Form 1040 SR SP U S Tax Return for Seniors Spanish Version 2023-2026

What is the Form 1040 SR SP U S Tax Return For Seniors Spanish Version

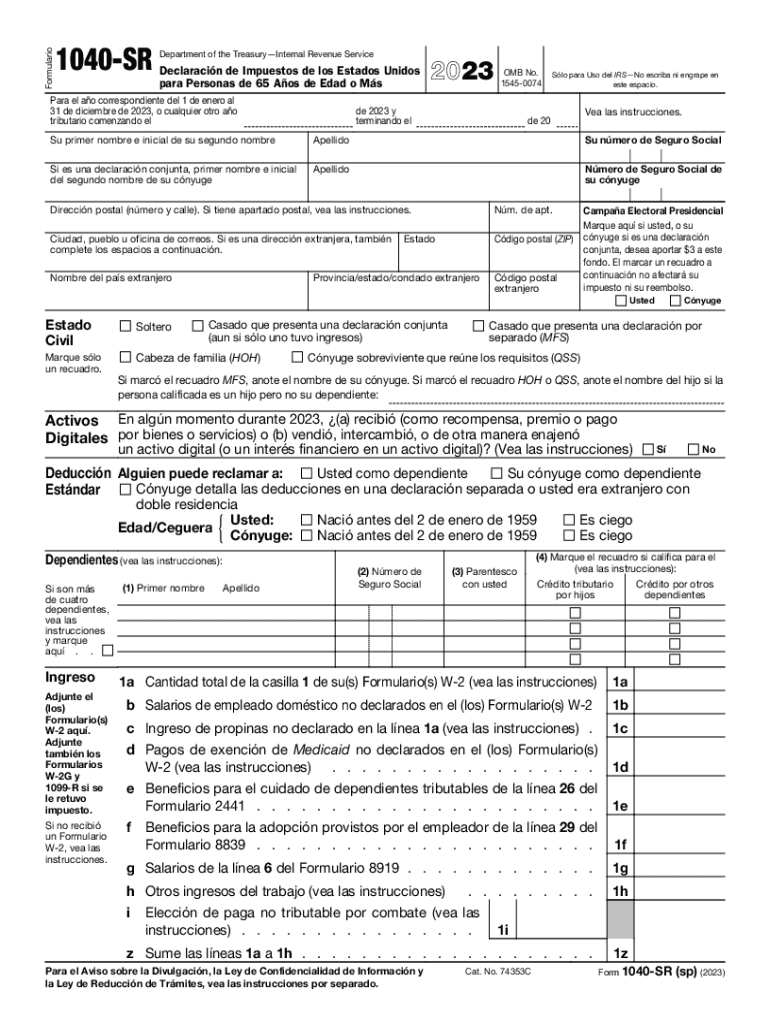

The Form 1040 SR SP U S Tax Return For Seniors Spanish Version is a simplified tax return specifically designed for seniors aged sixty-five and older. This form allows eligible seniors to report their income, claim deductions, and determine their tax liability in Spanish. It is tailored to meet the needs of older taxpayers, making the filing process more accessible and understandable.

This version of the form includes features such as larger print and simplified language, which can help seniors navigate their tax responsibilities more easily. It is essential for seniors to use this form to ensure compliance with U.S. tax laws while taking advantage of any applicable tax benefits.

How to use the Form 1040 SR SP U S Tax Return For Seniors Spanish Version

Using the Form 1040 SR SP U S Tax Return For Seniors Spanish Version involves several steps to ensure accurate completion. First, gather all necessary documents, including income statements, Social Security information, and any other relevant financial records. This preparation helps streamline the process.

Next, carefully fill out the form, following the instructions provided. Pay attention to sections that pertain specifically to seniors, such as those related to retirement income and deductions for medical expenses. After completing the form, review it for accuracy before submitting it to the IRS.

Steps to complete the Form 1040 SR SP U S Tax Return For Seniors Spanish Version

Completing the Form 1040 SR SP U S Tax Return For Seniors Spanish Version involves a systematic approach:

- Gather all required documents, including W-2s, 1099s, and records of other income.

- Begin filling out the form, starting with personal information such as name, address, and Social Security number.

- Report income in the appropriate sections, ensuring all sources are included.

- Claim deductions and credits available to seniors, such as medical expenses and retirement savings contributions.

- Calculate your total tax liability and any refund or amount owed.

- Review the completed form for any errors or omissions.

- Sign and date the form before submitting it to the IRS.

Required Documents

To successfully complete the Form 1040 SR SP U S Tax Return For Seniors Spanish Version, several documents are essential:

- W-2 forms from employers for wage income.

- 1099 forms for other income sources, such as self-employment or interest.

- Records of Social Security benefits received.

- Documentation of any retirement account distributions.

- Receipts for medical expenses and other deductible items.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting income and claiming deductions.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 1040 SR SP U S Tax Return For Seniors Spanish Version is crucial for compliance. Typically, the deadline for filing individual tax returns is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day.

For seniors who may require additional time, it is possible to file for an extension, allowing up to six additional months to complete the return. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete form 1040 sr sp u s tax return for seniors spanish version

Easily Prepare Form 1040 SR SP U S Tax Return For Seniors Spanish Version on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Form 1040 SR SP U S Tax Return For Seniors Spanish Version across any platform using the airSlate SignNow apps for Android or iOS, and enhance any document-based procedure today.

How to Edit and Electronically Sign Form 1040 SR SP U S Tax Return For Seniors Spanish Version Effortlessly

- Find Form 1040 SR SP U S Tax Return For Seniors Spanish Version and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your updates.

- Select your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 1040 SR SP U S Tax Return For Seniors Spanish Version and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 sr sp u s tax return for seniors spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 1040 sr sp u s tax return for seniors spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1040 SR SP U S Tax Return For Seniors Spanish Version?

The Form 1040 SR SP U S Tax Return For Seniors Spanish Version is a simplified tax return form specifically designed for seniors. It allows older taxpayers to file their federal income tax in their preferred language, making the process easier and more accessible for Spanish speakers.

-

How can airSlate SignNow help me with the Form 1040 SR SP U S Tax Return For Seniors Spanish Version?

airSlate SignNow provides a seamless eSigning solution that allows you to complete and submit your Form 1040 SR SP U S Tax Return For Seniors Spanish Version quickly. You can easily upload, sign, and send your documents electronically, ensuring efficiency and security.

-

Is there a cost associated with using airSlate SignNow for Form 1040 SR SP U S Tax Return For Seniors Spanish Version?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different needs, ensuring that you can find an option that fits your budget for eSigning your Form 1040 SR SP U S Tax Return For Seniors Spanish Version. The plans are competitively priced, providing excellent value for a reliable eSigning service.

-

What features does airSlate SignNow offer for the Form 1040 SR SP U S Tax Return For Seniors Spanish Version?

When you use airSlate SignNow for your Form 1040 SR SP U S Tax Return For Seniors Spanish Version, you gain access to features like customizable templates, team collaboration, and advanced security measures. These features enhance your document management experience, ensuring a smooth filing process.

-

Can I integrate airSlate SignNow with my accounting software for the Form 1040 SR SP U S Tax Return For Seniors Spanish Version?

Absolutely! airSlate SignNow offers integrations with several popular accounting software platforms, allowing you to streamline your process for managing the Form 1040 SR SP U S Tax Return For Seniors Spanish Version. This integration helps in maintaining accuracy and reduces redundancy in your tax filing efforts.

-

What are the benefits of using airSlate SignNow for senior tax documents?

Using airSlate SignNow for senior tax documents, like the Form 1040 SR SP U S Tax Return For Seniors Spanish Version, enhances both the convenience and security of the signing process. It simplifies managing important tax documents, making it easy for seniors to focus on their finances without getting bogged down in paperwork.

-

How secure is my information when using airSlate SignNow for tax returns?

Your information is extremely secure with airSlate SignNow. We employ industry-standard encryption and comply with privacy regulations to protect your sensitive data while you complete the Form 1040 SR SP U S Tax Return For Seniors Spanish Version.

Get more for Form 1040 SR SP U S Tax Return For Seniors Spanish Version

- Sigma coa form

- Domestic partner declaration benefits from metlife form

- Annual sludge summary report form annual sludge summary report form

- Pa form mv 140fill out and use this pdf

- Monthly service agreement template form

- Monthly subscription agreement template form

- Mortgage agreement template form

- Music video production contract template form

Find out other Form 1040 SR SP U S Tax Return For Seniors Spanish Version

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors