Form 1040 SR SP U S Tax Return for Seniors Spanish Version 2022

What is the Form 1040 SR SP U S Tax Return For Seniors Spanish Version

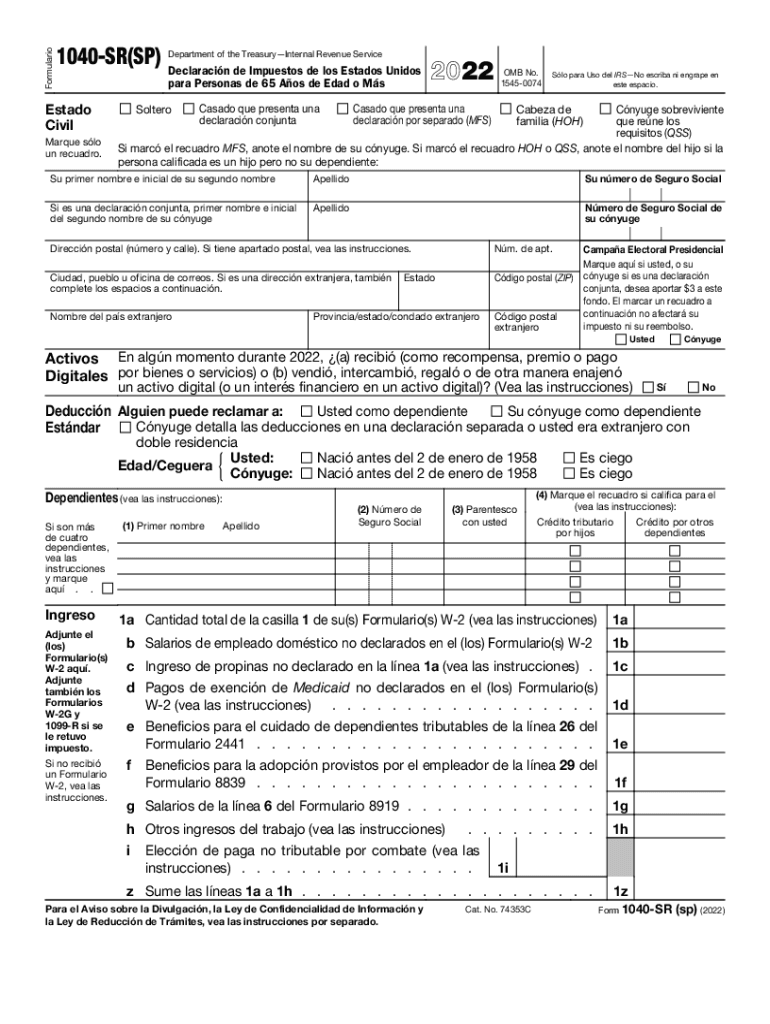

The Form 1040 SR SP U S Tax Return For Seniors Spanish Version is a simplified tax form designed specifically for senior citizens in the United States. This version allows seniors, typically aged sixty-five and older, to file their federal income taxes in Spanish, making the process more accessible. The form is intended for individuals who meet certain income thresholds and prefer a streamlined approach to tax filing. It includes various sections that cater to the unique financial situations of seniors, such as pensions, retirement accounts, and Social Security benefits.

How to use the Form 1040 SR SP U S Tax Return For Seniors Spanish Version

Using the Form 1040 SR SP U S Tax Return For Seniors Spanish Version involves several straightforward steps. First, gather all necessary financial documents, including W-2 forms, 1099 forms, and any other income statements. Next, carefully read the instructions provided with the form, which are available in Spanish. Fill out the form by entering your personal information, income details, and any deductions or credits you may qualify for. After completing the form, review it for accuracy and ensure all required signatures are included before submission.

Steps to complete the Form 1040 SR SP U S Tax Return For Seniors Spanish Version

Completing the Form 1040 SR SP U S Tax Return For Seniors Spanish Version involves a systematic approach:

- Gather all relevant tax documents, including income statements and deduction records.

- Download or obtain the form from the IRS website or local tax office.

- Begin with your personal information, ensuring accuracy in names and Social Security numbers.

- Report all sources of income, including wages, pensions, and Social Security benefits.

- Claim eligible deductions and credits, such as medical expenses or charitable contributions.

- Double-check all entries for completeness and accuracy.

- Sign and date the form before submitting it to the IRS.

Key elements of the Form 1040 SR SP U S Tax Return For Seniors Spanish Version

Key elements of the Form 1040 SR SP U S Tax Return For Seniors Spanish Version include sections for reporting income, claiming deductions, and calculating tax liability. The form also features special lines for seniors to report Social Security benefits and retirement income. Additionally, it provides options for standard deductions, which are often more beneficial for seniors. The layout is designed to be user-friendly, with clear instructions in Spanish to assist seniors in navigating the tax filing process.

