Form CT941X Must Be Filed and Paid Electronically unless Certain Conditions Are Met 2020

What is the CT-941X Form?

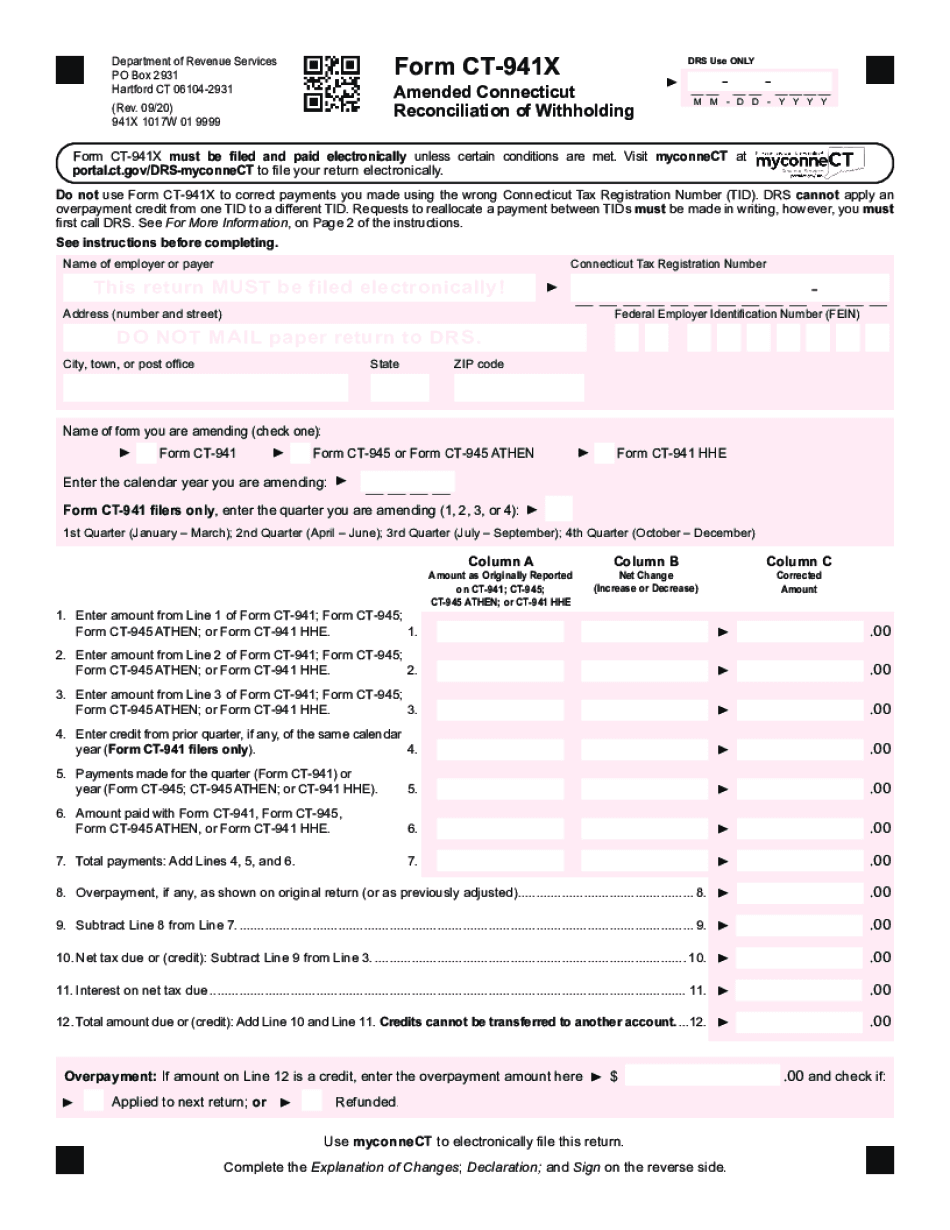

The CT-941X form is an amended version of the Connecticut Quarterly Reconciliation of Withholding form. It is used by employers to correct errors made on previously filed CT-941 forms. This form is essential for ensuring that the correct amounts of state income tax withholding are reported and paid. Filing this form accurately helps maintain compliance with Connecticut tax regulations.

Steps to Complete the CT-941X Form

Completing the CT-941X form involves several key steps:

- Gather all relevant information from your original CT-941 forms, including the periods needing correction.

- Clearly indicate the corrections being made, specifying the original amounts and the revised figures.

- Ensure that all required fields are filled out accurately to avoid delays in processing.

- Review the form for any errors before submission to ensure compliance with state requirements.

Legal Use of the CT-941X Form

The CT-941X form is legally binding when completed and submitted according to state guidelines. It must be filed electronically unless specific conditions allow for an alternative submission method. Compliance with the Connecticut Department of Revenue Services regulations is crucial to avoid penalties.

Filing Deadlines and Important Dates

Employers must adhere to specific deadlines when filing the CT-941X form. Generally, the amended form should be submitted as soon as discrepancies are identified. It is important to check the Connecticut Department of Revenue Services website for the most current deadlines to ensure timely compliance.

Form Submission Methods

The CT-941X form must be filed electronically, ensuring that the submission is processed efficiently. Employers may use the Connecticut Department of Revenue Services online portal for this purpose. In certain cases, if electronic filing is not possible, alternative submission methods may be available, but these are limited and should be verified with the state.

Penalties for Non-Compliance

Failure to file the CT-941X form accurately or on time can result in penalties imposed by the Connecticut Department of Revenue Services. These penalties may include fines and interest on any unpaid taxes. It is crucial for employers to correct any errors promptly to avoid these consequences.

Quick guide on how to complete form ct941x must be filed and paid electronically unless certain conditions are met

Prepare Form CT941X Must Be Filed And Paid Electronically Unless Certain Conditions Are Met easily on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as it allows you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents promptly without delays. Manage Form CT941X Must Be Filed And Paid Electronically Unless Certain Conditions Are Met on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Form CT941X Must Be Filed And Paid Electronically Unless Certain Conditions Are Met effortlessly

- Locate Form CT941X Must Be Filed And Paid Electronically Unless Certain Conditions Are Met and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow specially provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the information and then click on the Done button to save your updates.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Form CT941X Must Be Filed And Paid Electronically Unless Certain Conditions Are Met and ensure outstanding communication at any step of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct941x must be filed and paid electronically unless certain conditions are met

Create this form in 5 minutes!

How to create an eSignature for the form ct941x must be filed and paid electronically unless certain conditions are met

The best way to create an electronic signature for your PDF in the online mode

The best way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an e-signature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The way to generate an e-signature for a PDF document on Android OS

People also ask

-

What is an amended document in Connecticut?

An amended document in Connecticut refers to a legal document that has been modified or updated to reflect changes or corrections. This is often necessary for ensuring compliance with state laws. Using airSlate SignNow, you can easily create and manage Connecticut amended documents for your business.

-

How can airSlate SignNow help with Connecticut amended documents?

airSlate SignNow offers a seamless platform to create, edit, and eSign Connecticut amended documents. Its intuitive interface allows you to make necessary changes quickly, ensuring your documents are always up-to-date. Additionally, you can track revisions, making collaboration effortless.

-

What are the pricing options for using airSlate SignNow for Connecticut amended documents?

airSlate SignNow provides several pricing plans tailored to fit different business needs, including options for managing Connecticut amended documents. Whether you are a small business or a large enterprise, there’s a plan that offers the features you require at a budget-friendly price.

-

Are there any features specifically designed for Connecticut compliance?

Yes, airSlate SignNow includes features designed to ensure that your Connecticut amended documents comply with state regulations. With templates and customizable fields, you can create compliant documents while also benefiting from secure eSigning and storage.

-

Can I integrate airSlate SignNow with other tools for my Connecticut amended document workflow?

Absolutely! airSlate SignNow offers integrations with various business tools, making it easier to manage your Connecticut amended document workflow. Whether you need CRM integration or cloud storage solutions, SignNow can seamlessly connect with your existing software.

-

What are the benefits of eSigning Connecticut amended documents?

eSigning Connecticut amended documents through airSlate SignNow enhances efficiency and security. It saves time compared to traditional methods and ensures that documents remain legally binding. Plus, you can track the status of your amended documents in real-time.

-

How secure are the Connecticut amended documents signed through airSlate SignNow?

airSlate SignNow prioritizes security for all Connecticut amended documents. It uses encryption and compliance measures to protect your data, ensuring that your documents are safe from unauthorized access. You can trust that your sensitive information is protected.

Get more for Form CT941X Must Be Filed And Paid Electronically Unless Certain Conditions Are Met

- Waiver of lien corporation or llc alaska form

- Waiver of stop lending notice rights individual alaska form

- Interrogatories to plaintiff for motor vehicle occurrence alaska form

- Interrogatories to defendant for motor vehicle accident alaska form

- Llc notices resolutions and other operations forms package alaska

- Waiver of stop lending notice rights corporation or llc alaska form

- Notice of dishonored check civil keywords bad check bounced check alaska form

- Mutual wills containing last will and testaments for unmarried persons living together not married with no children alaska form

Find out other Form CT941X Must Be Filed And Paid Electronically Unless Certain Conditions Are Met

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple