Form IRS 1040 Schedule 8812 Fill Online, Printable 2024

What is the Form IRS 1040 Schedule 8812 Fill Online, Printable

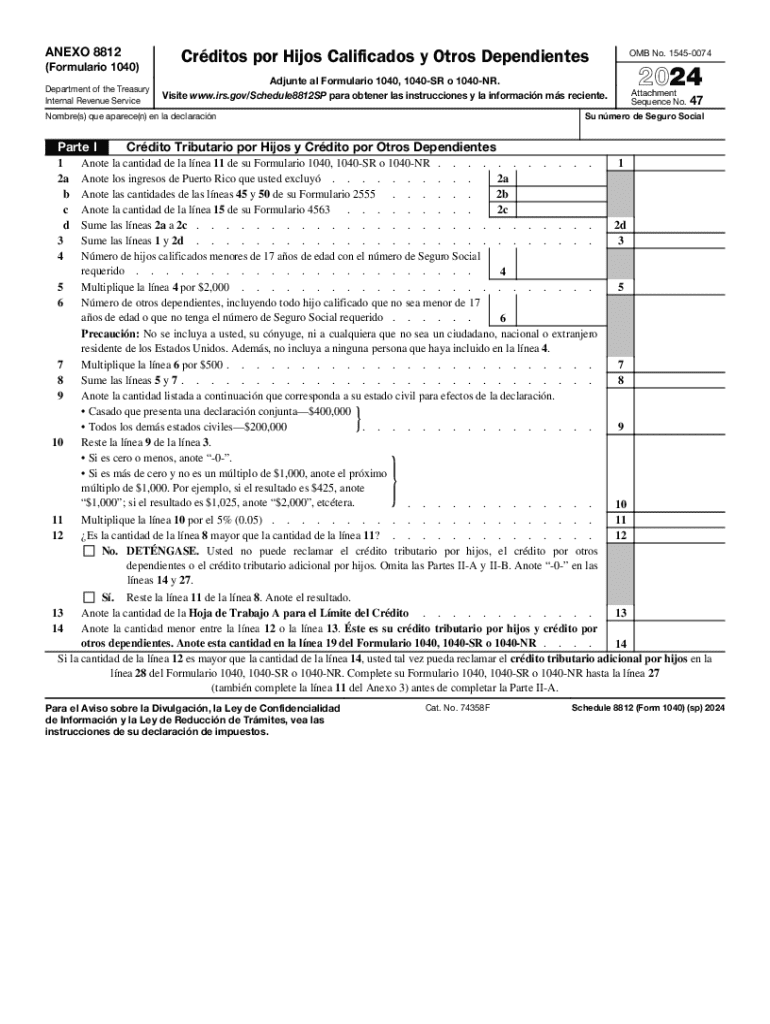

The Form IRS 1040 Schedule 8812 is used by taxpayers in the United States to claim the Additional Child Tax Credit (ACTC). This form allows eligible taxpayers to receive a credit for each qualifying child under the age of 17. The ACTC is particularly beneficial for those who may not have received the full Child Tax Credit due to their income level. By filling out this form, taxpayers can potentially increase their refund or reduce their tax liability. The form can be filled out online, printed, and submitted along with the main IRS 1040 form.

How to use the Form IRS 1040 Schedule 8812 Fill Online, Printable

Using the Form IRS 1040 Schedule 8812 involves several steps to ensure accurate completion. First, gather all necessary information about your qualifying children, including their names, Social Security numbers, and dates of birth. Next, access the form online through a reliable platform. Fill in the required fields, ensuring that all information is accurate and complete. After completing the form, review it for any errors before printing it out. Finally, attach the completed Schedule 8812 to your IRS 1040 form when filing your taxes.

Steps to complete the Form IRS 1040 Schedule 8812 Fill Online, Printable

Completing the Form IRS 1040 Schedule 8812 involves a systematic approach:

- Gather necessary documentation, including your IRS 1040 form and details about your qualifying children.

- Access the Schedule 8812 form online and begin filling in your personal information.

- Input the details of each qualifying child, ensuring accuracy in their names and Social Security numbers.

- Calculate the credit amount based on the provided instructions and your income level.

- Review the completed form for any inaccuracies or missing information.

- Print the form and attach it to your IRS 1040 when submitting your tax return.

Key elements of the Form IRS 1040 Schedule 8812 Fill Online, Printable

The Form IRS 1040 Schedule 8812 includes several key elements necessary for claiming the Additional Child Tax Credit. These elements consist of:

- Personal Information: Taxpayer's name, Social Security number, and filing status.

- Qualifying Children: Information regarding each child, including their names, Social Security numbers, and dates of birth.

- Credit Calculation: Sections for calculating the total credit based on income and number of qualifying children.

- Signature: A section for the taxpayer's signature, confirming the accuracy of the information provided.

Eligibility Criteria

To qualify for the Additional Child Tax Credit using Form IRS 1040 Schedule 8812, certain eligibility criteria must be met. Taxpayers must have qualifying children who are under the age of 17 at the end of the tax year. Additionally, the taxpayer’s income must fall within specific limits set by the IRS. These limits can vary each tax year, so it is essential to refer to the latest IRS guidelines. Furthermore, the taxpayer must have a valid Social Security number for themselves and their qualifying children to claim the credit.

Filing Deadlines / Important Dates

Filing deadlines for the Form IRS 1040 Schedule 8812 align with the standard tax filing dates in the United States. Typically, individual tax returns are due by April 15 of each year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of any changes in deadlines, especially for extensions or special circumstances that may affect their filing schedule. It is advisable to file as early as possible to avoid last-minute issues.

Create this form in 5 minutes or less

Find and fill out the correct form irs 1040 schedule 8812 fill online printable

Create this form in 5 minutes!

How to create an eSignature for the form irs 1040 schedule 8812 fill online printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IRS 1040 Schedule 8812, and why do I need it?

The Form IRS 1040 Schedule 8812 is used to claim the Additional Child Tax Credit. Filling it out accurately is essential for taxpayers who qualify for this credit, as it can signNowly reduce their tax liability. By using airSlate SignNow, you can easily fill out the Form IRS 1040 Schedule 8812 Fill Online, Printable, ensuring you don’t miss out on potential savings.

-

How can I fill out the Form IRS 1040 Schedule 8812 online?

You can fill out the Form IRS 1040 Schedule 8812 Fill Online, Printable using airSlate SignNow's user-friendly platform. Simply upload the form, enter your information, and our tools will guide you through the process. This makes it easy to complete your tax forms accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for filling out tax forms?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Our cost-effective solutions allow you to fill out the Form IRS 1040 Schedule 8812 Fill Online, Printable without breaking the bank. You can choose a plan that fits your budget while enjoying all the features we offer.

-

What features does airSlate SignNow provide for filling out tax forms?

airSlate SignNow provides a range of features including eSignature capabilities, document templates, and secure cloud storage. These tools make it simple to fill out the Form IRS 1040 Schedule 8812 Fill Online, Printable and manage your documents efficiently. Our platform is designed to streamline your workflow and enhance productivity.

-

Can I print the Form IRS 1040 Schedule 8812 after filling it out online?

Absolutely! Once you have completed the Form IRS 1040 Schedule 8812 Fill Online, Printable using airSlate SignNow, you can easily print it directly from our platform. This allows you to have a physical copy for your records or to submit to the IRS as needed.

-

Does airSlate SignNow integrate with other software for tax preparation?

Yes, airSlate SignNow integrates seamlessly with various tax preparation software and tools. This means you can easily fill out the Form IRS 1040 Schedule 8812 Fill Online, Printable and transfer your data to your preferred tax software. Our integrations help streamline your tax preparation process.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for your tax forms, including the Form IRS 1040 Schedule 8812 Fill Online, Printable, offers numerous benefits such as time savings, accuracy, and ease of use. Our platform simplifies the process, reduces errors, and ensures that you can complete your forms quickly and efficiently.

Get more for Form IRS 1040 Schedule 8812 Fill Online, Printable

Find out other Form IRS 1040 Schedule 8812 Fill Online, Printable

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement