Inst 944 SP Form

What is the Inst 944 SP

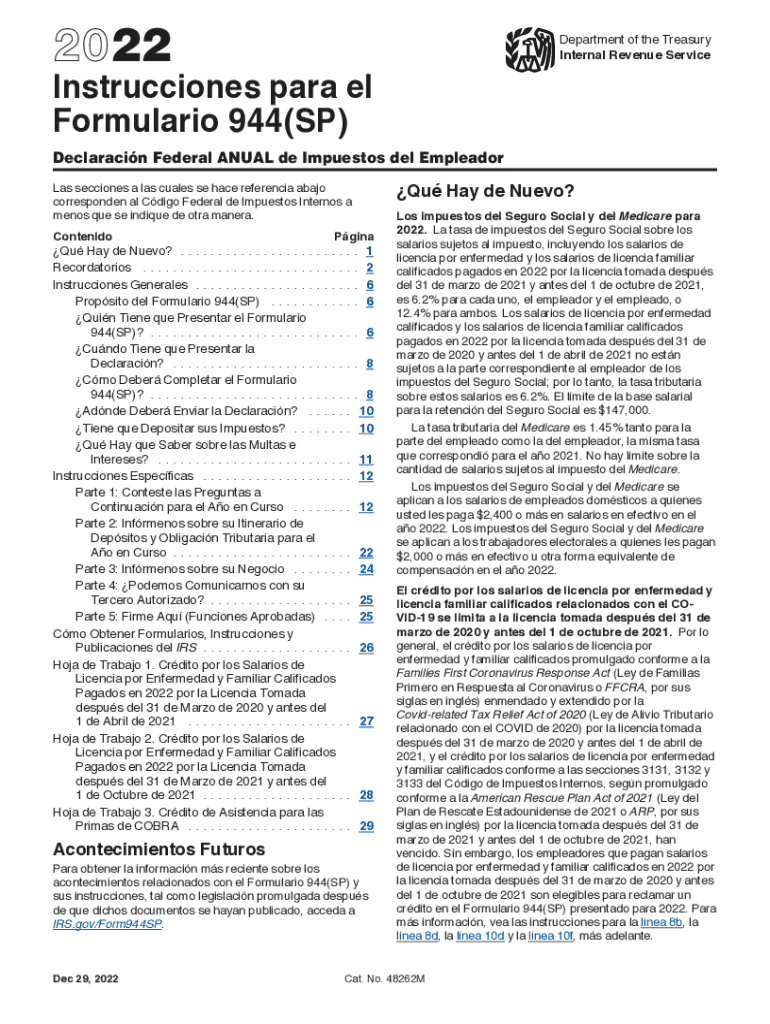

The Inst 944 SP is an important document used by employers in the United States for reporting payroll taxes. Specifically, it is the instructions for the Form 944, which is designed for small businesses that have a low annual payroll tax liability. This form allows eligible employers to file their payroll taxes annually rather than quarterly, streamlining the process and reducing the frequency of submissions. The Spanish version of the instructions, indicated by "SP," ensures that Spanish-speaking employers can easily understand their obligations and complete the form accurately.

How to use the Inst 944 SP

Using the Inst 944 SP involves following the detailed instructions provided to ensure accurate completion of Form 944. Employers should first determine their eligibility to file Form 944 based on their payroll tax liability. Once eligibility is confirmed, employers can use the Inst 944 SP as a guide to fill out the form correctly. It includes step-by-step instructions on reporting wages, calculating taxes owed, and understanding the payment process. The clear layout helps employers navigate through various sections, ensuring that all required information is included.

Steps to complete the Inst 944 SP

Completing the Inst 944 SP involves several key steps:

- Determine eligibility for filing Form 944 based on annual payroll tax liability.

- Gather necessary information, including employee wages and tax rates.

- Follow the instructions in the Inst 944 SP to fill out each section of Form 944 accurately.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or by mail.

Each of these steps is crucial for ensuring compliance with IRS regulations and avoiding potential penalties.

Legal use of the Inst 944 SP

The Inst 944 SP serves a legal purpose by guiding employers through the correct process of reporting payroll taxes. It is essential for employers to use this form in accordance with IRS regulations to avoid any legal issues. Accurate reporting of payroll taxes is not only a legal obligation but also a crucial aspect of maintaining good standing with the IRS. Employers should ensure that they are using the latest version of the Inst 944 SP to comply with any updates or changes in tax law.

Filing Deadlines / Important Dates

Filing deadlines for Form 944 are critical for employers to adhere to in order to avoid penalties. Typically, the form is due on July 31 of the year following the tax year being reported. Employers should also be aware of any specific deadlines for making tax payments, which may vary based on their filing frequency. It is advisable to check the IRS guidelines for any changes or updates to these dates each year to ensure timely compliance.

Required Documents

To complete the Inst 944 SP and Form 944, employers need to gather several important documents, including:

- Records of employee wages and hours worked.

- Documentation of any tax credits or deductions applicable.

- Previous payroll tax filings, if applicable.

- Employer identification number (EIN) for accurate reporting.

Having these documents ready can facilitate a smoother completion process and help ensure that all necessary information is accurately reported.

Quick guide on how to complete inst 944 sp

Effortlessly Prepare Inst 944 SP on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally-friendly substitute to conventional printed and signed documents, as you can easily access the necessary form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage Inst 944 SP on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Inst 944 SP with Ease

- Obtain Inst 944 SP and click Get Form to begin.

- Leverage the tools we provide to fill in your form.

- Indicate important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Choose your method of sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Inst 944 SP and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct inst 944 sp

Create this form in 5 minutes!

How to create an eSignature for the inst 944 sp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Inst 944 SP and how does it work with airSlate SignNow?

Inst 944 SP is a specific form grouping used for seamless document management within airSlate SignNow. By using Inst 944 SP, businesses can efficiently prepare, send, and eSign documents, ensuring compliance while saving time and resources.

-

How can airSlate SignNow benefit my business using Inst 944 SP?

Using airSlate SignNow with Inst 944 SP streamlines the signature process, enhances collaboration, and provides easy access to form templates. This efficiency leads to quicker turnaround times, reducing bottlenecks in document workflows.

-

What are the pricing options for airSlate SignNow featuring Inst 944 SP?

airSlate SignNow offers flexible pricing plans suitable for businesses of any size utilizing Inst 944 SP. Each plan includes essential features for document management and eSigning, allowing you to choose one that best fits your operational needs.

-

Is airSlate SignNow compatible with other software when using Inst 944 SP?

Yes, airSlate SignNow offers numerous integrations with popular applications, allowing users to implement Inst 944 SP within their existing workflows. This compatibility enhances productivity by synchronizing data across applications.

-

Can I customize documents using Inst 944 SP in airSlate SignNow?

Absolutely! airSlate SignNow enables you to customize your documents with Inst 944 SP. This flexibility ensures that your documents meet your specific requirements, making the eSigning process more relevant to your business needs.

-

How secure is my information when using Inst 944 SP with airSlate SignNow?

Security is a top priority for airSlate SignNow. When utilizing Inst 944 SP, your documents are protected with high-level encryption, ensuring that sensitive information remains confidential throughout the signing process.

-

What is the turnaround time for documents processed with Inst 944 SP in airSlate SignNow?

Documents processed with Inst 944 SP in airSlate SignNow can often be completed within minutes. This efficiency is achieved through an intuitive interface that simplifies the sending and signing process, signNowly reducing delays.

Get more for Inst 944 SP

Find out other Inst 944 SP

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT