions provided on the form. After calculating the MTA surcharge, ensure all figures are accurate before signing and dating the form. Finally, choose your submission method, whether online, by mail, or in person.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form CT 3 M. Generally, the form must be submitted by the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically means the deadline is March 15. Failure to file on time may result in penalties, so it is advisable to mark your calendar and prepare the form well in advance of the due date.

Legal use of the Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

The legal use of the Form CT 3 M is governed by New York State tax laws. To be considered valid, the form must be filled out completely and accurately, reflecting the corporation's financial activities for the tax year. The form must be signed by an authorized representative of the corporation, affirming that the information provided is true and correct. Compliance with these legal requirements ensures that the form is accepted by the New York State Department of Taxation and Finance.

Required Documents

To successfully complete the Form CT 3 M, several documents are required. These include:

- Income statements for the tax year

- Expense records and receipts

- Previous year's tax returns for reference

- Any relevant schedules or supporting documentation that detail deductions

Having these documents organized and readily available will facilitate a smoother completion process for the form.

Penalties for Non-Compliance

Failure to file the Form CT 3 M on time or inaccuracies in the submitted information can lead to significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal actions. It is essential for corporations to understand their obligations and ensure timely and accurate submissions to avoid these consequences.

Quick guide on how to complete form ct 3 m general business corporation mta surcharge return tax year 2020

Manage Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year with ease on any device

Digital document management has become increasingly popular among companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to update and electronically sign Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year effortlessly

- Locate Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 3 m general business corporation mta surcharge return tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 m general business corporation mta surcharge return tax year 2020

The best way to create an eSignature for a PDF in the online mode

The best way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the ct 3m 4m feature in airSlate SignNow?

The ct 3m 4m feature in airSlate SignNow refers to our enhanced document management capabilities that streamline the signing process. This feature allows users to handle multiple documents efficiently, improving workflow and reducing turnaround time. With ct 3m 4m, you can also ensure secure and compliant document handling.

-

How does pricing work for the ct 3m 4m feature?

Pricing for the ct 3m 4m feature is structured to be budget-friendly, catering to businesses of all sizes. airSlate SignNow offers flexible subscription options that include access to all key features along with ct 3m 4m. You can choose a plan that best suits your needs without compromising on functionality.

-

What are the benefits of using the ct 3m 4m feature?

Utilizing the ct 3m 4m feature in airSlate SignNow offers numerous benefits, including increased productivity and reduced operational costs. By simplifying the eSigning process, users can save valuable time while ensuring seamless collaboration. This feature enhances the overall user experience with improved efficiency.

-

Can I integrate ct 3m 4m with other software?

Yes, airSlate SignNow's ct 3m 4m feature seamlessly integrates with a variety of third-party applications, enhancing your existing workflows. Whether it's CRM systems, document management tools, or cloud storage services, the integration capabilities allow for a cohesive user experience. This interoperability increases the utility of the ct 3m 4m feature.

-

Is the ct 3m 4m feature suitable for small businesses?

Absolutely! The ct 3m 4m feature is designed with scalability in mind, making it an ideal solution for small businesses. It offers an array of cost-effective tools that empower smaller teams to manage their document workflows effectively. AirSlate SignNow ensures that even smaller operations can enjoy the advantages of the ct 3m 4m feature.

-

What types of documents can be managed with ct 3m 4m?

With the ct 3m 4m feature in airSlate SignNow, users can manage a wide variety of documents, including contracts, agreements, and forms. This versatility allows for comprehensive document handling, regardless of your industry or needs. The platform supports various document formats while ensuring compliance and security.

-

How does ct 3m 4m improve document turnaround times?

The ct 3m 4m feature signNowly improves document turnaround times by automating the signing process and minimizing manual tasks. Users can send and receive documents swiftly, and real-time tracking provides updates on signing progress. With these enhancements, airSlate SignNow accelerates workflows and facilitates faster decision-making.

Get more for Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

- Cym basketball score sheet form

- Spanish american war worksheet form

- Bukura agricultural college intake 2022 form

- Willingness certificate form

- Neurological assessment form 5028271 50 28 27

- Orea rental application form 410

- P r o p e r t y ta x mine and quarry rendition of form

- Tax utah govcommissiondecisionlocally assessed property signed 09 24 09 commissioners p form

Find out other Form CT 3 M General Business Corporation MTA Surcharge Return Tax Year

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free