Eligibility Criteria

To use the Form 1040 SR SP U S Tax Return For Seniors Spanish Version, taxpayers must meet specific eligibility criteria. Primarily, individuals must be sixty-five years of age or older by the end of the tax year. Additionally, the form is intended for those with a simpler tax situation, typically involving income from pensions, Social Security, and limited other sources. There are also income limits that must be adhered to, ensuring that the form is appropriate for those who may not require the complexity of the standard Form 1040.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 SR SP U S Tax Return For Seniors Spanish Version align with standard federal tax deadlines. Typically, the deadline for filing is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Seniors should be aware of these dates to avoid late penalties. Additionally, those who require an extension can file for one, allowing for an additional six months to submit their tax return.

Quick guide on how to complete form 1040 sr sp u s tax return for seniors spanish version 624654283

Effortlessly Complete Form 1040 SR SP U S Tax Return For Seniors Spanish Version on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and electronically sign your documents rapidly without any delays. Manage Form 1040 SR SP U S Tax Return For Seniors Spanish Version across all platforms with the airSlate SignNow applications for Android or iOS and streamline any document-centric task today.

Steps to Modify and Electronically Sign Form 1040 SR SP U S Tax Return For Seniors Spanish Version with Ease

- Find Form 1040 SR SP U S Tax Return For Seniors Spanish Version and click on Get Form to initiate the process.

- Use the tools provided to fill out your document.

- Select pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all details and then hit the Done button to save your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Alter and electronically sign Form 1040 SR SP U S Tax Return For Seniors Spanish Version to guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 sr sp u s tax return for seniors spanish version 624654283

Create this form in 5 minutes!

How to create an eSignature for the form 1040 sr sp u s tax return for seniors spanish version 624654283

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1040 SR SP U S Tax Return For Seniors Spanish Version?

The Form 1040 SR SP U S Tax Return For Seniors Spanish Version is specifically designed for seniors to file their taxes in Spanish. This version of the tax return simplifies the filing process for older adults who are more comfortable with the Spanish language, ensuring they understand the tax obligations clearly.

-

How can I access the Form 1040 SR SP U S Tax Return For Seniors Spanish Version?

You can access the Form 1040 SR SP U S Tax Return For Seniors Spanish Version through our platform at airSlate SignNow. It is available for easy download and eSignature, making it convenient for seniors to prepare and submit their tax returns securely.

-

Is there a cost associated with using the Form 1040 SR SP U S Tax Return For Seniors Spanish Version?

While downloading the Form 1040 SR SP U S Tax Return For Seniors Spanish Version is free, using our eSignature service may involve a subscription fee. We offer cost-effective pricing plans that cater to the needs of individual users and businesses.

-

What features does the airSlate SignNow platform offer for the Form 1040 SR SP U S Tax Return For Seniors Spanish Version?

Our platform offers several features for the Form 1040 SR SP U S Tax Return For Seniors Spanish Version, including secure eSigning, document tracking, and easy document sharing. These features streamline the tax filing process, especially for seniors who may need assistance.

-

Are there any benefits to using the Form 1040 SR SP U S Tax Return For Seniors Spanish Version?

Yes, the Form 1040 SR SP U S Tax Return For Seniors Spanish Version provides several benefits, including ensuring accurate tax filing and reducing the stress of navigating complex tax forms. It helps seniors save time and money by simplifying the tax return process.

-

Can I integrate the Form 1040 SR SP U S Tax Return For Seniors Spanish Version with other software?

Definitely! airSlate SignNow allows seamless integration with various accounting and financial software. This ensures that the Form 1040 SR SP U S Tax Return For Seniors Spanish Version can be easily linked to your existing systems for enhanced efficiency.

-

What support options are available for users of the Form 1040 SR SP U S Tax Return For Seniors Spanish Version?

We offer various support options for those using the Form 1040 SR SP U S Tax Return For Seniors Spanish Version, including a comprehensive help center, live chat support, and detailed video tutorials. This ensures that you have assistance whenever you need help with your tax return.

Get more for Form 1040 SR SP U S Tax Return For Seniors Spanish Version

- Chax payment bformb sports south llc

- Edinburgh depression scale name date completed please form

- Affidavit of authorization 17012235 form

- Etat des lieux de sortie indiquez la date laquelle ltat des lieux dentre a t ralis form

- Choices form royal mail defined contribution plan zurich

- Trust beneficiary receipt and release form florida

- Addictions academy form

- Richmond ocra form

Find out other Form 1040 SR SP U S Tax Return For Seniors Spanish Version

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later