Schedule 8812 Form 1040 Sp Credits for Qualifying Children and Other Dependents Spanish Version 2023

What is the Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version

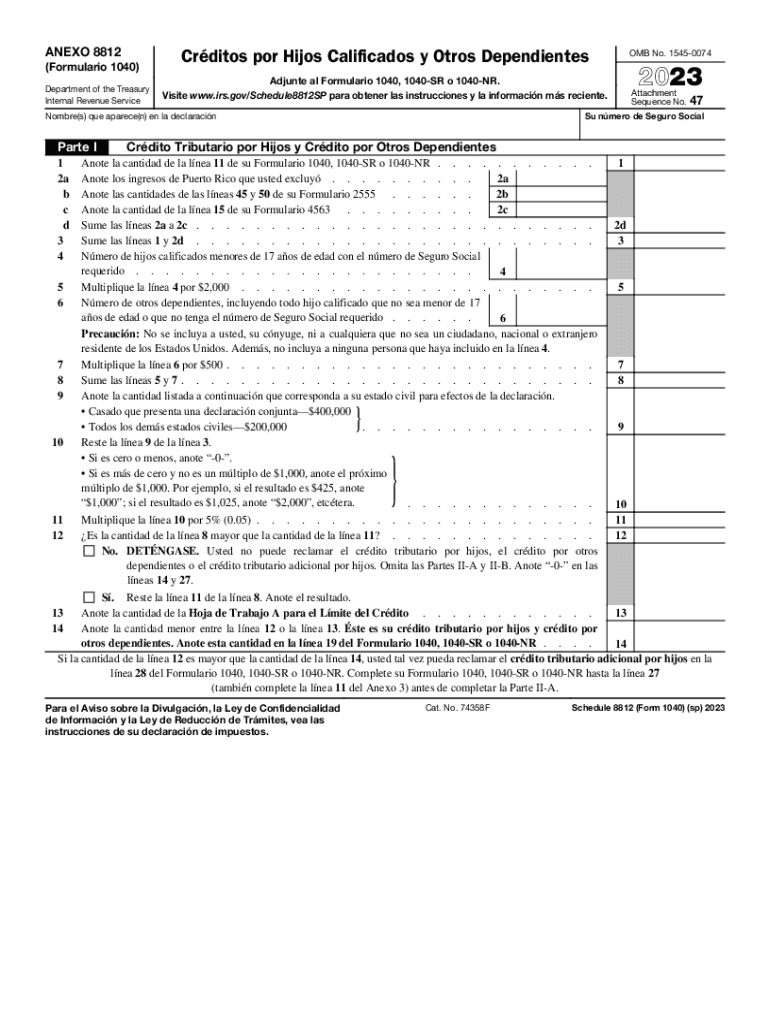

The Schedule 8812 Form 1040 sp is a tax form used by individuals in the United States to claim credits for qualifying children and other dependents. This form is specifically designed for Spanish-speaking taxpayers, providing them with the necessary resources to accurately report their eligibility for these credits. The credits available can significantly reduce the tax liability for families with dependents, making it an essential part of the tax filing process for eligible individuals.

How to use the Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version

To effectively use the Schedule 8812 Form 1040 sp, taxpayers must first gather all relevant information regarding their dependents. This includes names, Social Security numbers, and the relationship to the taxpayer. Once the information is collected, taxpayers can fill out the form by providing the necessary details in the designated sections. It is crucial to ensure that all information is accurate to avoid delays in processing or potential audits.

Steps to complete the Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version

Completing the Schedule 8812 Form 1040 sp involves several key steps:

- Gather documentation for all qualifying children and dependents.

- Fill in personal information, including filing status and income details.

- List each qualifying child or dependent, including their Social Security number.

- Calculate the total credits based on the provided guidelines.

- Review the form for accuracy before submission.

Eligibility Criteria

To qualify for the credits outlined in the Schedule 8812 Form 1040 sp, taxpayers must meet specific criteria. Generally, the dependents must be under a certain age, must live with the taxpayer for more than half the year, and must not provide more than half of their own support. Additionally, the taxpayer's income must fall within the limits set by the IRS to qualify for the full credit amount.

Required Documents

When filling out the Schedule 8812 Form 1040 sp, taxpayers should have the following documents ready:

- Social Security cards for all qualifying children and dependents.

- Proof of residency, such as utility bills or lease agreements.

- Income statements, including W-2s or 1099s.

- Any prior year tax returns, if applicable.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule 8812 Form 1040 sp. Taxpayers should refer to the IRS instructions to ensure compliance with all requirements. These guidelines cover eligibility, calculation of credits, and any recent changes to tax laws that may affect the credits available for qualifying children and other dependents.

Quick guide on how to complete schedule 8812 form 1040 sp credits for qualifying children and other dependents spanish version

Complete Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, facilitating the ability to find the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, amend, and electronically sign your documents swiftly and without delays. Handle Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The simplest way to edit and electronically sign Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version without hassle

- Find Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version and click on Get Form to commence.

- Leverage the tools available to finalize your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Craft your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Choose your preferred method to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow meets all your needs in document management with just a few clicks from any device of your choice. Modify and electronically sign Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule 8812 form 1040 sp credits for qualifying children and other dependents spanish version

Create this form in 5 minutes!

How to create an eSignature for the schedule 8812 form 1040 sp credits for qualifying children and other dependents spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version?

The Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version is a tax form used to claim credits for qualifying children and other dependents. It helps taxpayers understand how to maximize their benefits under the child tax credit and additional child tax credit provisions. This form provides essential guidance in Spanish, ensuring clear comprehension for Spanish-speaking users.

-

How can I access the Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version?

You can easily access the Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version online through airSlate SignNow. Our platform allows users to download the necessary forms conveniently and complete them efficiently. This access ensures you have all the tools needed to manage your tax credits effectively.

-

What are the benefits of using airSlate SignNow for the Schedule 8812 Form 1040 sp?

By using airSlate SignNow, you gain simplified access to the Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version, along with the ability to eSign documents securely. Our solution offers user-friendly features that streamline the process of filling out and submitting tax forms. You'll also benefit from a cost-effective solution that enhances your overall workflow.

-

Is there a cost associated with accessing the Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version?

Yes, airSlate SignNow offers a subscription-based model that provides access to numerous features, including the Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version. Pricing options are designed to be affordable for individuals and businesses alike, ensuring you can manage your documents without breaking the bank. Visit our website for specific pricing details.

-

Can I integrate airSlate SignNow with other applications for using the Schedule 8812 Form 1040 sp?

Absolutely! airSlate SignNow provides seamless integrations with various applications, allowing you to use the Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version within your preferred software. This capability enhances your productivity by keeping your favorite tools centralized. Popular integrations include major cloud storage and productivity suites.

-

What features does airSlate SignNow offer for the Schedule 8812 Form 1040 sp?

airSlate SignNow offers features such as document templates, electronic signatures, cloud storage, and customizable workflows, all tailored to enhance the experience of using the Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version. These tools simplify document management and ensure compliance with tax regulations. You'll enjoy a comprehensive suite of resources at your fingertips.

-

Is technical support available for questions about the Schedule 8812 Form 1040 sp?

Yes, airSlate SignNow provides technical support for users seeking assistance with the Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version. Our responsive support team is ready to help you navigate any difficulties or questions you may have, ensuring a smooth user experience. You can signNow out via email or our support chat!

Get more for Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version

- Pokhara university transcript form

- Doterra getting started checklist essential wellness pros form

- Edital de consulta obra de paulistana ifpi edu form

- Photography booking form template

- Form funding

- Kreinhop field day t shirt order form

- Printable grid paper 8 5 x 11 form

- Sample membership questionnaire cdm church management software form

Find out other Schedule 8812 Form 1040 sp Credits For Qualifying Children And Other Dependents Spanish Version

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe