Ct 941 Amended Return Form 2012

What is the Ct 941 Amended Return Form

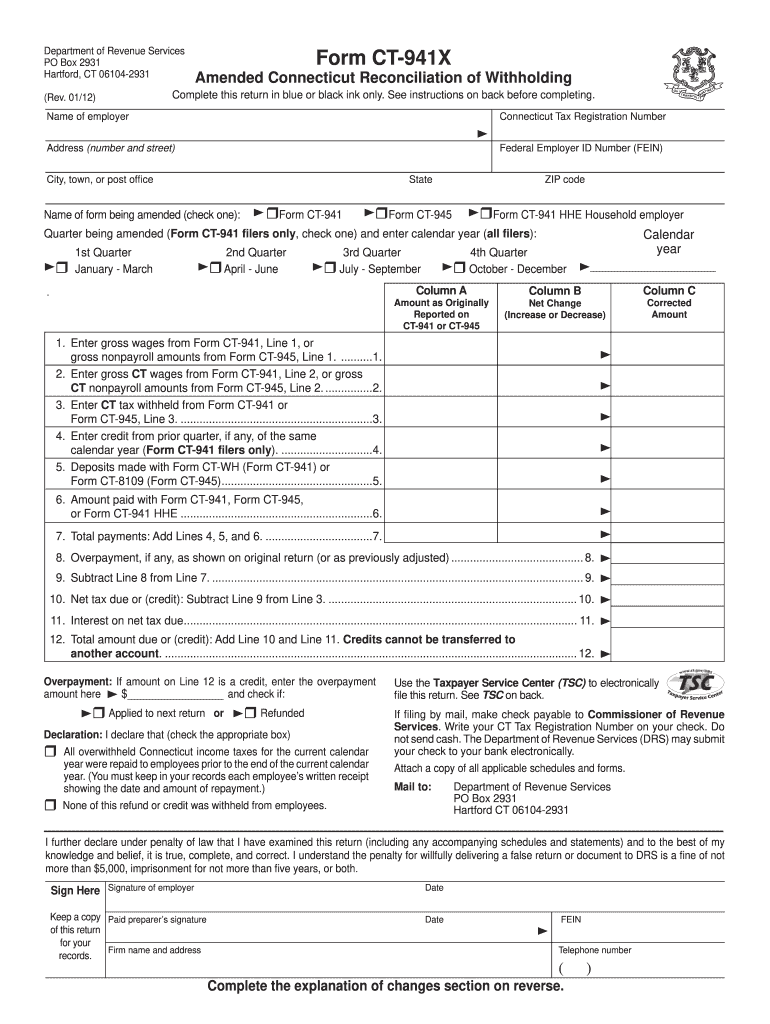

The Ct 941 Amended Return Form is a tax document used by employers in Connecticut to correct errors on previously filed quarterly payroll tax returns. This form allows businesses to amend their reported wages, tax withholdings, and other relevant information. Filing an amended return is crucial for ensuring compliance with state tax regulations and for accurate reporting of tax obligations.

How to use the Ct 941 Amended Return Form

To use the Ct 941 Amended Return Form, first, obtain a copy of the form from the Connecticut Department of Revenue Services website or through authorized channels. Carefully review the instructions provided with the form to understand the specific sections that need to be completed. Fill out the form with the correct information, ensuring that all necessary corrections are clearly indicated. Once completed, submit the form according to the guidelines provided, either online or via mail.

Steps to complete the Ct 941 Amended Return Form

Completing the Ct 941 Amended Return Form involves several key steps:

- Gather all relevant documents, including the original Ct 941 return and any supporting payroll records.

- Identify the specific errors that need correction and note the accurate information.

- Fill out the amended return, clearly indicating the changes made from the original submission.

- Review the form for accuracy and completeness before submission.

- Submit the amended return by the specified method, ensuring you keep a copy for your records.

Legal use of the Ct 941 Amended Return Form

The legal use of the Ct 941 Amended Return Form is essential for compliance with Connecticut tax laws. Employers are required to file this form to correct any inaccuracies in their payroll tax submissions. Failing to amend incorrect returns can lead to penalties, interest on unpaid taxes, and potential audits. Therefore, it is important to ensure that the amended return is filed within the appropriate time frame and follows state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 941 Amended Return Form typically align with the quarterly tax reporting schedule. Employers should be aware of the due dates for each quarter to ensure timely submission. It is advisable to file the amended return as soon as the errors are identified to minimize any potential penalties or interest charges. Keeping track of these deadlines is crucial for maintaining compliance with state tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The Ct 941 Amended Return Form can be submitted through various methods. Employers can choose to file the form online via the Connecticut Department of Revenue Services portal, which offers a convenient and efficient option. Alternatively, the form can be mailed to the appropriate address provided in the filing instructions. In-person submissions may also be possible at designated state offices, although this option may vary based on current regulations and office availability.

Quick guide on how to complete ct 941 amended return 2012 form

Your assistance manual on how to prepare your Ct 941 Amended Return Form

If you’re interested in learning how to generate and dispatch your Ct 941 Amended Return Form, here are a few straightforward guidelines to simplify the tax submission process.

To begin, all you need to do is sign up for your airSlate SignNow account to transform how you manage documents online. airSlate SignNow offers a highly intuitive and robust document solution that enables you to modify, create, and finalize your tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, returning to amend answers whenever necessary. Enhance your tax administration with advanced PDF editing, eSigning, and convenient sharing.

Follow the instructions below to complete your Ct 941 Amended Return Form in minutes:

- Set up your account and start editing PDFs in no time.

- Utilize our catalog to access any IRS tax form; explore different versions and schedules.

- Click Obtain form to open your Ct 941 Amended Return Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to append your legally-binding eSignature (if required).

- Examine your document and correct any errors.

- Save edits, print your copy, send it to the intended recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper may increase errors and delay refunds. Naturally, before electronically filing your taxes, verify the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct ct 941 amended return 2012 form

FAQs

-

How much would an accountant charge me for filling out a Quarterly Federal Tax Return (941) in Texas?

For full service payroll I charge $100 per month for up to 5 employees. That includes filing the federal and state quarterly returns and year end W2's.If you just need the 941 completed and you have all of your payroll records in order, then the fee would be $50 to prepare the form for you. Note that you also need to file a quarterly return with TWC if you have Texas employees.

-

How long does it take the IRS to accept or reject an IRS Form 941 return?

If you e-file, you should get your e-file acknowledgement back within the hour. Your software provider should provide you with your ack code, which they receive from the IRS.The IRS servers are lightning fast now after they upgraded them a few years ago after the Russians hacked into them back in 2015. (IRS believes Russians are behind tax return data bsignNow - CNNPolitics). No more waiting 24 -48 hours for an ack code, even though they still tell you officially that’s how long it will take.If you paper file, the whole process slows down to a crawl, and if you make a mistake, the interest and penalties add up before you even know there’s a problem.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

What is the official website to fill out the GST return form?

https://www.gst.gov.in/

-

How do I amend an outward supply in GSTR 3B after filling out a return?

This is a major issue with GST return that it can not be revised once you filed the same. There are so many taxpayers who are facing this problem. There is a way to correct this mistake.You can adjust outward supply in upcoming months. For example your outward supply was Rs. 30 K for the month of April’18 and you have mentioned only Rs. 20 K by mistake. There is a difference of Rs. 10 K and this amount can be adjusted in next month Return.You can refer GST Circular No. 26/26/2017 GST for more information in this regard.Hope it helps.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

Create this form in 5 minutes!

How to create an eSignature for the ct 941 amended return 2012 form

How to create an eSignature for your Ct 941 Amended Return 2012 Form in the online mode

How to create an electronic signature for your Ct 941 Amended Return 2012 Form in Google Chrome

How to make an eSignature for putting it on the Ct 941 Amended Return 2012 Form in Gmail

How to make an eSignature for the Ct 941 Amended Return 2012 Form from your smartphone

How to create an eSignature for the Ct 941 Amended Return 2012 Form on iOS devices

How to generate an eSignature for the Ct 941 Amended Return 2012 Form on Android OS

People also ask

-

What is the CT 941 Amended Return Form and why might I need it?

The CT 941 Amended Return Form is a document used to correct errors on previously filed Connecticut quarterly payroll tax returns. If you’ve made mistakes in your reported wages or taxes withheld, filing this form is essential to ensure compliance and avoid penalties. airSlate SignNow offers a seamless way to eSign and submit your CT 941 Amended Return Form efficiently.

-

How does airSlate SignNow help me complete the CT 941 Amended Return Form?

With airSlate SignNow, users can easily fill out and eSign the CT 941 Amended Return Form online. Our user-friendly platform allows you to upload your existing documents, make necessary edits, and securely sign them, all in one place. This streamlines the process and saves you time compared to traditional methods.

-

Is airSlate SignNow cost-effective for filing the CT 941 Amended Return Form?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to file the CT 941 Amended Return Form. Our pricing plans are designed to cater to various business sizes and needs, ensuring you get the best value for your document management and eSignature solutions.

-

Can I integrate airSlate SignNow with my existing accounting software for the CT 941 Amended Return Form?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easier to access and manage your CT 941 Amended Return Form. This integration allows for smooth data transfer and ensures that all your financial information is up-to-date and accurately reflected in your filings.

-

What are the benefits of using airSlate SignNow for the CT 941 Amended Return Form?

Using airSlate SignNow for the CT 941 Amended Return Form streamlines the filing process, reduces paperwork, and enhances collaboration. Our platform offers features like cloud storage, real-time tracking, and easy sharing, making it ideal for businesses looking to improve efficiency and accuracy in their tax filings.

-

How secure is airSlate SignNow when filing the CT 941 Amended Return Form?

Security is a top priority at airSlate SignNow. We employ industry-standard encryption and security protocols to protect your sensitive information when filing the CT 941 Amended Return Form. Our platform ensures that your data is safe and compliant with regulations, giving you peace of mind when managing your documents.

-

What types of documents can I sign in addition to the CT 941 Amended Return Form?

In addition to the CT 941 Amended Return Form, airSlate SignNow allows you to sign a variety of documents, including contracts, agreements, and other tax forms. Our versatile platform supports multiple document types, making it a comprehensive solution for all your eSigning needs.

Get more for Ct 941 Amended Return Form

- Certificate of liability insurance state of michigan form

- Sl1 form axis bank

- System request form

- Dynascape student edition form

- M6 system of equations answer key form

- Permit authorization affidavit fairfaxcounty form

- Apar grade iv 431794768 form

- Raising mentally strong kids how to combine the power form

Find out other Ct 941 Amended Return Form

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template